Union Budget 2025, a historic eighth Budget for finance minister Nirmala Sitharaman, has been presented with much fanfare. A number of measures to improve import-export have been introduced so that a strategic push will be given to Prime Minister Narendra Modi’s vision of Make in India.

Tax sops have been given to the middle class, which comprises 31 per cent of the population. There are benefits for the farmer, the small industries sector, the investor, and the exporter. The main purpose of this Budget is to achieve a Viksit Bharat or developed India by 2047. The aspiration is not just development but inclusive development.

The Budget aims to accelerate growth, enhance the spending power of India’s rising middle class, invigorate India’s private sector investment, and uplift household sentiment.

The Union Budget was tabled a day after the Economic Survey 2024-25 was released, on the inaugural day of the first session of Parliament in 2025. The pain points highlighted by the Economic Survey have been tackled effectively by the Union Budget, proving once again that Modi has his finger on the pulse of the masses.

Middle class aspirations

Hailed as a Budget for the middle class, Union Budget 2025 aims to ensure that individuals have more disposable income to spend and invest. Income of up to Rs 12 Iakh per annum will not be taxable, as there will be a rebate and no tax slabs will be applicable. This will have a buoyant effect on the middle class’ spending and the upwardly mobile aspirations of young India.

In the words of Kamal Bali, President and CEO of Volvo Group India, “I feel around 25-30 million personal taxpayers will save around 100,000 rupees ($1,155.59) annually. It will boost discretionary capital spending like buying a vehicle. Taxpayers will have better repaying capacity for EMIs.”

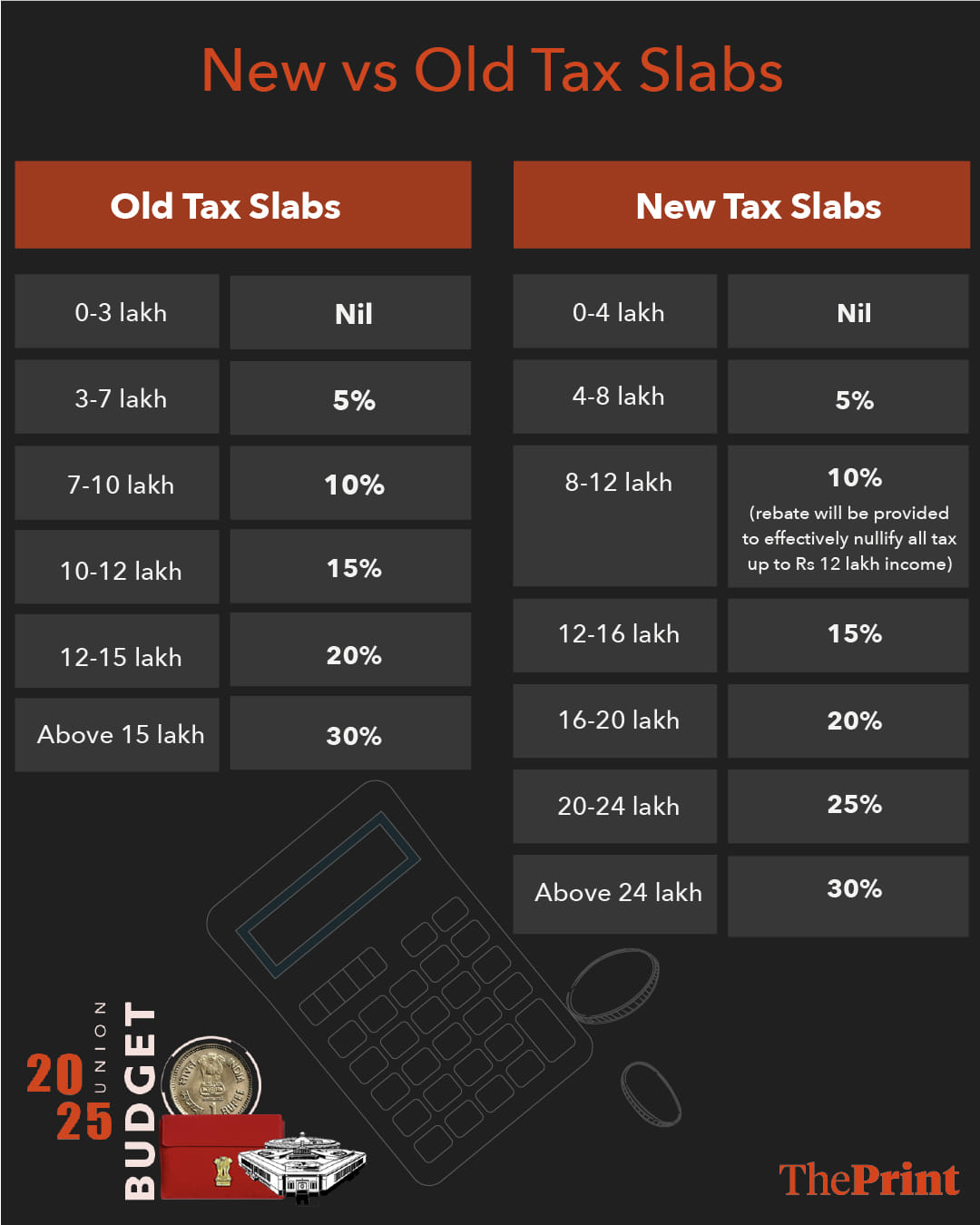

Tax slabs under the new regime are as follows:

Further, Section 87A has been revised for resident individuals, with the rebate limit being increased from Rs 7 lakh to Rs 12 lakh and the maximum rebate from Rs 25,000 to Rs 60,000. The Budget is also being called youth-centric, as individuals are not being forced to invest in ELSS, provident fund, pension funds, or life insurance to save taxes.

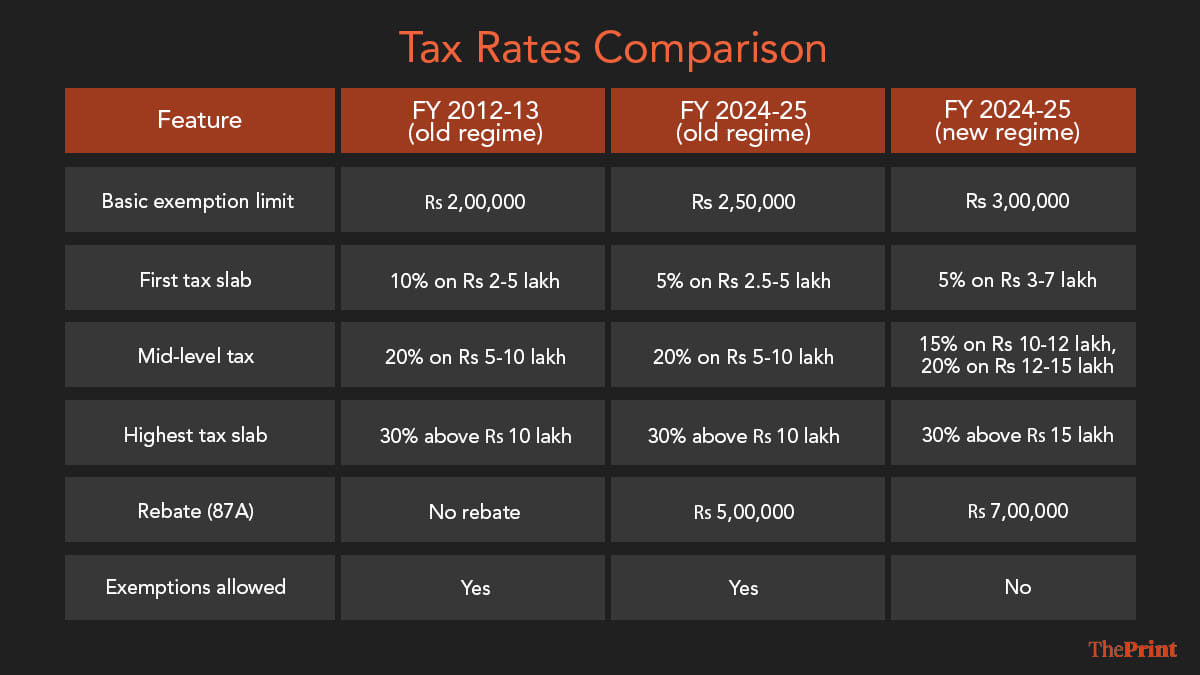

The tax slabs are explained in a simple table below:

Also read: Budget 2025 is good for Uttarakhand—UDAN boosts tourism, higher credit for MSMEs: Shaurya Doval

Agriculture sector

As per the Economic Survey 2024-25, the gross value added (GVA) in agriculture is estimated to grow by 6.4 per cent in FY25 and the agricultural sector has shown a steady performance. To boost the agricultural sector further and encourage diversification in order to make India food sufficient, the government has proposed some positive measures in the Union Budget.

A national mission has been launched to enhance crop productivity, targeting 1.7 crore farmers. The PM Dhan Dhanya Krishi Yojana has been launched in 100 districts that face challenges like low crop yield and financial woes. The scheme is to be implemented with the support of state governments. This scheme will encourage farmers to grow productively and experiment with crop rotation. Effective storage spaces will be built to preserve the food grown and water-saving schemes will be launched.

The Budget also proposes a 6-year plan to boost self-reliance in pulses that focuses on tur, urad, and masoor to avoid dependence on imports. India is the largest consumer of pulses and in 2024, imported 25 per cent of its annual consumption. A Makhana Board has been set up in Bihar to boost the production of fox nuts.

The Kisan Credit Card loan limit has been increased to Rs 5 lakh. Further, the National Mission on High Yielding Seeds has been set up along with a Mission for Cotton Productivity.

Deloitte India partners have lauded the scope of agricultural reforms. A thriving agricultural sector ensures food security and helps moderate inflation, indirectly benefiting urban and rural middle-class families alike. The Opposition, however, is already stirring up a hornet’s nest. “ Budget is full of new schemes, programmes, many of these beyond the capacity of this government,” said former FM P Chidambaram.

Manufacturing sector

The Government of India has proposed setting up a National Manufacturing Mission to boost the vision of Make in India. The Mission will improve the ease of doing business in India by streamlining regulatory processes and easing the setting up of global supply chains, so the country may better compete with China as a manufacturing hub. The five focus areas for the Mission are ease and cost of doing business in India, an employable and future-ready workforce, a dynamic MSME sector, technological advancement, and quality in production.

India’s manufacturing sector accounts for 16-17 per cent of the country’s GDP and the government seeks to boost this number. It is set to become a global hub for toy production through the National Action Plan for Toys, by focusing on skill development, clusters, and a manufacturing ecosystem. About 22 lakh jobs are to be created under the leather scheme.

In the manufacturing sector, clean energy tech will get a boost. The Mission aims to build an ecosystem for solar PV cells, EV batteries, motors and controllers, electrolysers, wind turbines, very high-voltage transmission equipment and grid-scale batteries.

The Economic Survey 2024-25 had flagged the unemployment rate of 3.2 per cent for individuals above age 15 as a persistent challenge. Through the above measures, the Union Budget aims to address this major gap in India’s progress.

Also read: Budget 2025 corrects misguided tax regime of Nehruvian socialism. Changes India’s destiny

Customs duties

To lower the cost of production for domestic industries, Budget 2025 has proposed lower customs duties on a range of capital goods, intermediate inputs, and raw materials. This measure is designed to make it more cost-effective for manufacturers to upgrade technology and expand production capabilities.

“The removal of basic customs duties on key materials for battery manufacturing is a strategic move to boost domestic EV production, foster a sustainable ecosystem, and drive India’s transition to a greener economy,” said Girish Wagh, Executive Director at Tata Motors.

The Basic Customs Duty on 36 life-saving drugs has been removed. Changes in customs duty on certain electronic goods have been made. There is to be no primary duty on lead and zinc, and duty has been removed on crust leather goods.

“The exemption of 36 life-saving cancer drugs from customs duty further reduces financial strain on patients, reinforcing affordability and better health outcomes,” said Preetha Reddy, Executive Vice Chairperson at Apollo Hospitals.

Healthcare and Budget 2025

To help India emerge as a global healthcare leader, the Union Budget has increased its allocation by 9.78 per cent. This translates to Rs 99,859 crore, up from Rs 90,958 crore in FY25.

“The addition of 75,000 seats over the next five years, coupled with the launch of Centers of Excellence in AI, will foster innovation in health-tech and expand R&D investments,” said Pratap C Reddy, the founder of Apollo Hospitals.

The Budget aims to enhance the promotion of medical tourism in India through private sector partnerships. This will increase India’s capacity to attract global patients, positioning it as the go-to destination for affordable, world-class medical care under the ‘Heal in India’ mission.

The government has proposed to establish 200 day care cancer centres in 2025-26. It will facilitate the setting up of these centres in all district hospitals in the next three years. In the next year, the Union Budget aims at adding 10,000 additional seats in medical colleges and hospitals. The government aims to add 75,000 seats in the next five years.

These opportunities seek to address the issue of skill mismatch and female labour force participation as an improved healthcare sector will create more jobs that are likely to be open to women.

Also read: Budget 2025 makes the Old Tax Regime redundant. It’s all about income tax relief

Infrastructure development

The Economic Survey 2024-25 showed that significant progress had been made in the infrastructure sectors by Team Modi. The overall capex of the Union government increased by 31.7 per cent year-on-year in FY25. The spanking new Made-in-India Vande Bharat trains are increasing connectivity to remote areas, including Srinagar. Tracks are being electrified at a super-fast rate and the Dedicated Freight Corridor is providing a network for faster transportation of goods.

Ports have been modernised under Sagarmala, boosting maritime trade. Metro rail networks in cities such as New Delhi, Mumbai, and Bengaluru have expanded, improving urban mobility. The development of new airports and logistics hubs has further strengthened India’s infrastructure, driving economic growth and improving connectivity nationwide.

As of 30 November 2024, under the Bharatmala Project, India has completed 18,926 km of National Highways. Additionally, the Pradhan Mantri Gram Sadak Yojana (PMGSY) has constructed 7,65,601 km of rural roads as of 26 July 2024. In FY 2024-25, India is projected to add up to 13,000 km of roads, reflecting a 5-8 per cent increase from the previous year.

The thrust on infrastructure development to achieve PM Modi’s vision of Viksit Bharat 2047 continues under Union Budget 2025. It allocates interest funds for states to boost infrastructure development, with 120 more cities to be connected under the UDAN scheme.

A Maritime Development Fund of Rs 25,000 crore has been established to bolster the shipbuilding and repair industry. The government will be contributing up to 49 per cent of the cost and the remainder will be sourced from ports and the private sector. The Ministry of Road Transport and Highways gets Rs 2,87,333 crore and the Ministry of Railways Rs 2,55,445, 5.643% and 5.07% respectively of the Union Budget. Further, India Post will be developed as a major affordable logistics organisation.

Digital transformation

Under the Modi government, Digital India raced ahead with initiatives such as UPI and Aadhar-linked services, leading to digital inclusion throughout the country, linking the poorest of the poor. As of 14 August 2024, under the Pradhan Mantri Jan Dhan Yojana (PMJDY), over 53.1 crore bank accounts have been opened, with total deposits exceeding Rs 2.3 lakh crore. Notably, nearly 30 crore of these accounts are held by women, highlighting the scheme’s impact on financial inclusion.

India now leads in digital payments and 5G deployment, empowering businesses and citizens alike. The number of internet subscribers per 100 population was a whopping 62.3 in September 2024.

The Union Budget has introduced a UPI-linked card for small vendors. Special AI research centres will be set up and 50,000 Atal Tinkering Labs will be set up in government schools to promote AI and digital India. A further outlay of Rs 500 crore for a Centre of Excellence in AI will ensure that India doesn’t get left behind in the global race. Further, broadband connectivity will be provided for all government secondary schools.

Also read: What did Budget 2025 accomplish? Consumption boost for wealthy taxpayers, selective tariffs

Weakening rupee and export promotion

The weakening rupee has been a cause of great concern. Between April and December 2024, the rupee has depreciated 3 per cent against the the US dollar. This may be good news for exporters, but can also lead to inflation as imported components get expensive. Therefore, the government has cut customs duties on certain electric components, automotive components, and life-saving drugs.

Further, the government is committed to reducing the fiscal deficit to 4.4 per cent of GDP for FY 2025-26, down from 4.8 per cent in the previous year. This disciplined fiscal approach is designed to enhance investor confidence and support the rupee’s stability. Efforts are underway to attract foreign portfolio investors (FPIs) and foreign direct investment (FDI) in order to bolster foreign exchange reserves. To this extent, a 100 per cent FDI limit has been allowed in the insurance sector. A robust reserve position provides the Reserve Bank of India (RBI) with greater capacity to manage currency volatility.

We can safely say this is a people’s Budget—of the people, by the people and for the people. It appeals to an aspirational, young India, to the people who will lead the vision of Viksit Bharat 2047. It is middle-class values that are going to be the engine of growth for the country. Irrespective of societal divisions, they seek prosperity and have the energy to carry it forward in the interest of future generations. This responsibility makes them aspire and yet work for the future without asking for immediate returns or gratification.

This transition has taken place over the past 10 years of good governance. Toilets, homes, gas connections, water taps, rations, roads, ports, and electricity helped people break free of poverty traps. Thus, Budget 2025, relying on the innate strength of 58 per cent of our population, is an enabling Budget.

Meenakashi Lekhi is a BJP leader, lawyer and social activist. Her X handle is @M_Lekhi. Views are personal.

(Edited by Prasanna Bachchhav)

This article is a nice PR work….and every year this goes on….Every year economic survey points out the pain points – decreasing private investment and low employment generation among other things….then what…do some hogwash and say that India is going to be this and that with all the catchy marketing slogans by the PM and the team…A mere tax cut will not do any thing…and also taxes are honey pots for politicians of all ilk, so they are going to raise cess, tariffs and other this things to balance it….then who suffers, the common man…who is always an idiot…

On a lighter note, credit should be shared with Print columnist Vir Sanghvi.