New Delhi: Indians increasingly prefer to drink whisky over other forms of liquor — and among whiskies, they’re choosing premium brands over cheaper alternatives. This could partly be due to people saving money by drinking at home, and using those savings to buy pricier bottles, an industry report has found.

The report on the alcoholic beverage industry by Mumbai-based financial services conglomerate Antique Stock Broking, released Monday and reviewed by ThePrint, found that spirits make up 93 per cent of alcohol consumption in India — far higher than in peer countries such as China (69 per cent), Brazil (36 per cent), the US (33 per cent), the UK (22 per cent), and South Africa (17 per cent).

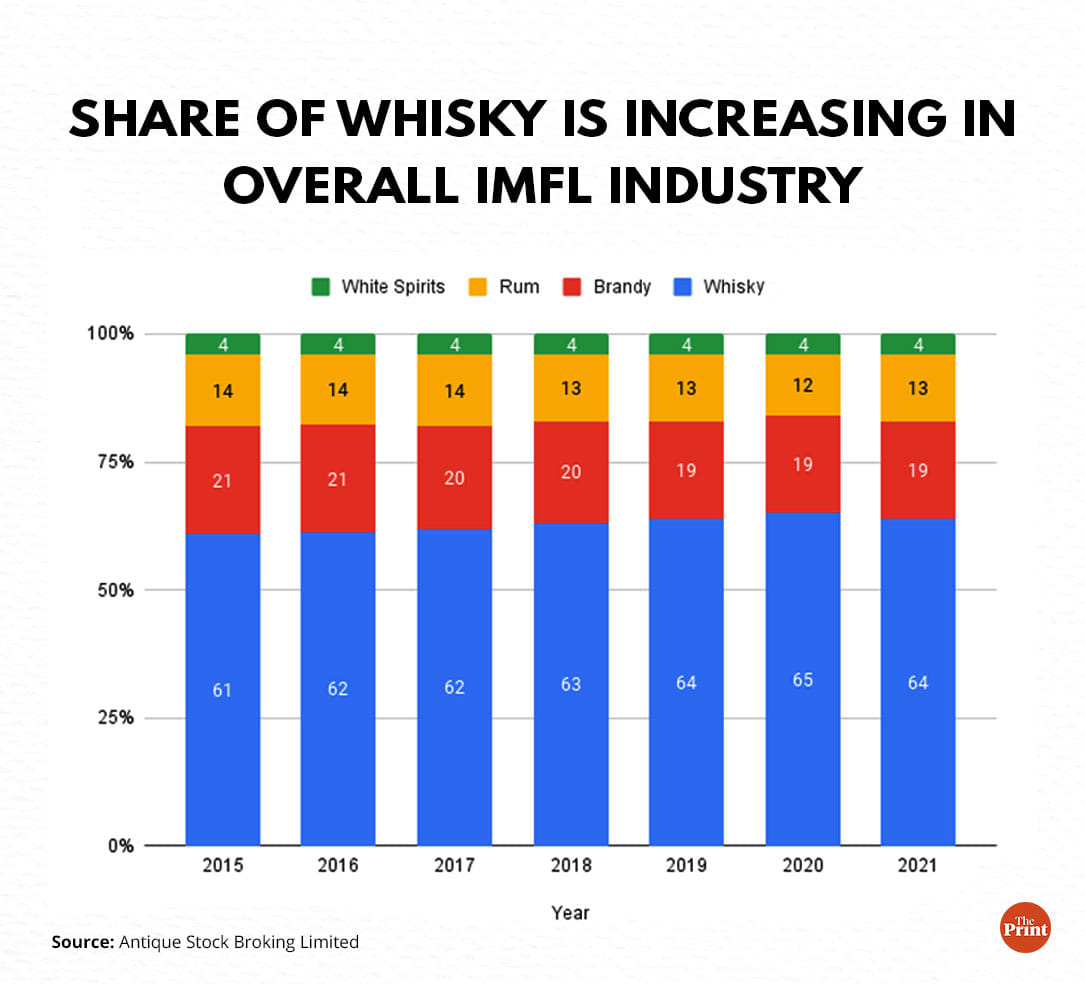

Analysing the Indian-made foreign liquor (IMFL) market in the country, the report found that whisky’s share increased gradually over the 2015-2021 period, while the share of brandy fell commensurately. The share of rum has also fallen marginally over this period.

“Indian IMFL is largely dominated by brown spirits contributing more than 96 per cent of the volume,” the report said. “In overall spirits, whisky contributed 64 per cent of the total IMFL volume in 2021. The contribution of whisky has increased from 59.5 per cent in 2014 driven by volume growth of 1 per cent CAGR (compound annual growth rate) over 2014-2021 versus no growth in industry volume.”

The data shows that the contribution of whisky further increased to 65 per cent in 2020 following the pandemic-induced disruption.

Also read: Smoking, alcohol & high BMI among biggest risk factors linked to cancer death, says Lancet study

Move towards premium brands

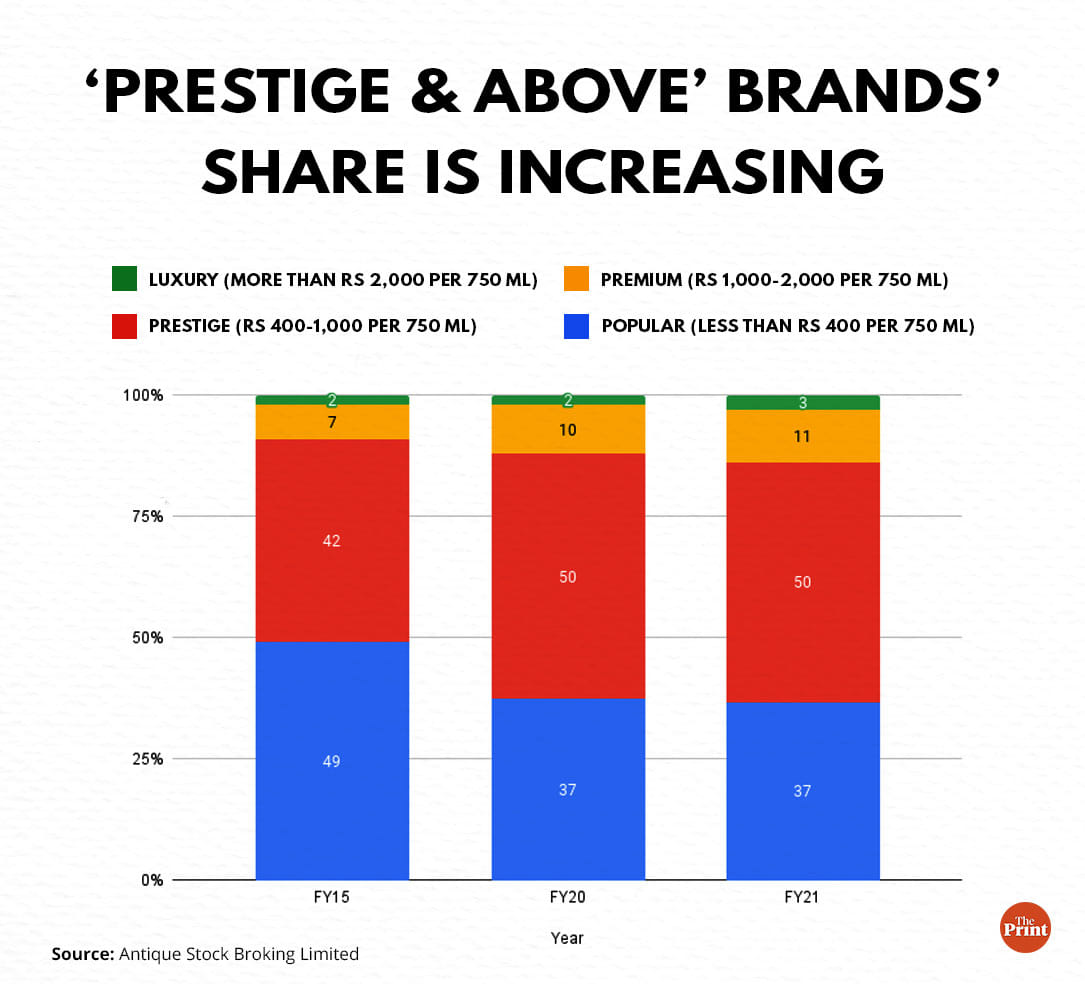

Within IMFL, the analysis found that the Prestige & Above (P&A) segment, which comprises brands priced at more than Rs 400 per 750 ml, has been increasing its share and now contributes more than 50 per cent to the overall IMFL market.

“P&A segment volume has grown at 7 per cent CAGR vs industry growth of 3 per cent (over calendar year 2014-2019),” the report said. “Our understanding is that within the P&A segment, premium and luxury brands have grown in double digits compared to mid-single digits for prestige brands.”

Premium and luxury brands are spirits that cost more than Rs 1,000 and Rs 2,000 per 750 ml, respectively. Popular brands — those priced at less than Rs 400 per 750 ml — have seen their share fall significantly over 2014-2021.

Pandemic changed the way we drink

“During Covid-19, IMFL volume declined by 18 per cent in calendar year (CY) 2020 due to restrictions on mobility of people and closing/operational hour restrictions on restaurants/bars/pubs,” the report said.

According to the researchers, the off-trade consumption — conducted outside bars, hotels, restaurants, etc — accounted for 80 per cent of the total before the pandemic and increased to 85 per cent in CY2020.

“However, we expect the share of off-trade to reduce subsequently, with the opening of the economy and restaurants/bars/pubs,” the report said. “During Covid-19, many states increased taxes on alcohol to compensate for loss of revenue during the pandemic. Though, some states rolled back part/full tax hikes after witnessing significant drop in sales.”

Traditionally, Indian consumers have preferred to consume alcohol outside their homes, the report said.

“However, the outbreak of COVID-19 and restrictions on on-trade consumption led to an increase in off-trade consumption — partially offsetting sales loss,” it added. “During the pandemic many consumers have started consuming alcohol at home, which in turn can drive higher volume growth in the long term, as it improves affordability.”

In essence, what has been happening is that consumers are realising that imbibing alcohol at home is cheaper as restaurants, bars, and pubs charge 30-50 per cent over the MRP. As a result, people are choosing to drink at home and use the savings to buy premium brands.

Another factor encouraging consumers to drink at home is the liberalisation of rules related to the home delivery of alcohol.

“In order to boost consumption of alcohol and support state revenue, many states have relaxed restrictions on home delivery,” the report said. “States like West Bengal, Maharashtra, Odisha, and Punjab have provided permission for home delivery of alcohol.”

Southern states lead the way

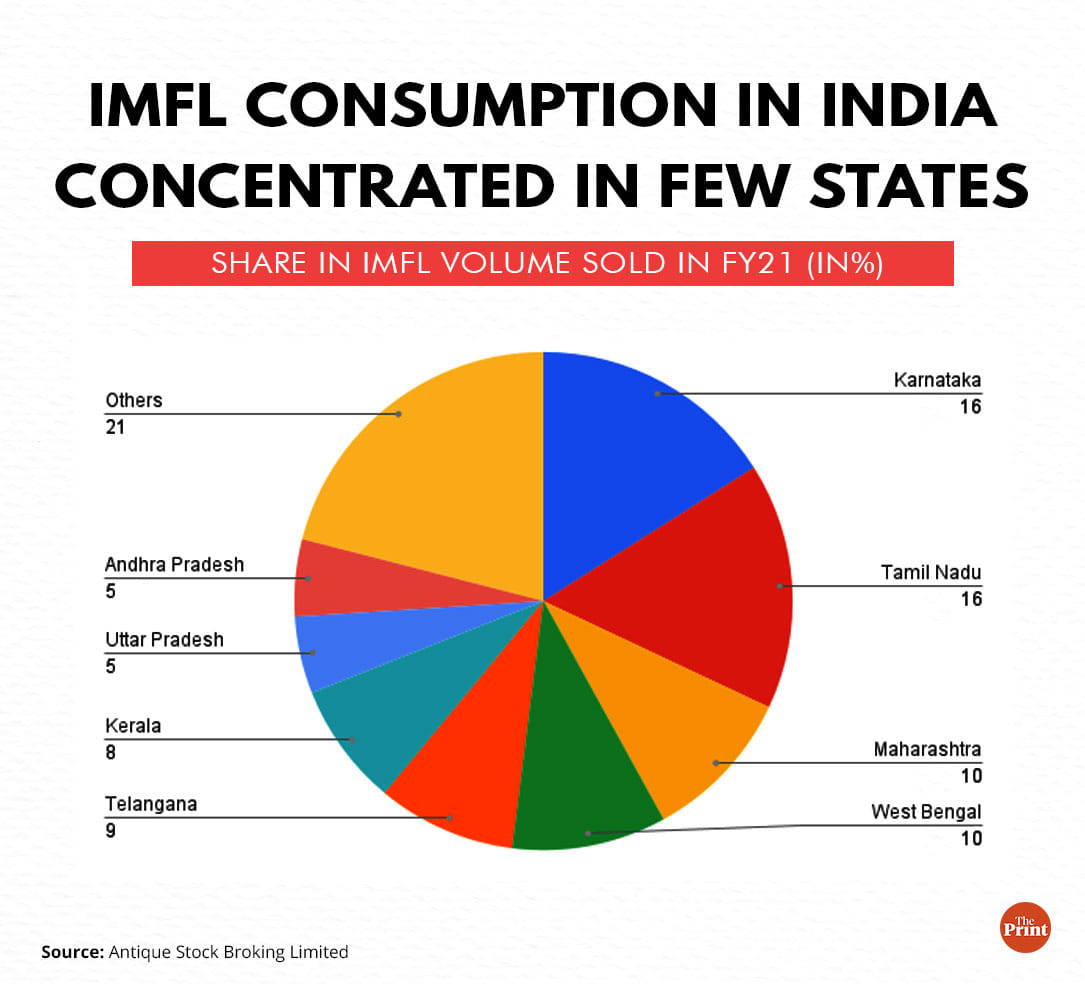

The consumption of IMFL in India is highly-concentrated in a few states. The top six states — Karnataka, Tamil Nadu, Maharashtra, West Bengal, Telangana, and Kerala — together account for nearly 70 per cent of all IMFL consumption in India.

Some states and Union Territories are more dependent on the tax collected from the sale of alcohol than others. For example, 32 per cent of Puducherry’s total tax revenue comes from the sale of alcohol. This number is 25 per cent for Uttarakhand (the next highest), 22 per cent for Uttar Pradesh, 20 per cent each for Karnataka, Sikkim, Chhattisgarh, and Himachal Pradesh, and just 4 per cent for Kerala (the lowest dependence).

However, the report pointed out that regulatory uncertainty in some states is leading to volatility in the sector.

“Andhra Pradesh’s (fourth largest state by volume) volume has declined post 2019 after the state government changed,” it said. “The government introduced a new liquor policy soon after coming to power and announced its plan to implement complete prohibition by reducing the number of outlets in a phased manner. It also changed the route to market by setting up state-managed retail outlets and discontinuing private retailers.”

In contrast, Chhattisgarh has moved from government control to private sector participation, which is expected to be a boon for the industry, the report added.

(Edited by Nida Fatima Siddiqui)

Also read: Devdas at 20: It’s time Bollywood stopped showing alcoholism as romance and rebellion