New Delhi: India has been ordered to return $1.2 billion to Cairn Energy Plc after Prime Minister Narendra Modi’s administration lost arbitration proceedings in a tax dispute.

An international arbitration tribunal ruled that the tax claim was not a valid demand and asked the government to repay the funds withheld along with interest to Cairn, people with knowledge of the matter said, asking not to be identified citing rules on speaking to the media. India had seized dividend, tax refund and sale of shares due to the Scottish oil explorer to partly recover the dues. India can appeal.

A spokeswoman for the tax department did not answer a call made to mobile phone during business hours.

Cairn Energy’s victory will be a second loss for India in an international arbitration after Vodafone Group Plc won a years-long tax dispute with the Indian government in September over a controversial $3 billion tax demand. Unlike in the Vodafone case, the government will have to repay Cairn. India in 2012 retrospectively amended the tax code, giving itself the power to go after M&A deals all the way back to 1962 if the underlying asset were in India.

The restitution of Cairn’s claim compares with its market capitalization of $1.3 billion, and “if successful and enforced, could produce windfall-enabling M&A or a special dividend,” Bloomberg Intelligence analyst Will Hares wrote last year.

According to the verdict, the retrospective tax demand was unfair treatment under the bilateral investment protection pact between the South Asian nation and the U.K., the people said.

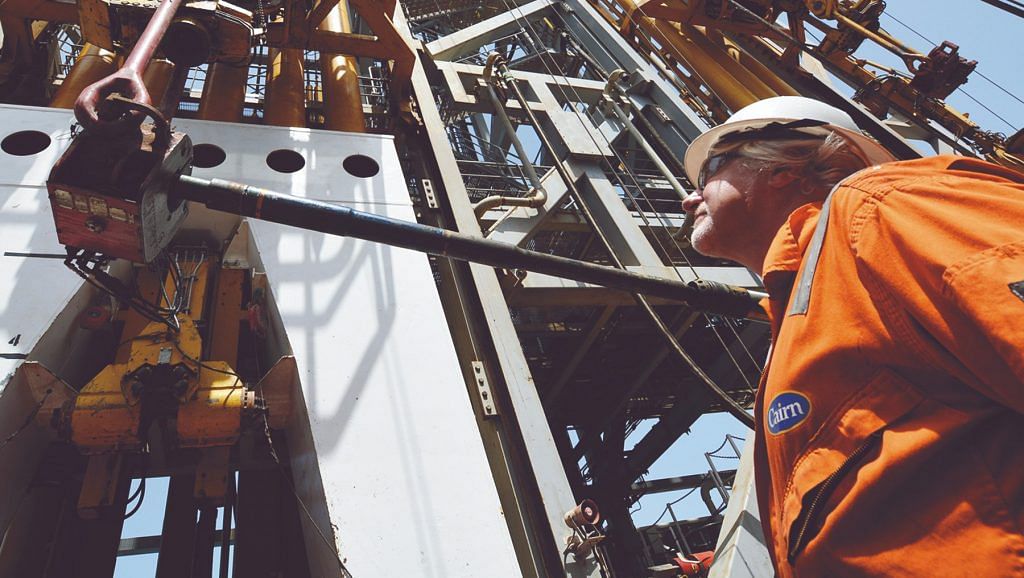

The U.K. oil explorer received the tax claim from Indian authorities in March 2015 over a restructuring carried out in 2006 while preparing for an initial public offering of Cairn India. The Indian tax authorities had seized 10% of Cairn India Ltd.’s shares, then valued at about $1 billion, according to information on Cairn Energy’s website.

In 2011, Cairn Energy sold most of its holding in the Indian unit to billionaire Anil Agarwal’s Vedanta Resources Plc for $8.7 billion. Cairn Energy had transferred ownership of its Rajasthan oil field, the country’s biggest onshore discovery in two decades, to Cairn India.

The Edinburgh-based company filed a dispute under the U.K.-India Investment Treaty and sought international arbitration that started later in 2015 for the losses over expropriation of its investments in India from the minority holding.- Bloomberg

Also read: Tata vs Mistry, Ambani vs Bezos among biggest trials in the world coming to courts in 2021