New Delhi: Their models are sleek, stylish, and more importantly, environmentally friendly. However, that green USP is a thing of the past and something else has taken over the discourse. For Ather Energy, one of India’s leading e-scooter makers, safety has become the top pitch. And it’s not just Ather.

A series of fires in 2022, including in Ola e-scooters, sowed doubt among Indian consumers about the safety of these vehicles. To counter this, companies have flipped their strategy. It is now safety over everything else.

“Our focus has always been the safety of our scooters. But after these incidents hit the news, people started believing this misconception that e-scooters are a volatile, unsafe mode,” said an Ather official, requesting anonymity.

In 2021, Ola e-scooters came in with a bang—stylish, convenient, and affordable, everything the urban middle class aspired to. But that changed in 2022, when videos of these scooters going up in flames on highways, outside malls, and in parking lots started doing the rounds. Angry customers and bystanders narrated their close calls.

Government estimates based on media reports show that between 2022 and 2023, at least 15 fires involved Ola e-scooters alone, according to Ministry of Environment, Forest and Climate Change (MoEFCC) officials. Safety concerns were also raised over Okinawa and PureEV e-scooters.

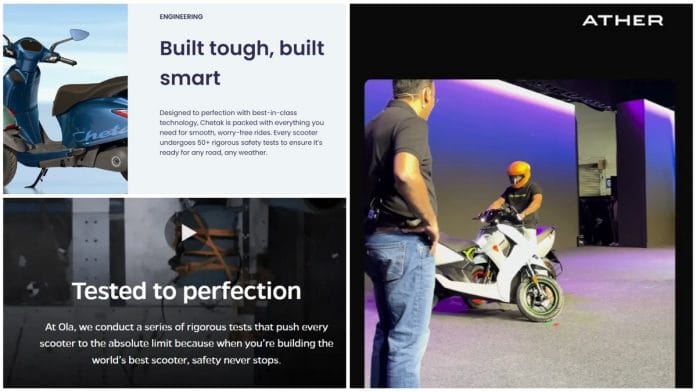

What this ultimately did was turn India’s electric scooter industry on its head. Safety became the new selling point, with every brand racing to claim the title of the safest e-scooter in town. The Bajaj Chetak website assures that “every scooter undergoes 50+ rigorous safety tests,” Ather has an entire page dedicated to “Safety First,” and Ola Electric promises every scooter is “tested to perfection”. Each brand makes sure to list its battery’s superior properties. The incidents have also pushed the government to tighten safety norms for e-scooters.

Experts say the Indian e-scooter industry has weathered its darkest phase and is now emerging strong. With legacy mobility giants such as Bajaj, TVS, and Hero entering the market since then, India’s two-wheeler EV market has become more competitive, reliable, and technologically advanced.

Automotive and clean energy industry professional Deb Mukherji said the 2022 Ola e-scooter fires had raised serious questions about the safety and reliability of these vehicles.

“That was a time when the e-scooter market was 100 per cent dependent on Chinese imports. These were low-end products with little quality control, which often did not have any quality control,” he recalled.

These parts were also not tested to suit Indian conditions, like extreme heat and humidity. Since then, the scenario has improved.

“Now we have better quality and safety standards. This segment has really set out to capture the market,” Mukherji said.

There’s been a low-grade panic around EV blazes worldwide, with recent incidents including a Tesla fire in New York state and a Xiaomi sedan catching fire in China this week. One global estimate showed there was about one fire per 100,000 electric vehicles sold; for petrol or diesel vehicles, fires occur around seven times more often. While experts say the fears stem from perceptions and publicity more than prevalence, EV fires are harder to douse, since batteries can reignite and need prolonged cooling.

Also Read: Everyone wants a used BluSmart EV. It’s Delhi’s biggest fire sale

New tech for safety

The Diplos e-scooter range from Bengaluru-based Numeros is the new kid on the block. Developments in earlier years of the sector, including the 2022 fires, only reinforced Numeros’ focus on safety, durability, and reliability, according to the company.

Shreyas Shibulal, founder and CEO of Numeros Motors, said the new e-scooters underwent 13.9 million kilometres of on-ground testing for heat, cold, altitude, floods, and humidity. It was ridden across different terrains and cities from the hot deserts of Jaisalmer to the freezing mountains of Manali and the humid coasts of Goa.

“At Jaisalmer, we tested Diplos at peak temperatures of 50 degrees Celsius, covering 5,000 kilometres,” he said.

Numeros also uses advanced 3D modelling and validation software to simulate and identify potential safety weaknesses before a single vehicle is built. This helps engineers catch design flaws early and avoid expensive late-stage rework.

“That’s proof of how seriously we take safety,” Shreyas added.

For Ather, which was already in the market when the e-scooter fires were reported, regaining customer trust was imperative. One of its USPs is fully indigenous batteries, built on custom semi-automatic production lines with diecast aluminium casings for better thermal management.

‘Safety’ is now the sales pitch for these companies, riding on innovation and stricter quality control.

Last year, Ather also announced its Battery Protection Programme, offering an extended warranty that guarantees the batteries’ state of health (SoH) will remain above 70 per cent for up to eight years.

The confidence in India’s electric vehicle ecosystem has come from both ends—manufacturers and consumers. The fact that the big guns are entering this segment is itself a stamp of approval

-Environment Ministry official

EVs in India mostly use lithium-ion batteries comprising rechargeable cells. These batteries are affordable, charge fast, and last long, but their flammable electrolyte makes them vulnerable to catching fire.

The fires are caused by an exothermic reaction that releases heat and causes a chain reaction, which ultimately leads to a sudden increase in temperature.

A senior official from the Union Environment Ministry said this reaction is usually triggered when electric vehicles are built with poor-quality cells, flawed battery pack design, and improper integration of the battery and the vehicle.

“To save on cost, these scooters compromise on quality,” the official added.

Rising demand & rare-earths roadblock

The last decade has been a rollercoaster ride for Indian e-scooter manufacturers.

The e-vehicles dashboard maintained by Delhi-based think tank Council on Energy, Environment and Water (CEEW) shows that total e-scooter sales in India climbed from 1,569 in 2014 to 1,150,799 in 2024.

This year, electric two-wheelers accounted for 58.49 per cent of India’s EV sales, up two percentage points from 2024.

The entry of legacy players such as Hero Electric, Bajaj Auto, and TVS Motor Company has also boosted public confidence. These companies come with better infrastructure, marketing, and a stronger public image.

“The confidence in India’s electric vehicle ecosystem has come from both ends—manufacturers and consumers. The fact that the big guns are entering this segment is itself a stamp of approval,” said an Environment Ministry official.

Indian roads are not changing anytime soon. But we refuse to take safety as an option just because you’re on two wheels

-Ather CEO Tarun Mehta

But right when things had started to look up for the e-scooter industry, it has been hit by another roadblock.

In April, following the US’s tariff impositions, China introduced restrictions on rare earth exports.

The resulting shortage of rare-earth metals—used to create powerful, compact magnets for EVs—has drastically affected production. In August, Bajaj reduced its e-scooter delivery target by as much as 50-60 per cent in the face of the rare earths crunch.

This group of 17 elements, including terbium, europium, samarium, and dysprosium, are also used in smartwatches, computer screens, radars, and medical equipment.

Then in yet another blow this month, China expanded its export controls on rare earths, adding five more elements to its restricted list and tightening export licenses for magnets.

But even on this front, there have been some good tidings.

On 6 October, Ola Electric became India’s first automotive OEM (original equipment manufacturer) to receive government certification for its in-house developed ferrite motor, “completely free of rare-earth elements”.

Such motors use ferrite magnets instead of rare-earth magnets to generate the magnetic field necessary for the operation of an EV. They are cheaper and more sustainable than motors using costly rare-earth elements like neodymium.

“Things might get better now. We are hoping that the production will start picking up again,” the Environment Ministry official said.

Also Read: India’s shift to EV is making China richer. Over $7 bn paid in 5 years

Subsidies and stringent rules

Supportive domestic policies and a global tilt toward cost-effective, cleaner transport have been the backbone of the EV industry in India.

A 2024 analysis by Ken Research found that the Indian e-scooter market’s growth was primarily driven by demand for affordable, eco-friendly mobility. Rising fuel prices and government incentives pushed more people to adopt e-scooters.

Some estimates show that running an e-scooter costs around Rs 0.15 per km, compared to Rs 2.5 for a petrol scooter. Data from the Petroleum Planning and Analysis Cell (PPAC) also shows that fuel prices in Indian cities rose by more than 7 per cent in 2023.

It was owing to all these factors that the Indian e-scooter market reached US$ 1 billion in 2023, with Delhi, Bengaluru, and Pune leading in demand.

“These cities have also seen better infrastructure for charging points, making them favourable for EV adoption,” the Ken Research report read.

The focus of the Indian government on EVs has also been vital. Along with a revised version of the FAME II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme—offering subsidies and tax waivers for EV buyers—the Centre has implemented more stringent quality checks for e-scooter manufacturers.

In 2022, the government amended AIS-156, India’s automotive safety standard for electric vehicles, to include stricter rules on fire prevention and electrical hazards. Companies are required to make their e-scooters undergo a thermal propagation test to ensure that a fire in one battery cell does not spread to the rest of the pack.

Mandatory water protection tests to guard against short circuits, along with audiovisual warnings on e-scooters, have further raised safety standards. Manufacturers cannot enter the market without AIS-156 certification.

The e-scooter industry has matured significantly over the past few years, according to Mukherji.

“The growth is not just limited to the Indian market. Even globally, we have better quality checks around e-scooter parts. The global EV battery market continues to be dominated by China, but now more established brands like CATL and BYD are controlling it,” he said.

Meanwhile, some EV companies are extending their safety focus to the travails of Indian roads too, from Ather’s pothole alert system to Bajaj Chetak’s “thud-proof” design.

“Indian roads are not changing anytime soon,” said Ather CEO Tarun Mehta in an Instagram video. “But we refuse to take safety as an option just because you’re on two wheels.”

(Edited by Asavari Singh)