Gurugram: Everything in the photo has changed. The four-year-old child is closer to being a teenager. The mother’s black hair is now streaked with greys on the sides. And the father, who clicked the photo, now carries a paunch. But the tower that made the backdrop of this picture remains the same – a skeletal rising from the ground, unfinished and abandoned.

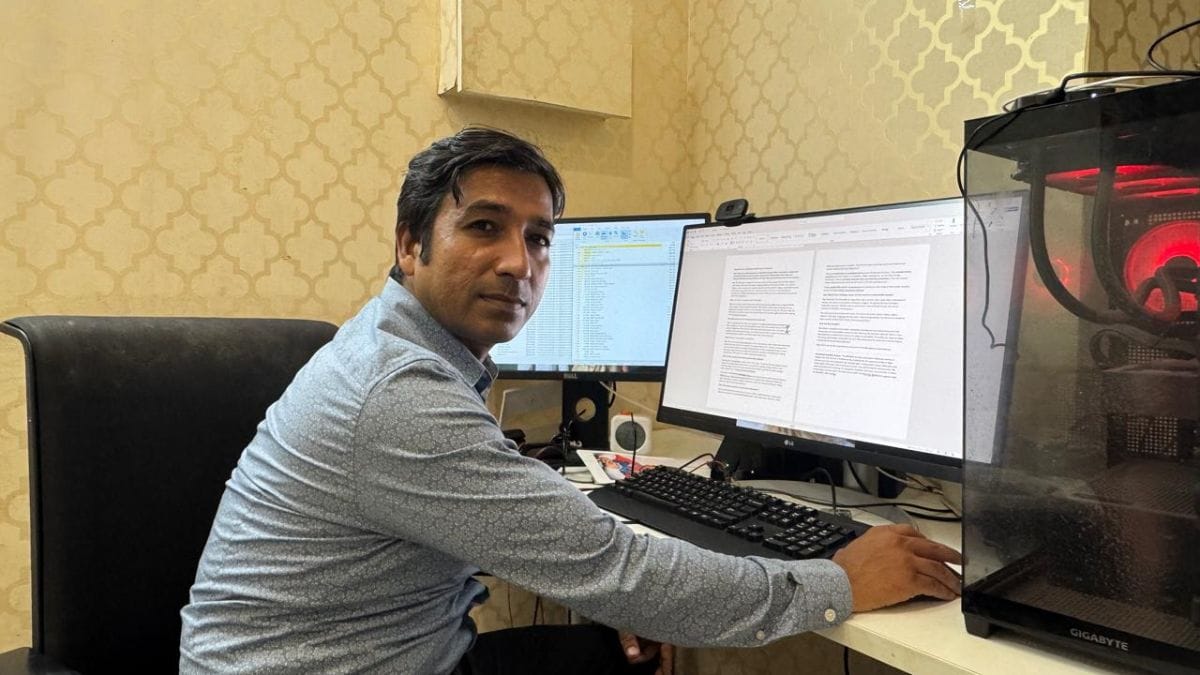

“I feel miserable. It was my dream to raise my children in our very home. The dream has been lost and so has the money,” said 44-year-old Sunil Dhoundiyal, who is forced to live in a one BHK rented apartment in Dwarka.

Dhoundiyal is one of many victims of the Haryana government’s ambitious Affordable Housing Policy, launched in 2013. Over 25 thousand owners, as per the homebuyers association, are still waiting for their promised apartments. The select few whose apartments were built are struggling with the basics — no water supply, poor sewage systems and broken approach roads. The policy was aimed to provide housing for all under the Public-Private Partnership (PPP) model. It was said that all “such projects shall be required to be necessarily completed within four years from the approval of building plans…” Twelve years later, several projects — including by Ocean Seven Buildtech (OSB) Pvt Limited and Mahira Homes — remain in limbo. The builders have cited several reasons: delays caused by the pandemic, and the cancellation of licenses, among others. But the biggest reason, according to them, is the financial unviability of the projects. There are around 60 affordable housing projects in Gurugram.

And with homebuyers protesting, the administration is tightening the noose around the builders. On 31 August, the department of town and country planning (DTCP) registered an FIR against OSB for failing to complete its three affordable housing projects – Expressway Towers, Golf Height 69 and The Venetian. The DTCP accused the builder of committing “irregularities regarding funds raised by the buyers of these projects.”

“The profit margins in these projects are very low. The sale rate has been fixed by the government. However, the cost of construction keeps increasing over time. We had taken 10 affordable housing projects and delivered all of them. In several projects, we even faced losses and paid from our own pockets,” said Brahm Dutt, director of Pyramid Infratech.

While Pyramid Infratech’s Urban homes affordable housing property in Sector 70A is complete, it lacks basic amenities. Signature Global, a prominent name in real estate, undertook 22 projects under the Affordable Housing Policy at different points in time and has delivered only 12 of them so far. Projects include Signature Global Solera in Sector 102 and Andour Heights in Sector 71.

“The problem is that the authorities require us to sell at a fixed price of Rs 5,000 per sq ft. However, our input costs are much higher, and they vary depending on the location. For instance, Sector 71 is a prime location, and the costs there are significantly higher compared to Sector 102,” said Durgesh Kumar, Senior Manager of Strategic Communications at Signature Global.

He added that they are focused on completing the remaining projects, with the last one launched in 2022.

“Our first project was launched in 2014 and delivered within three years. While we didn’t incur losses, we operated on very thin margins,” Kumar said.

Over 25 thousand owners, as per the homebuyers association, are still waiting for their promised apartments. The select few whose apartments were built are struggling with the basics — no water supply, poor sewage systems and broken approach roads.

Around three years ago, builders approached RERA and DTCP, urging them either to discontinue the policy or revise the fixed pricing structure.

“Builders were incurring heavy losses. We requested that either the per sq ft selling price be increased or the policy be withdrawn altogether. Eventually, no new projects were launched under this policy,” said another prominent developer on condition of anonymity.

The Affordable Housing Policy was a scheme for the entire Haryana, but in Gurugram, it attracted a different clientele. Instead of serving the lower-income groups, majority houses were pocketed by white-collared professionals—the ones who couldn’t fulfill their housing dreams in the city’s exorbitant real estate market.

“When someone thinks of affordable housing, the first thought that comes to mind is of low-income group families or EWS receiving government support to buy a home,” said Deepak Firlok, president of the affordable homebuyers association. Firlok lives in Urban Pyramid Infratech, an affordable housing property, in Sector 71A.

But in Gurugram, unlike Noida, there are no real options for the middle class, said Firlok.

“It’s either Rs 25–30 lakh under the affordable housing category or Rs 1 crore and above in the open market. There’s no middle ground. So, most middle-class professionals from other cities working in Gurugram have turned to affordable housing, simply because that’s the only way they can hope to own a home in Gurugram,” he said.

Also read: Chennai station is packed with migrant workers returning to UP, Bihar from Tiruppur

ED raids, FIRs

It was an advertisement by the regulatory body RERA that prompted Dhondiyal to book a 3BHK apartment at Mahira Homes in Sector 68 under the affordable scheme in 2018. He took a loan of Rs 15 lakh and, over the next few years, paid the builder Sikandar Singh of Mahira Homes in installments.

“If a person is even taking a loan for a Rs 22 lakh flat, think of the income they have,” asked Dhondiyal. These houses range in size from approximately 600 to 700 sq ft, and fall under two categories: 2BHK and 3BHK units.

By 2022, Dhondiyal had paid the entire amount of Rs 23 lakh. And that’s when the project — already crawling at a snail’s pace — came to a complete halt.

In 2023, the Department of Town and Country Planning (DTCP) declared that forgery involving fake identities and guarantees had been committed by the builders. Headlines such as “DTCP orders FIR against Mahira developers for submitting forged building plan” and “FIR against Mahira homes for submitting forged papers” were all over the news. The escrow account of the builder was frozen. To put a stop to the rampant diversion of funds by several real estate players, the RERA Act 2017 made provision of an escrow account that would be managed by a third party and funds shall be released to the developer only after certain conditions are met by them. Mahira Homes’ license was cancelled. And the builder completely stopped working on the project.

“Who were the third parties in this escrow account? Engineer, CA and architect and they are on the payroll of the builder. This happened in the case of Ocean Seven Buildtech Pvt. Ltd. where Axis Bank released the money from the Escrow account without proper verification and due diligence,” alleged Sanjay Lal, lawyer and president of Gurugram’s Apartment Owners Association.

Lal, who is also a member of the central advisory council of RERA, recalled a meeting that took place three years ago at the regulator’s office in the presence of Hardeep Singh Puri, then Minister of Housing and Urban Affairs. During the meeting, Lal raised concerns about affordable housing projects getting stuck, builders exiting midway, and the resulting loss in confidence among the middle class in the scheme.

“Hardeep Puri was in the meeting and he was very responsive and considerate. We genuinely thought some action would follow, but unfortunately, the Haryana government didn’t do anything,” said Lal.

Meanwhile, a shaken Dhoundiyal and thousands of other buyers took to the streets in protests.

The directors and owners of the Mahira Groups are former MLA Dharam Singh Chokker and his son Vikas Chokher and Sikander Singh. During ED searches at the houses of the Mahira Group’s owners, the agency said that it found “luxury cars worth Rs 4 crore, jewellery worth Rs 14.5 lakh, Rs 4.5 lakh in cash and evidence related to the diversion of home buyers’ money.”

“My only question is — how did DTCP discover the forgery only after all of us had paid the full amount? Didn’t they verify the license before approving the project? Why did they wake up only after 100 per cent payment was collected from buyers?” said Dhondiyal, who works in the private sector.

Meetings with the Deputy Commissioner and ministers, letters to the Chief Minister’s grievance cell, everywhere Dhoundiyal turned with hope, he said, he was met only with assurances — not action.

“And then homebuyers, along with me, panicked and approached the authorities in Chandigarh requesting to renew the builder’s license so that the work can be resumed and the construction of our flats can be completed,” said Dhoundiyal.

Giving in to homebuyer’s pressure, in April 2022, another six months’ time was given to the builder who promised to finish work by September 2022. But again, the builder slacked. And then came the Enforcement Directorate raid in 2024.

The directors and owners of the Mahira Groups are former MLA Dharam Singh Chokker and his son Vikas Chokher and Sikander Singh. During ED searches at the houses of the Mahira Group’s owners, the agency said that it found “luxury cars worth Rs 4 crore, jewellery worth Rs 14.5 lakh, Rs 4.5 lakh in cash and evidence related to the diversion of home buyers’ money.”

“It broke my heart to know that this is what the builder was doing with our hard-earned money,” he said.

Dhoundiyal who lives in a 1BHK with his wife and two kids in Dwarka, pays monthly rent of Rs 20,000 along with the Rs 18,000 EMI to the bank for the apartment that’s nowhere near possession. It was in January this year when he went through three sleepless nights after it became difficult for him to manage expenses. Next, he was at the hospital, admitted for suffering brain stroke.

“The builders made the castle out of homebuyers’ money and the administration is only coming up with announcements, one FIR after another. In the middle, we homebuyers are literally struggling to make our ends meet,” said Dhoundiyal.

Also read: Belagavi to Boeing. Karnataka aerospace hub is a shining postcard for Make in India

The civic neglect

After crossing pothole-ridden, waterlogged roads with garbage piled along the sides, the gates open to Pyramid Urban Homes in Sector 70A. Fifteen brown-painted towers stand huddled together, their premises ending as abruptly as they begin. The area is very small with no facilities such as swimming pool, or even parking. This is the affordable housing complex where Deepak Firlok lives.

A typical day at Pyramid Urban Homes begins with the arrival of nearly a dozen water tankers entering the premises. According to residents, the cost of procuring this tanker water alone amounts to around Rs 5 lakh per month, a heavy financial burden for the community.

The day ends with yet another challenge: tankers removing sewage water from the sewage treatment plant (STP), which lacks proper functioning equipment. A day without tankers removing the water from the STP results in overflowing sewage water flooding the society and filling the air with a foul stench.

A typical day at Pyramid Urban Homes begins with the arrival of nearly a dozen water tankers entering the premises. According to residents, the cost of procuring this tanker water alone amounts to around Rs 5 lakh per month, a heavy financial burden for the community

“A total of Rs 10 lakh a month — divided among 1,300 flats — is paid by the residents just to meet their basic needs. The builders have simply built this complex without any proper infrastructure,” said Firlok, who has to park his car a kilometre away from his home due to the lack of parking space.

“There isn’t even a proper road leading here, no water supply, and the sewage plant barely works.”

Firlok has run from pillar to post– from MCG offices, to DTCP regarding the problems with affordable houses. But there has been no action, he said. The reason being that most affordable houses at his own complex are mostly rented out to tenants while owners are living in their comfortable houses.

ThePrint reached out to the MCG commissioner for a comment but is yet to receive a response on it.

Around 1,500 of the units in this affordable complex are rented out to tenants who pay roughly Rs 15,000 monthly for a 2BHK. “Isn’t this a fraud? How were they allowed to buy these flats? It has defeated the purpose of housing for all,” Firlok questioned.

The policy has three categories of homebuyers with different income brackets who are eligible—EWS (up to Rs3 lakh per annum), LIG (Rs3-6 lakh per annum) and MIG (over Rs 6 lakh per annum).

According to Firlok, 1,015 tenants are living out of 1,500 flats .

“These homes were meant for people who truly needed them. But many owners live comfortably in Delhi and still collect rent from here. Some haven’t just bought one flat — one owner, for instance, has purchased multiple apartments.”

However, the builders are not aware of any such investment because, Firlok said, that the homebuyers have been buying the flats in the name of their relatives and friends. A common practice in India’s inflated real estate market where prices have skyrocketed in the last few years, making housing for many out of reach.

As the president of affordable homebuyers association, Firlok has been raising the issues faced by such flat owners. “Fifteen projects have been delivered, 35 are delayed, and another 15 havent even started.”

Also read: Policemen suspended after Paneer goes bad in greater Noida. A tale of a protest & BJP leader

One property, multiple sales

Gaurav Kumar holds a brown-coloured file close to his chest. Inside it, lies his sister’s dream of owning a house. Receipts carrying the proof of payment — Rs 26 lakh — made to the builder, registration documents and an A4 size sheet printed with a timeline of what transpired after his sister booked the flat in 2021.

For Kumar’s sister, an affordable house proved to be a right opportunity to live independently – away from her parents and brothers’ family. She is 36 and unmarried.

But now, it’s her elder brother, Kumar, who has been making repeated trips to RERA office, trying to ensure that the apartment she once dreamed of actually sees the light of day.

“Last year, there was a meeting held between RERA and the buyers, and we had come to an agreement that Ocean Seven Buildtech (OSB) Pvt Ltd will finish the project in one year. The builder gave a timeline of February 2025,” said Kumar.

But nothing took off the ground and now, OSB has an FIR against it. Haryana State Enforcement Bureau has registered the FIR against Ocean Seven Buildtech (OSB) Pvt Ltd and its director Swaraj Singh on 31 August. The FIR was registered after a complaint of district towner planner (enforcement) Amit Mandolia. A lookout notice has also been sent amid fears that Singh might attempt to flee the country.

According to the complaint by DTP, OSB was granted licenses between 2016 and 2019 to develop three affordable housing projects in Sector 109, Sector 69 and Sector 70. Sector 109 is where Kumar’s sister had bought her 2bhk.

However, after several complaints by homebuyers before RERA, it was found that the builder had made “multiple sales of same units” to different allottees. The complaint also spoke about the outstanding dues of Rs 21 crore of OSB against suspended licenses.

“RERA should take over our project and ensure its completion. What is the fault of homebuyers in all this? Why should we suffer?” asked Gaurav Kumar whose sister booked a home under the affordable scheme

“Despite the suspension of the license by RERA, the builder continued to collect payments from the homebuyers in the garb of building an affordable apartment,” said a senior official from DTCP. The official said that 95 per cent of the payment was collected from the buyers and only 62 per cent of the work was completed by OSB builders. It’s the latest case against them. And the project has been stalled since 2019 with almost no progress.

The FIR has come as a sigh of relief for Kumar. In last one year alone, Kumar has attended 32 hearings at RERA. In most hearings, the builder side didn’t show up.

But Kumar said that FIR doesn’t solve the problem of flat buyers. The homebuyers have been demanding that RERA take over the incomplete projects under affordable schemes under Section 8 of RERA Act, 2016. Under the section 8 of RERA Act, it is the obligation of authority consequent upon the lapse of or revocation of registration.

“RERA should take over our project and ensure its completion. What is the fault of homebuyers in all this? Why should we suffer?” asks Kumar as he entered the under-construction complex. Barely a dozen workers are working around. The engineer at the site, who doesn’t want to be named, said that even his payment has been delayed.

“When we are not getting payment from the builder, how will we continue the work?” he asked.

Kumar pointed his finger at the sixth floor of the 13-floor apartment. “Nothing is happening there today.”

Outside the complex, a rusted board reads, ‘OSB. Expressway Towers Sector 109, Sohna Road.’

“It has taken so long to build the apartments that even the signboard has started to rust.”

(Edited by Anurag Chaubey)

ये कहानी सिर्फ इनकी नही इस कहानी के किरदार हम भी है, लेकिन हमे सुनने वाला कोई नही, मैंने भी प्रधान मंत्री आवास योजना के तहत महिरा 103 दौलताबाद द्वारका एक्सप्रेसवे मे 2019 मे एक दो कमरो का घर बुक करवाया था, ओर आज 2025 समाप्त होने को है लेकिन काम बंद पड़ा है 2021 से काम बंद पड़ा है और कोई सुनने को राजी नही. माहिरा बिल्डर जो की एक नामी कांग्रेस का नेता रहा है धर्म सिंह छोकर और उसके दो कपूत सिकंदर और विकास इन्होंने tcp विभाग गुरुग्राम के अधिकारियों को पैसा खिला कर लोवर मिडिल क्लास के भारतियों नागरिको के साथ जालसाजी की हमारे सपनो को तोड़ दिया, हमे ऐसे फसा दिया की आज ना घर है, और जो घर मिला नही उसकी किश्त बना को देते अपनी हालत खराब है ये हालात है हम सबके माहिरा 103 मे 800 फ्लैट है yanir800 परिवार की जिंदगी दाव पर लगी है और सरकार को कोई फुर्सत नही इस पर ध्यान देने की.