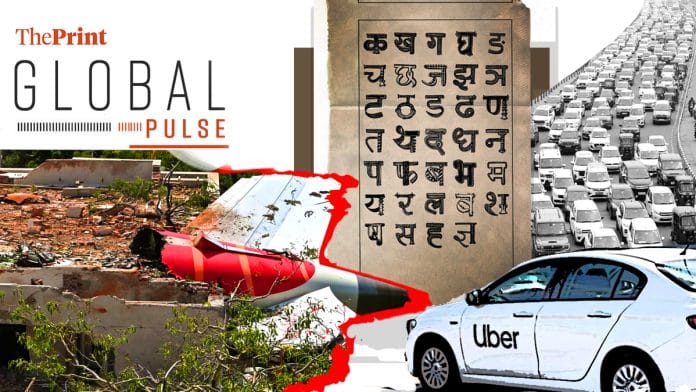

New Delhi: The probe into the crash of Air India’s London-bound plane in Ahmedabad last month is focusing on pilot error, and not on issues in the Boeing 787 Dreamliner aircraft, report Andrew Tangel, Shan Li and Krishna Pokharel in The Wall Street Journal.

“Indian officials have released little information to the public about the investigation, fuelling some frustration with American government and industry officials since the June 12 crash,” reads the report, citing people familiar with the matter.

BBC’s Cherylann Mollan dives into the latest chapter of India’s language wars, which is unfolding in Maharashtra—India’s “richest state”.

“…The uneasiness is especially high when it comes to Hindi, the most-spoken language in India. Over the years, steps by various federal governments to promote Hindi have fuelled fears within non-Hindi speaking states that the local culture will be diluted. These worries have been exacerbated by high migration from less-developed Hindi-speaking states to other parts of India, especially the south, in search of jobs,” reads the report.

The Economist focuses on “how to ease pollution, gridlock and honking on India’s roads”. The solutions needed to solve the stream of urban issues plaguing Indian metropolitan cities might not be to the taste of Indian elites—building and widening more roads only adds to the scale of the problem, it says.

“In addition, a small number of ornery road users wield outsize power. India has only 34 cars for every 1,000 people; their owners are unusually rich and privileged. These drivers tend not to favour stricter rules or more parking fines. They reflexively oppose schemes, such as bus lanes and cycle paths, that look like they might cause inconvenience—even though these will eventually speed things up. Authorities have to get motoring, regardless. If India wants to get rich, it must fix the engines of its economic growth,” reads the article.

Also in The Economist is Security and Exchange Board of India’s ban on trading firm Jane Street. The American trading firm has served as training ground for Sam Bankman-Fried, “an erstwhile crypto billionaire now serving a 25-year prison sentence for a range of financial crimes”.

“Jane Street rejects the allegations (of market manipulation). In a note to staff, the company said its trading on the days in question was bread-and-butter arbitrage, bringing stock prices into line with those in the options market. SEBI’s theories demonstrate ‘a misunderstanding of standard hedging practices’, it argues. The firm also says it has communicated repeatedly with SEBI, despite the regulator’s suggestion it has been unco-operative. Jane Street is working on an official response, which it has 21 days to make,” the article notes.

Chris Kay and William Sandlund report in Financial Times that India is due to see a “record year” in IPOs—making it the world’s largest IPO market outside the US. But there is a caveat.

“However, with New Delhi yet to cut a trade deal with Washington and (US President Donald) Trump threatening the country with further tariffs, India would need a few more (IPO) deals to go well to determine if the bull market is back, especially at a time when the macro background remains uncertain,” Perris Lee, head of Asia-Pacific equity capital markets at business intelligence service Mergermarket, tells FT.

Uber’s dominance in India’s ride-hailing market is up for questioning, following the success of Rapido, reports Newley Purnell in Bloomberg.

“The Rapido app was downloaded some 33 million times last year, outpacing Uber’s 21 million downloads and Ola’s 19 million over that period, according to Appfigures. While Uber and Ola have more cumulative downloads, when it comes to new user acquisition, Rapido is managing it best,” says Randy Nelson, head of insights at Appfigures, according to the report.

(Edited by Nida Fatima Siddiqui)