New Delhi: UltraTech Cement’s acquisition of a sizable stake in India Cements, coming on the heels of Ambuja Cements’ acquisition of Penna Cement Industries, is yet another step towards the consolidation of the cement sector in India.

Large players are getting larger and are cornering an increasing share of the sector’s growth.

Kumar Mangalam Birla-promoted UltraTech Cement Thursday announced that it had bought a 23 percent non-controlling stake in Chennai-based India Cements for Rs 1,889 crore.

Two weeks earlier, the Adani Group-owned Ambuja Cements announced that it had signed a binding agreement to acquire 100 percent of Hyderabad-based Penna Cement Industries for Rs 10,422 crore.

These two acquisitions are the latest in a string of other such moves, where India’s largest cement companies are making strategic buys to not only expand capacity but also widen their geographical reach.

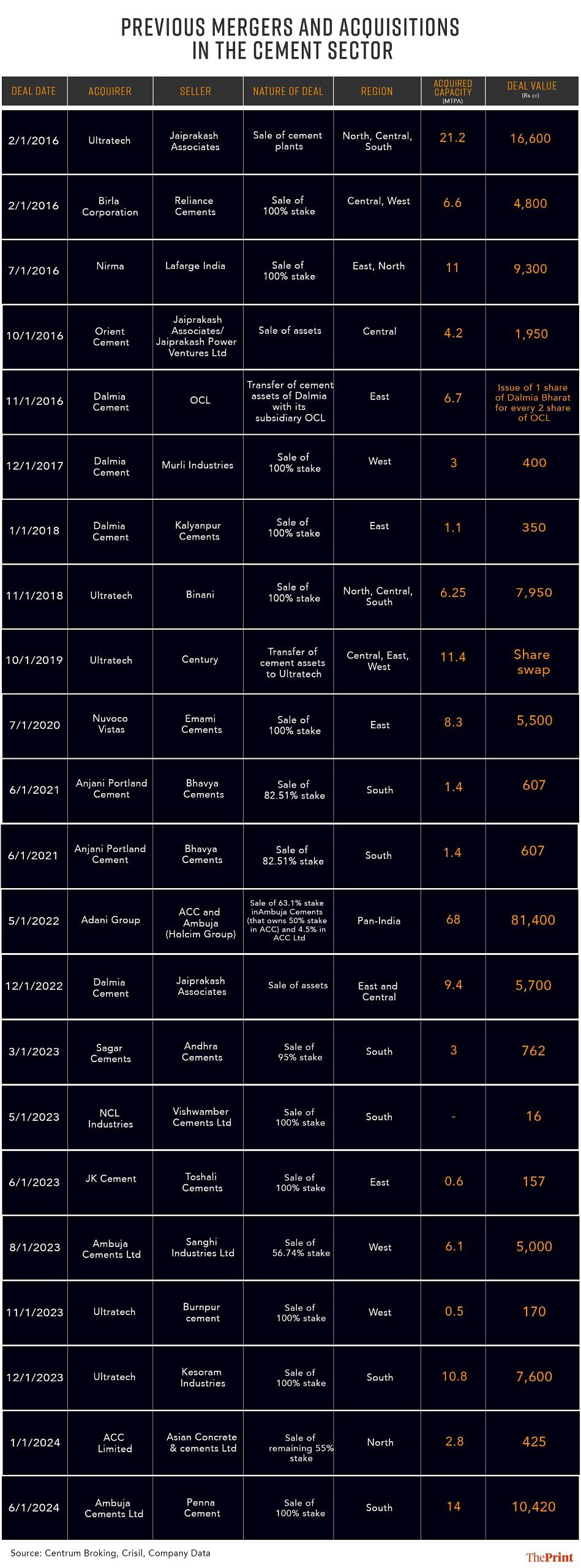

An analysis of these recent mergers and acquisitions in the cement sector showed that prior to the UltraTech Cement-India Cements deal, 21 other deals have taken place in the cement sector since early 2016, totalling a value of at least Rs 1.59 lakh crore. Some of the deals involved share swaps, and so, their monetary value is not readily available.

Further, the data shows that the bulk of the deals (Rs 1.12 lakh crore), at least in monetary terms, took place post-pandemic.

Also read: Company fundamentals over ‘Modi stocks’ — polls over, analysts predict shift in investor strategy

Ultratech move in response to Adani

“We see this move as a sign of eventual consolidation in the industry and expect the two leaders, Ultratech and Adani, to pursue further inorganic opportunities,” Centrum Broking, a brokerage that offers sectoral research and analysis services, said in a note, following Ultratech’s announcement Thursday.

Centrum further noted that, since it entered the cement industry with the acquisition of ACC and Ambuja Cements in 2022, the Adani Group has now acquired close to 24 million metric tonnes (MMT) of capacity and is on track to reach 140 MMT of capacity by FY28.

“Given the aggressive growth path pursued by Adani, we believe Ultratech could have been prompted for this move,” Centrum said.

Ambuja’s acquisition of Penna was seen as a strategic move by the Adani Group to deepen its presence in south India, especially in Andhra Pradesh and Telangana, where Penna’s assets are concentrated.

“For Ultratech, acquisition of non-controlling stake in India Cements has preempted its competitor from further deepening its presence in the southern region,” it added. “This acquisition, once through, will also bring much needed consolidation in the southern region which has been languishing with excess supply and low utilisation rates for a while now.”

Also read: Not enough time left, same fiscal constraints — why July budget maths will be similar to February’s

Ongoing consolidation in the cement sector

Analysis of the cement sector shows that the top five players in the sector — Ultratech Cements, ACC, Ambuja Cements, Shree Cement, and Dalmia Bharat — have consolidated their positions and have increased their combined market shares over the last six years.

“Since FY18, larger companies have been consolidating their market shares, and the market share of top-5 players has risen from 67 percent in FY18 to 72 percent in FY24,” Equirus Securities said in a research report. These market shares are set to increase with the recent acquisitions in FY25.

Notably, an additional outcome of this consolidation is that fewer companies will likely benefit from the central government’s ongoing capital expenditure and infrastructure creation push.

Also read: Trending ‘brown girl anthem’ is dangerous. Makes ‘low iron’ seem like a must-have accessory

Larger players cornering revenue & profits

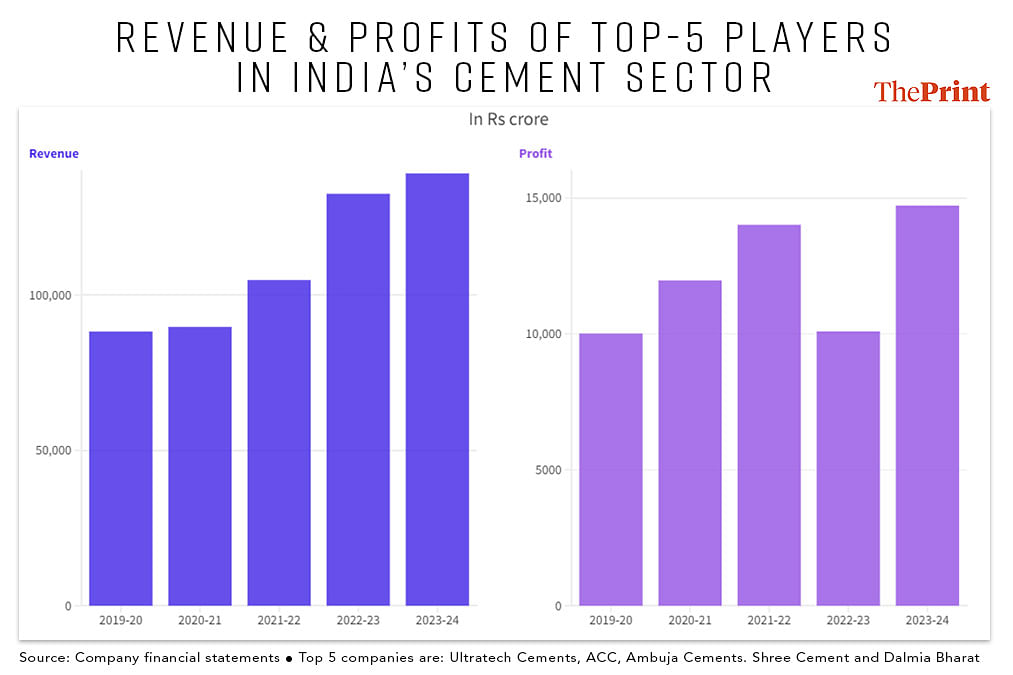

Analysis by ThePrint found that the consolidation of the cement industry, with a few players capturing large parts of the market, has meant that these companies have been able to enjoy a robust growth in their revenues and profits.

The top five players in the cement industry saw their combined revenues grow continuously for the last five years, from Rs 88,227 crore in 2019-20 to Rs 1.39 lakh crore in 2023-24. Similarly, the combined profits of these five companies increased to Rs 14,714 crore in 2023-24 from Rs 10,010 crore five years earlier.

“With aggressive strategies for maintaining/gaining market share via capacity addition and increasing distribution reach, we believe these top-5 players should continue to outperform the industry with government-led institutional demand going strong and overall industry demand also recovering,” Equirus Securities noted.

(Edited by Madhurita Goswami)

Also read: Unproductive speculation, rising household debt — SEBI, RBI’s concerns about India’s F&O market