New Delhi: With the Adani Group’s shares accounting for 3% of India’s two main exchanges, did the Indian economy falter in the wake of a scathing short-seller report that alleged financial impropriety in the ports-to-energy conglomerate?

The central government and India Inc have scoffed at the possibility of any serious fallout on the bourse, with one calling the over $100-billion rout in the group’s net worth a “storm in a tea cup”.

Union Minister Gajendra Singh said the allegations by US-based short-seller Hindenburg Research would not impact India’s economy. Uday Kotak, CEO of Kotak Mahindra Bank, contended that he did not see a “systemic risk” to the Indian financial system since, according to him, large Indian corporates rely more on global sources for debt and equity finance.

Finance Secretary T.V. Somanathan said the stock market stir was a “storm in a teacup” from a macroeconomic point of view and that India’s public financial system was robust enough to handle it.

Finance Minister Nirmala Sitharaman, too, agreed that the “macro fundamentals” of India’s economy and image remain unaffected when asked whether the withdrawal of the Rs 20,000-crore follow-on public offer (FPO) by Adani Enterprises would have any effect on India’s economy.

After the Group aborted the FPO on 1 February, many believed the move would cast a shadow on the country’s capital markets and prompt Indian and foreign investors to jump ship and dump their stocks and bonds.

But a New York Times article by Alex Travelli, titled “Why Adani’s $100 billion Loss hasn’t tanked India’s Markets”, bats in favour of the tycoon.

He argues that the debt concentration would be primarily faced by Life Insurance Corporation (LIC) and State Bank of India (SBI), lenders backed by the Indian government. If a situation arises, they will take the fall, the article says.

But so far, they don’t seem to be at risk of costing billions to policyholders across the country.

Additionally, if the billionaire were to file for bankruptcy, their hard assets, primarily the ports and power lines, would still be of immensely high value even if they were taken over by creditors.

Travelli also argues for a case against generalisations that big Indian corporations have a penchant for stock manipulation or fraud. Companies such as Infosys and Dr. Reddy’s Laboratories and Indian Hotels Company Ltd have a high corporate governance score by Refinitiv, he says.

The problem with limelight

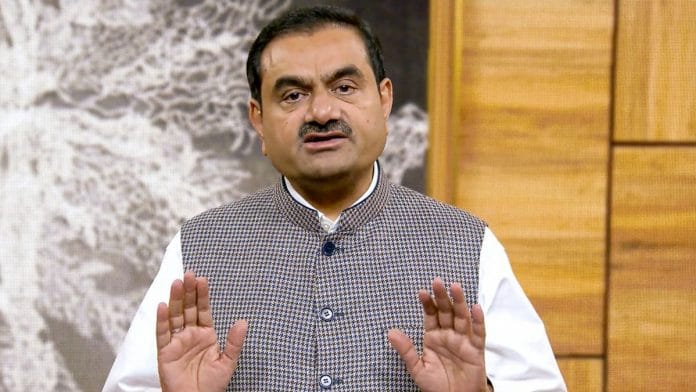

Gautam Adani’s capital-intensive projects such as airports, power plants and data centres intrinsically align with Prime Minister Narendra Modi’s growth agenda.

The billionaire has maintained a close relationship with the Prime Minister for decades, and has tied up in many of his projects with a nationalistic fervor. He even called the Hindenburg report “a calculated attack on India” and on “the independence, integrity and quality of Indian institutions.”

The “conjoined nature of the Modi and Adani organisations”, may have put the businessman under a harsher spotlight, but this “not typical of Indian capitalism in the 21st century”.

Travelli quotes Saurabh Mukherjea, the founder of Marcellus Investment Managers in Mumbai, saying that in the past decade, $1.5 trillion in value had been added to India’s public markets, 80 percent of it from just 20 companies.

The article says “some of those, like Adani, make a lot of noise, flaunting their heft and political connections”. “But 90 percent are ‘clean, well-run franchises,’ it quotes Mukherjea.

That is why Adani has caught the attention of the world, but Travelli surmises, “In public, though, few will say much about Mr. Adani. His friends are still powerful, even if he is diminished.”

As for the Indian economy, he says – “The quiet side of Indian capitalism intends to keep on spinning money, wherever the pieces of the Adani empire may fall.”

Also read: Modi govt open to SC’s ‘expert panel’ idea to avoid Adani repeat, but wants to appoint its members