New Delhi: India’s gold imports have surged over the last few months, driven by marriage and festival-related demands as well as people stocking up on the metal, anticipating future hardships and price surges.

The trend of relatively well-off people buying gold comes at a time when poorer Indian households continue to pawn their meagre gold for funds and see their holdings auctioned away due to repayment failures.

Analysts say this is a reflection of India’s uneven economic recovery amid the Covid pandemic.

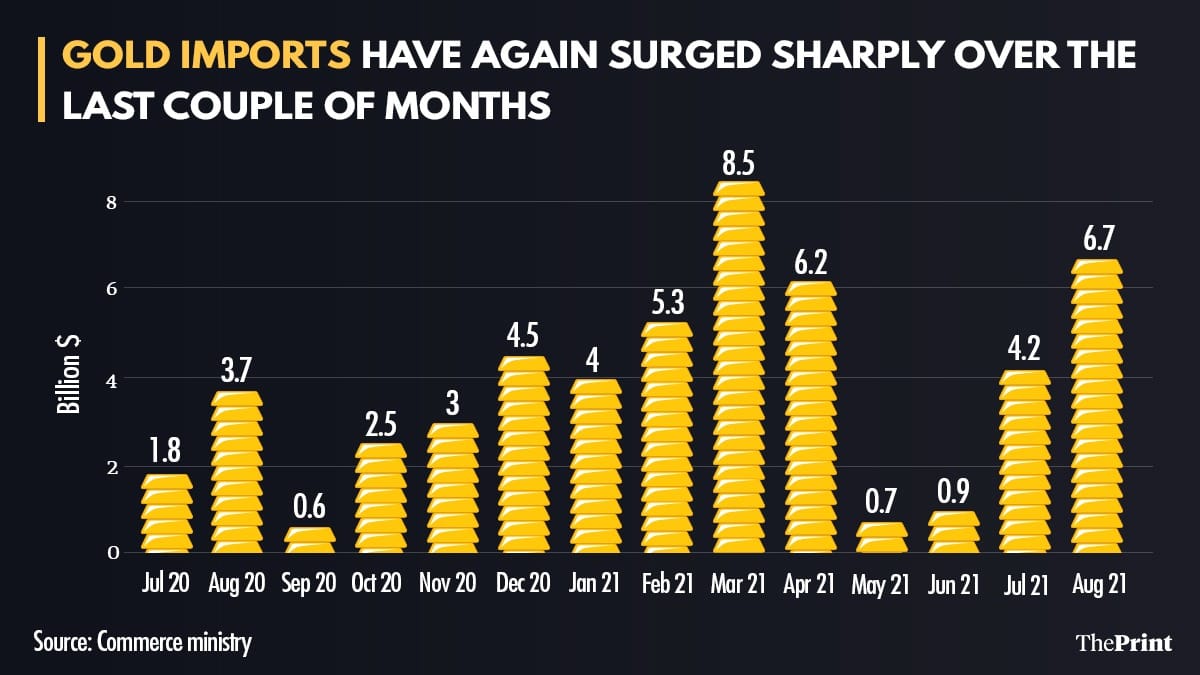

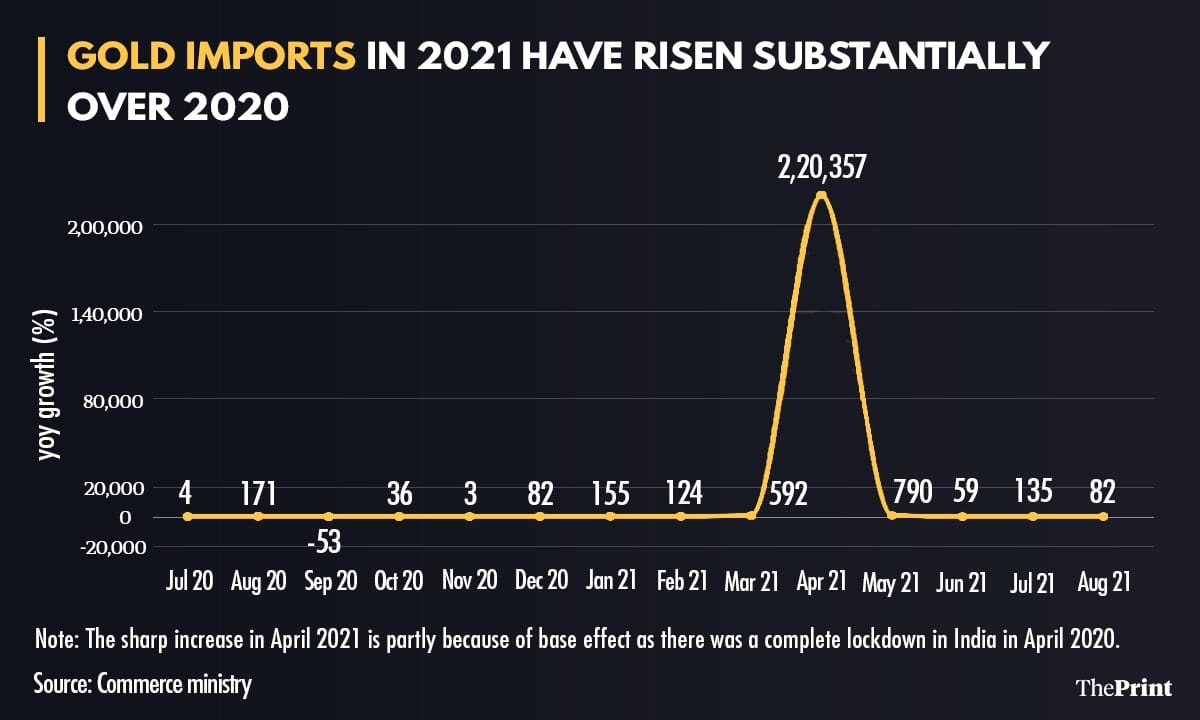

According to data available with the commerce ministry, gold imports surged 82 per cent in August to $6.7 billion and by 135 per cent in July to $4.2 billion. In the first five months of this fiscal, India has imported nearly $19 billion of gold jewellery, a growth of over 200 per cent over the imports of around $6 billion in the corresponding period last year.

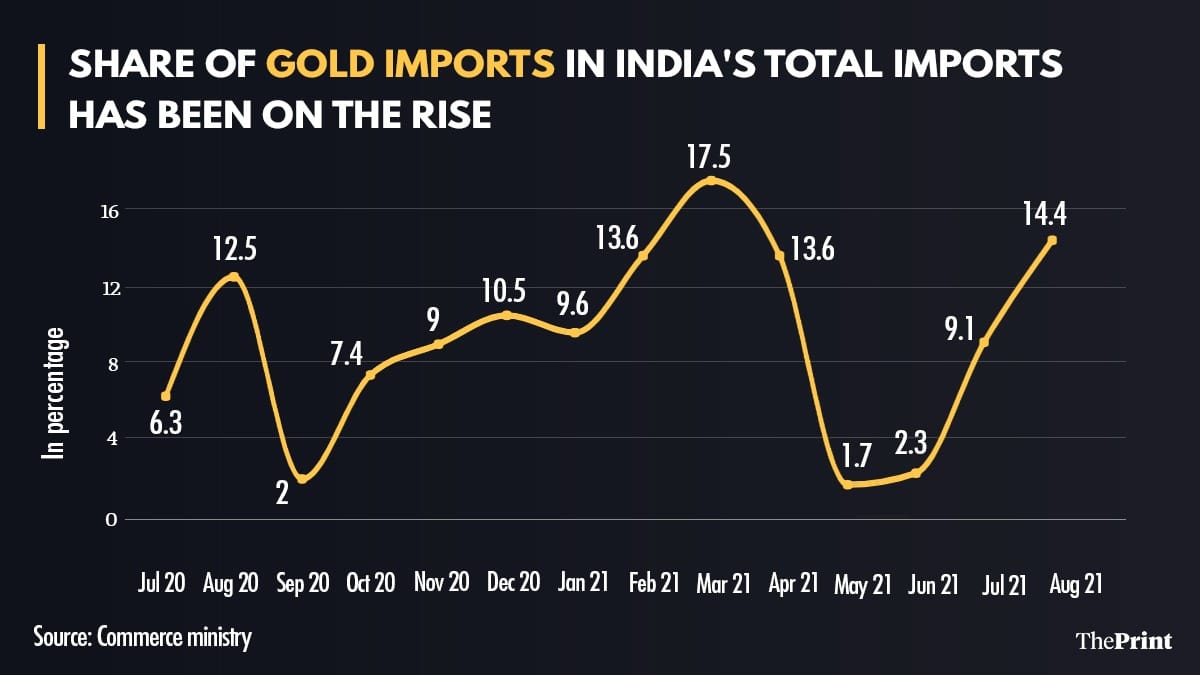

Over the last few months, the share of gold imports in total imports has also risen sharply, posing a fresh headache for policy makers. The share of gold imports has risen to over 14 per cent in August as compared to 9 per cent in July. Typically, gold imports are considered non-essential imports, with governments trying to reduce them through various ways such as higher import duty.

People buying gold in anticipation of 3rd wave

Stakeholders say those stocking up are doing so in anticipation of a third wave.

Karav Vavadia, a partner in K.R. Sons, a jewellery store with branches in Gujarat and Maharashtra, said the demand for gold jewellery had increased by 40 per cent this year when compared to last year’s lockdown.

“As soon as the number of Covid cases subsided, the gold prices increased by Rs 6,000. By the last week of July, we had several customers coming in and panic-buying in anticipation of a further increase in gold prices. Although gold prices dropped and came back to the previous price, the buying did not stop,” he said.

“People are now buying in anticipation of a third wave or lockdown,” Vavadia added. “As the marriage season approaches, a lot of people have decided to get married sooner than later, pushing the demand higher. In addition to this, with a reduced number of guests, more and more families are investing in gold to give as a gift to the newlyweds.”

According to Vavadia, the increased demand, however, has not driven up prices of gold jewellery.

Dinesh Jain, director, All India Gem and Jewellery Domestic Council & Gems and Jewellery Skill Council of India, attributed the increasing demand to a drop in Covid numbers and people buying gold as an easy to liquidate investment.

“Since the second half of July, we have witnessed an increase in sales by 40-50 per cent. It is because the pandemic has taught people that gold is easy to liquidate as social security or investment,” he said.

“We are seeing that the previously reluctant, younger people don’t mind putting their money in gold jewellery over bank deposits now. This has led to an increase in demand,” Jain added.

“Another factor is the ease of movement that people are witnessing now after the second wave of Covid cases have subsided,” Jain said. “People are planning to hold their marriages and other social functions at this time of the year, making gold jewellery an important investment. I won’t be surprised if this demand goes up to 70 per cent by November-December this year.”

He further said gold prices have become steady now over the last month, assuring buyers that it is safe to invest in the metal for now.

Ajai Sahai, director general and CEO of Federation of Indian Export organisations, pointed out that besides the festival season demand in the domestic market, gems and jewellery exports have also risen substantially. This could also contribute to the rise in imports, he said.

India has exported over $16 billion of gems and jewellery in the April-August period, a rise of 166 per cent from the $6 billion exported in the corresponding period last year.

Also read: Roti vs Malabar parotta, papad vs fryum – bizarre GST slabs for similar goods spark 4,600 cases

Rich are buying but poor are pledging

Even as the rich continue to stock up on gold, however, the poorer sections of society who took gold loans are unable to repay their loans. This has seen gold loan firms reporting a sharp increase in auctions.

Typically, auctions of gold jewellery are done by a gold loan company when the borrower is unable to repay the loan taken after mortgaging the gold.

Firms like Manappuram finance saw their auctions surging in the April-June quarter. Mannapuram finance auctioned 4.5 tonnes of gold in this period, as against 1 tonne in the preceding quarter.

D.K. Srivastava, Chief Policy Advisor at EY said this paradox of the rich buying and the poor pledging reflects the uneven nature of India’s economic recovery.

“The poor are taking the gold loans to tide over their loss of livelihoods but are not able to service the loan. On the other hand, those who can afford to are investing in gold anticipating better returns and in anticipation of the third wave,” he said.

“It is a reflection of India’s uneven economic recovery. While the formal sector of the economy has picked up and is the main reason for the reasonable growth performance the economy has witnessed, the informal sector is yet to recover from the loss of income caused due to the pandemic.”

(Edited by Arun Prashanth)

Also read: India’s GDP grows at 20.1% in June quarter but still below pre-Covid output level