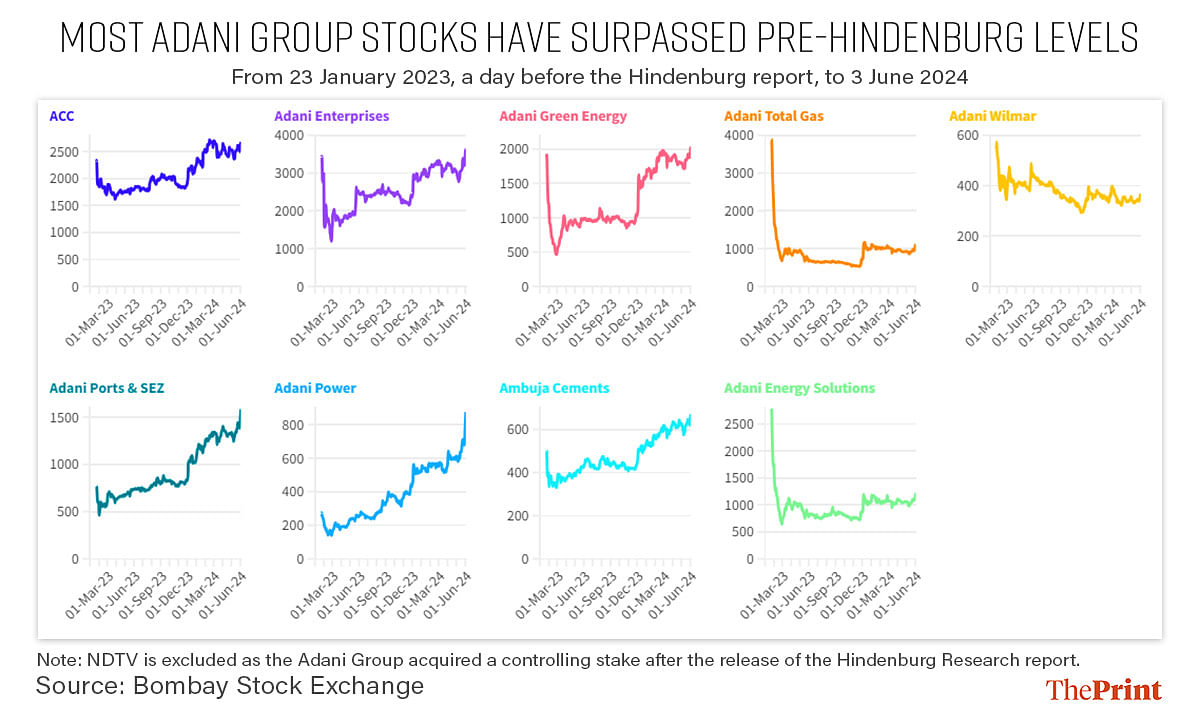

New Delhi: A rise in profits for most of its companies, a drive to reduce overall debt ratios, and a fresh surge in overall stock markets following the exit polls, have driven up the Adani Group’s stock prices. Most Adani stocks have erased all the damage they took from the release of the Hindenburg Research report in January 2023.

US-headquartered short-seller Hindenburg Research had released a report on 24 January last year, alleging substantial corporate malpractice by the conglomerate, its chairperson Gautam Adani, and his relatives. The Adani Group’s combined market capitalisation, a day before the release of the report, was about Rs 19.2 lakh crore.

This market capitalisation had plummeted in the weeks following the release of the report, in keeping with the crash in the stock prices of the group’s listed companies. Since then, however, the majority of these companies have seen a remarkable recovery in their share prices.

As of the end of the trading session on Monday, Adani Group’s market capitalisation has crossed its pre-Hindenburg level, and is currently at Rs 19.4 lakh crore, effectively having recovered all the losses in value incurred due to the Hindenburg report.

The stocks of three Adani companies — Adani Total Gas, Adani Wilmar and Adani Energy Solutions (formerly Adani Transmissions) — are still trading lower than pre-Hindenburg levels.

The other six, however, have seen a strong recovery. Adani Power’s stock, for example, is trading 220 percent higher than what it was on 23 January 2023, a day before the Hindenburg report was released. Adani Ports and SEZ is trading 106 percent higher, while Ambuja Cements is about 34 percent higher.

The group’s other cement company, ACC, is trading about 15 percent higher. Adani Enterprises (6.1 percent up) and Adani Green Energy (5.5 percent up) have also undone any fall they saw after the Hindenburg report.

Also Read: Ahead of election results, new govt data shows India’s GDP surged 8.2% in 2023-24

Profits up, debt ratios improving

The reasons for this optimistic recovery in Adani Group’s stocks have to do with what’s happening within the group — profits are largely up, debt is down or is focussed on future growth, and plans have been unveiled for future expansion. The surge is also a result of the perception that the group will do well with the return of the Prime Minister Modi-led government to power for a third term, a certainty if exit polls are to be believed.

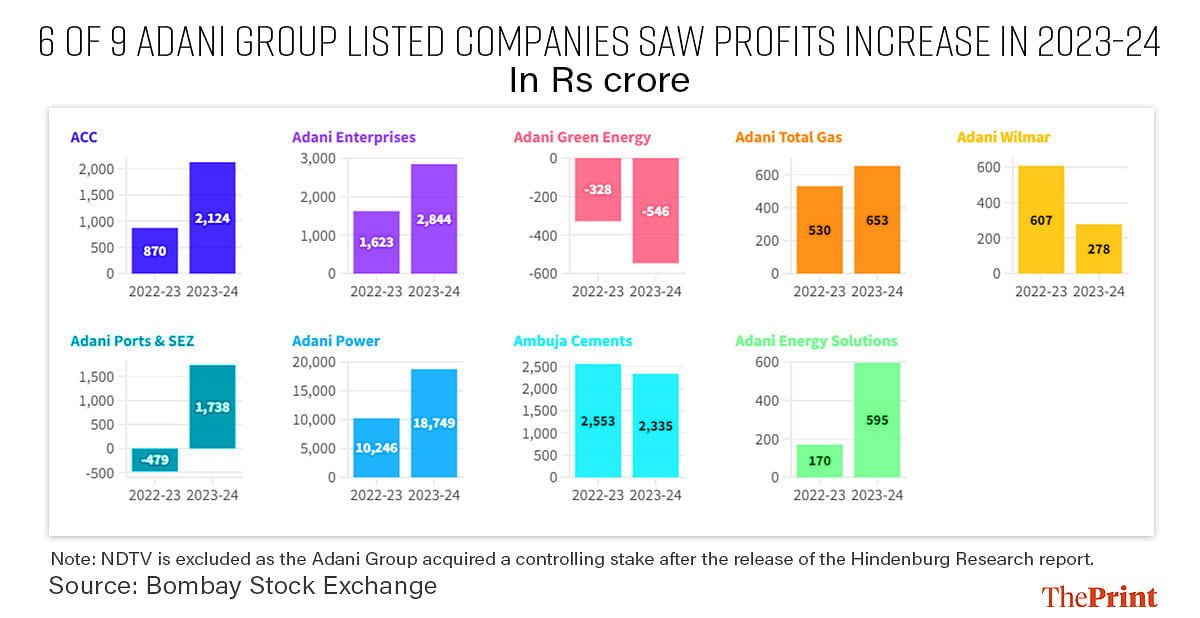

ThePrint analysed the stock price movements, market capitalisation, profits and debt levels of nine Adani Group companies that are listed on the stock exchanges. The group acquired a controlling interest in the tenth company — NDTV — after the Hindenburg report was released, and so it has not been considered for this analysis.

Of the nine companies under consideration, six saw their net profits increase in 2023-24, compared to 2022-23. Cement major ACC registered a 144 percent jump in its net profits to Rs 2,124.24 crore in 2023-24. Similarly, Adani Power saw an 82 percent rise in net profit to Rs 18,749.24 crore.

The other companies that saw their net profits grow were the group’s flagship firm Adani Enterprises (75 percent), Adani Green Energy (66 percent), Adani Total Gas (23 percent), and Adani Ports and SEZ, which moved from losses in 2022-23 to a profit of Rs 1,738 crore in 2023-24.

Another factor that is being seen as a sign of improving financial health is the trend of reducing the debt ratios among these companies.

“Net debt at the group level remained stable at Rs 2.2 lakh crore in FY24 vs Rs 2.3 lakh crore,” international brokerage Jefferies said in a note on the Adani Group last week.

The brokerage added that the Adani Group’s consolidated net debt-to-EBITDA ratio “improved materially” to 3.3x in FY24 vs around 5x a year earlier. EBITDA stands for earnings before interest, taxes, depreciation and amortisation, and is basically an indication of the cash flow of a company.

The net debt-to-EBITDA ratio is a gauge of a company’s ability to repay its debt obligations. The lower the ratio, the better the financial health of a company is. Jefferies added that the Adani Group companies that did see an increase in their debt levels, did so because they were financing future potential growth opportunities.

“Adani Ports and Adani Power saw a drop in net debt in FY24,” the Jefferies note read. “Increase in leverage for Adani Enterprises and Adani Green was on back of new capex projects undertaken by the companies.”

Riding the ‘Modi’ factor

The other factor that has boosted Adani Group stocks is the overall surge in the stock market, which rose 3.4 percent Monday, the first day of trading following the release of exit poll data, which showed the Modi government would be returning to power with a comfortable majority. The Sensex rose 3.4 percent, while the Nifty rose 3.25 percent.

Adani Group saw its stocks rise at an average of 7.8 percent Monday.

CLSA, another international brokerage, listed out 54 ‘Modi stocks’, which it said would be “direct beneficiaries” of the expected policy measures, if the Modi government retained power.

“We drill further and separate out the stocks, which are perceived to be the most direct beneficiaries from popularly expected policy measures, if we see a third term for the PM Modi-led ruling party with a strong electoral majority,” CLSA said in a note. “As these stocks are rallying more on perceptions — for easy recall, we call them Modi stocks.”

These 54 stocks included companies in sectors linked to capital expenditure and infrastructure creation, public sector enterprises, and “stocks of some corporate houses”.

Four Adani Group companies — Adani Ports & SEZ, Ambuja Cements, ACC and Adani Enterprises — were among those named as ‘Modi stocks’.

(Edited by Mannat Chugh)

Also Read: Exit polls signal triumph for BJP with its strongholds secure & predictions of big gains in south