New Delhi: Azure Power, the solar energy company whose former officials were indicted in the US along with key executives of the Adani Group, is no stranger to allegations of misgovernance. In fact, it’s been on the receiving end of two whistleblower complaints in the past that have hurt its credit ratings and ability to raise capital and fund expansion.

Last Wednesday, the US Department of Justice (DoJ) indicted Adani Group chairman Gautam Adani and his business associates for allegedly promising to pay $265 million in bribes to Indian government officials for securing solar energy contracts. Three of those business associates were linked to Azure Power Global, a Mauritius-registered renewal energy company with solar projects across India.

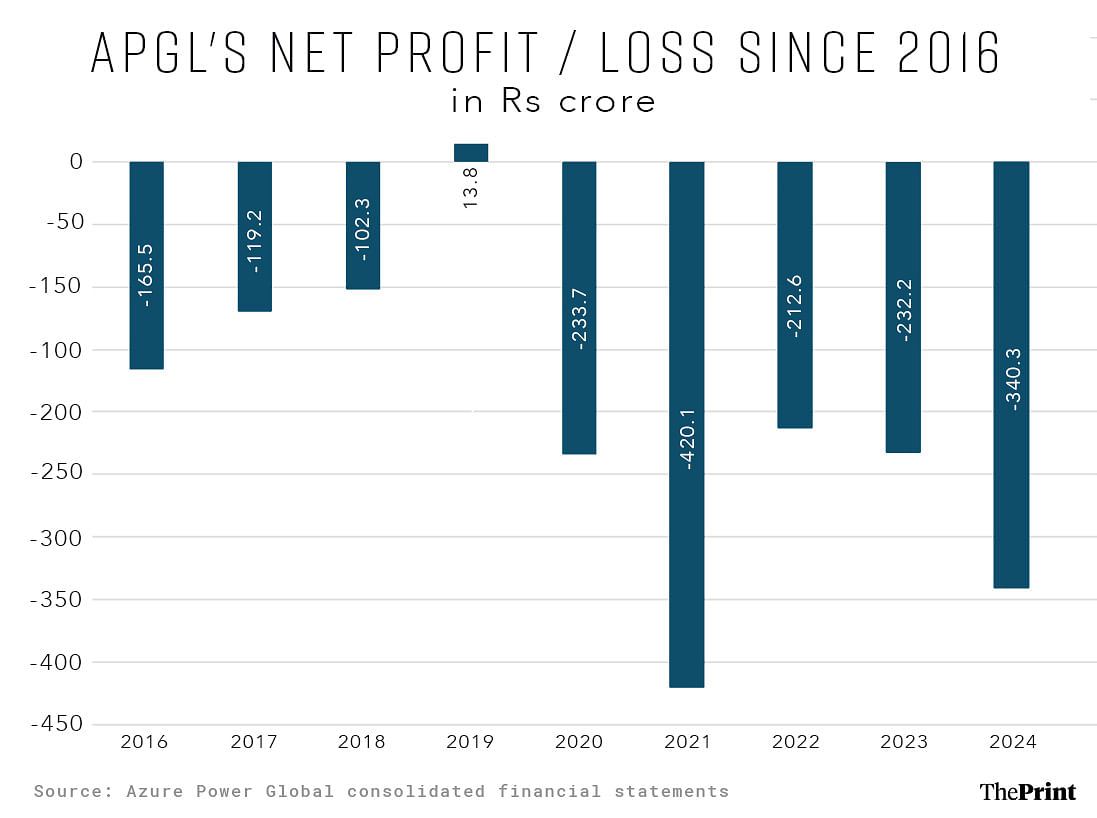

The company has been in losses every year since its incorporation in the US in 2008 by Inderpreet Singh Wadhwa as Azure Power Inc. The company in its current form—Azure Power Global Limited (APGL), a limited liability company—was incorporated in Mauritius on 30 January, 2015.

Notably, in its latest consolidated financial statements—released before the US DoJ indictment was made public—the company also spoke in some detail about the risks to its finances arising from “employee or executive misconduct” related to crimes such as bribery and corruption.

It was listed on the New York Stock Exchange (NYSE) in 2016, where it raised capital to fuel its expansion across India, becoming the first energy company operating in India to go public in the US.

According to the company’s financial statements, APGL is owned by three groups. CDPQ, a Canadian pension fund, is the company’s largest shareholder with a 53.4 percent stake. The rest is held by OMERS Infrastructure (21.4 percent), a Canada-based asset manager, and the public.

Born in the US for projects in India

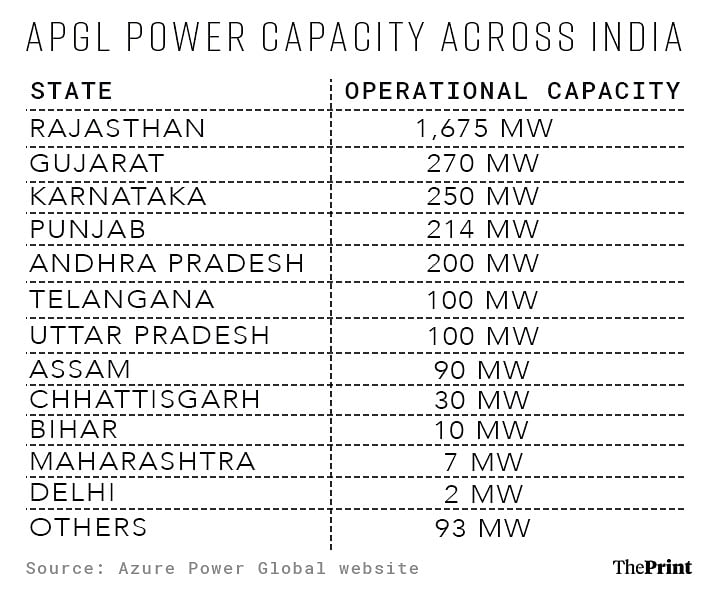

In 2009, the company launched operations in India and developed its first utility-scale solar project, a relatively modest 2 mega-watt (MW) solar plant in Punjab.

From 2009 to 2015, the company expanded its operations and built power projects across India. Projects became progressively larger in scale and capacity as the years went by. These include a 10 MW project in Gujarat (2011), a 34 MW project in Punjab (2014) and a 100 MW project in Rajasthan (2015).

Today, APGL has a renewable energy asset base of over 4.3 GWs with over 3 GWs of operational capacity, across at least 12 states.

Following its IPO on the NYSE in 2016, APGL partnered with several Indian ministries and departments for projects, some of which are subsidised by the central government.

For example, in December 2016, APGL announced it had installed a rooftop solar power plant for the Delhi Metro Rail Corporation’s (DMRC) Sultanpur facility as part of a 14 MW allocation by DMRC to APGL.

The company announced that it had become the largest supplier of solar power to the Indian Railways in September 2017. Over 66 MWs have been awarded to the company for providing power to railway facilities across 17 states and Union territories.

In October 2017, the company won an auction conducted by a subsidiary of the National Thermal Power Corporation to install a 1.3 MW solar rooftop project. The project involved providing 25 years of power to the Ministry of Health and Family Welfare facilities across five states.

The company also forayed into rural electrification in November 2017 through a contract awarded to its subsidiary, Azure M-Power, by the Jharkhand Renewable Energy Development Agency (JREDA) for a project to electrify 320 households using mini and micro grids.

On the hunt for funds

According to the company’s SEC filing, it wanted to use the funds it received from its 2016 Initial Public Offering (IPO) to further expand its operations. The company targeted to achieve 1 GW capacity by 31 December, 2017, and 5 GW capacity by 31 December, 2020.

However, APGL’s listing was not well received by investors. According to The Economic Times, the shares of AGPL were priced at $18 per share but closed at $14.60. Initially, APGL planned to raise $150 million through its IPO by offering 7.58 million shares at $21-23 per share.

However, days before the sale, around 4.17 million shares were bought for $75 million in a private placement by Caisse de dépôt et placement du Québec (CDPQ), a Canadian Pension Fund, which is listed as the largest shareholder in the company till date.

Notably, several of the former executives of Azure Power named in the US DoJ’s indictment made public last week had also earlier worked at CDPQ.

As APGL’s business interest in India continued to grow, the company explored other methods of funding its expansion. In July 2017, it announced it was issuing its first green bond to raise $500 million, specifically for solar power projects in India.

APGL continued to explore raising funds through green bonds in 2019, when it issued $350 million worth of bonds and listed them on the Singapore Exchange (SGX).

In a press release on 3 May, 2019, the company announced Wadhwa would retire as CEO and Chairman of the Board of Directors. He continued to serve as an adviser to the company until 31 December, 2019.

On the back of Wadhwa’s exit, Mint reported that several key investors were exploring selling their stake, including CDPQ and the International Finance Corporation (IFC).

It’s around this time that indications of trouble at the company started becoming visible.

No stranger to controversy

In May 2022, the company received a complaint from a whistleblower, alleging ‘health and safety lapses, procedural irregularities, misconduct by certain employees, improper payments and false statements’ at a project belonging to an APGL’s subsidiary.

The complaint was investigated by the company’s Ethics Committee which yielded alarming results.

The May 2022 investigation identified ‘evidence of manipulation and misrepresentation of project data by some employees at that project site.’

Additionally, although ‘weak controls’ over vendor payments were identified, the investigation found that there was no evidence suggesting improper payments to government officials.

On 29 August, 2022, after APGL published a press release disclosing the May 2022 allegations, the company’s share price fell 44 percent and a class action lawsuit was filed on behalf of investors.

Another whistleblower complaint was received in September 2022, making similar allegations but also included allegations of “misconduct related to joint ventures and land acquisition” and “failure to be transparent with the market”.

The Ethics Committee investigation revealed significant ‘issues in the process of acquiring land’.

According to the committee, improper payments may have been involved in relation to third party land aggregators but underscored that the company was not directly involved in any improper transfer of money.

As a ‘prudent measure’, APGL made an adjustment of Rs 2.8 crore in FY23 and Rs 1.2 crore in FY24 after conducting a review of all payments made to land aggregators over a two-year period, despite no improper payment made by the company being found.

Since the company was listed on the NYSE at the time, APGL reported findings from its investigation of both complaints to the SEC and US DoJ.

In August 2022, the company formed a ‘Special Committee’ to review projects and contracts ‘over a 3-year period for anti-corruption and compliance related issues.’

While this investigation is ongoing, the committee did identify evidence of individuals previously associated with the company engaging in improper payments related to certain projects. These details were disclosed to both the SEC and US DoJ.

On 13 November, 2023, the company’s shares were delisted from the NYSE on account of the company’s delayed filings as a result of these investigations.

A company on the brink

When the company filed its papers in 2016 with the SEC for its IPO, it also disclosed that “we have incurred losses since our inception”, a financial state the company is yet to emerge from. This, it said, was on account of its constant investments in new solar projects.

However, according to its latest disclosures, even this situation is precarious.

Under the ‘Financial Risks’ section of the company’s consolidated financial statements for the year ended 31 March, 2024, the company raised some alarming risks.

The first being the current state of its cash reserves and cash flows, which the company describes as “insufficient to meet our working capital requirements and expansion plans absent further financing”.

The second risk the company listed was how downgrades of their credit rating—following the company missing its returns filing deadline with the SEC and its subsequent delisting from the NYSE—could increase their cost of borrowing or trigger defaults of existing loan agreements.

In the past two fiscal years, rating agencies including Fitch Ratings, Moody’s Investor Service, CRISIL and Care Ratings each either downgraded or announced a review of credit ratings with negative implications of one or more of the group’s subsidies.

In January 2023, Fitch Ratings downgraded the US dollar bonds of two APGL subsidiaries, both of which were incorporated in Mauritius. The subsidiaries are categorised as ‘restricted groups’.

Azure Power Energy Ltd’s (APE) US dollar bonds were downgraded from ‘BB+’ to ‘BB’. Azure Power Solar Energy Private Limited’s (APSEP) bonds were downgraded from ‘BB’ to ‘BB-.’

Fitch underscored APGL missing the statutory deadline of August 2022 to file its audited financial statements for the year ended March 2022 with the SEC.

Six months later in July 2023, Fitch further downgraded both subsidiaries’ bond ratings to ‘B’ on the back of APGL’s potential delisting from the NYSE.

Moody’s followed suit and downgraded APE’s rating from ‘B1’ to ‘B2’ and APSEP’s rating from ‘Ba3’ to ‘B1’, a non-investment grade category suggesting a higher chance of default.

Both rating agencies underscored the potential delisting from NYSE and corporate governance issues related to delayed financial disclosures as reasons for the multiple downgrades.

This subsequently led to an increase in interest rates, and the company believes further rate increases are possible.

‘May not be profitable in the future’

In its latest consolidated financial statements, the company reiterated that it had never been profitable and said it “may not be profitable in the future”.

Net loss for the Fiscal Year 2024 was $41 million, up 57 percent from Fiscal Year 2023 which stood at $26 million.

In its financial statements, the company listed out a number of factors that could hurt its business arising out of foreign exchange risks, compliance risks and business risks.

On the business side, it said that factors like an adverse currency exchange rate could hurt its financials since much of its revenue was in rupees while large parts of its expenditure and borrowing was in foreign currencies.

“To the extent that we are unable to match revenue received in our functional currency with costs paid in foreign currencies, or hedge such exposure, exchange rate fluctuations in any such currency could have an adverse effect on our profitability,” the company said.

Notably, the company also made extensive comments about the potential implications of the investigations into the whistleblower complaints against it. It said that it could be “exposed to liabilities” if, as a result of the investigations, it was fined, its contracts were cancelled, or it was debarred from future contracts, among other things.

Although the company’s filings were made before the US DoJ indictment was made public, Azure Power Global did say that it could “be exposed to future litigation in connection with any findings of fraud, corruption, or other misconduct by persons who served as our directors, officers and employees”.

“Employee or executive misconduct could also involve the improper use or disclosure of confidential information, bribery, data breach or other illegal acts, which could result in regulatory sanctions and reputational or financial harm, including harm to our brand,” the company added.

This is particularly significant given that Ranjit Gupta, who was CEO of Azure Power Global Ltd between 2019 and 2022, and two other former Azure employees were named in the DoJ indictment for allegedly promising to bribe Indian government officials to further their business.

Udit Hinduja is a graduate of the inaugural batch of ThePrint School of Journalism and an intern with ThePrint.

(Edited by Zinnia Ray Chaudhuri)

Also read: Modi, Adani political & business monopolies come at a huge cost to democracy, market