Mumbai: Last year, Vipin Gupta’s daughter secured a 95 percent mark in Class 10. Her school collaborated with education technology brand Byju’s to honour and felicitate all the toppers. Gupta’s daughter came home with a medal and a certificate, and a barrage of calls from the company asking the Bareilly-based middle-class chemist to join a free online counselling session.

“I work with only one intention. That my child should be able to study a lot, get a good job and secure her future. Byju’s said their material and guidance would take my bright daughter the extra mile, so the very same day, I used my credit card to buy her a course for 11th, 12th and NEET (National Eligibility cum Entrance Test) preparation for Rs 78,000. I paid another Rs 10,000 to buy her their tablet computer device. They promised to send some soft copies and books for a trial period,” Gupta says.

The books never landed. Gupta eventually went through a rigmarole of first enquiring about the status of the books, then figuring out that he was never going to get them, and eventually asking for a refund.

“They ask you to call a hundred helplines and you will get a hundred ticket numbers. How can such a big company, which Shah Rukh Khan himself endorsed, behave like this? Even a thelewala (hawker) is better than this. You don’t like the wares, he will give you an instant refund,” Gupta said.

There has been a litany of complaints and refund requests like Gupta’s. But perhaps, Think & Learn Pvt. Ltd, popularly known as Byju’s, has barely had the time and resources to deal with them.

It is busier fighting the fires blazing on all fronts: It has been unable to pay its employees their salaries on time. It is battling allegations of mismanagement from a set of its own investors, with the latest setback being arbitration proceedings by a firm led by Ranjan Pai, who was among the earliest believers in the Byju’s story.

It has been embroiled in at least five cases in the National Company Law Tribunal (NCLT), an investigation by the Enforcement Directorate, and another by the Ministry of Corporate Affairs.

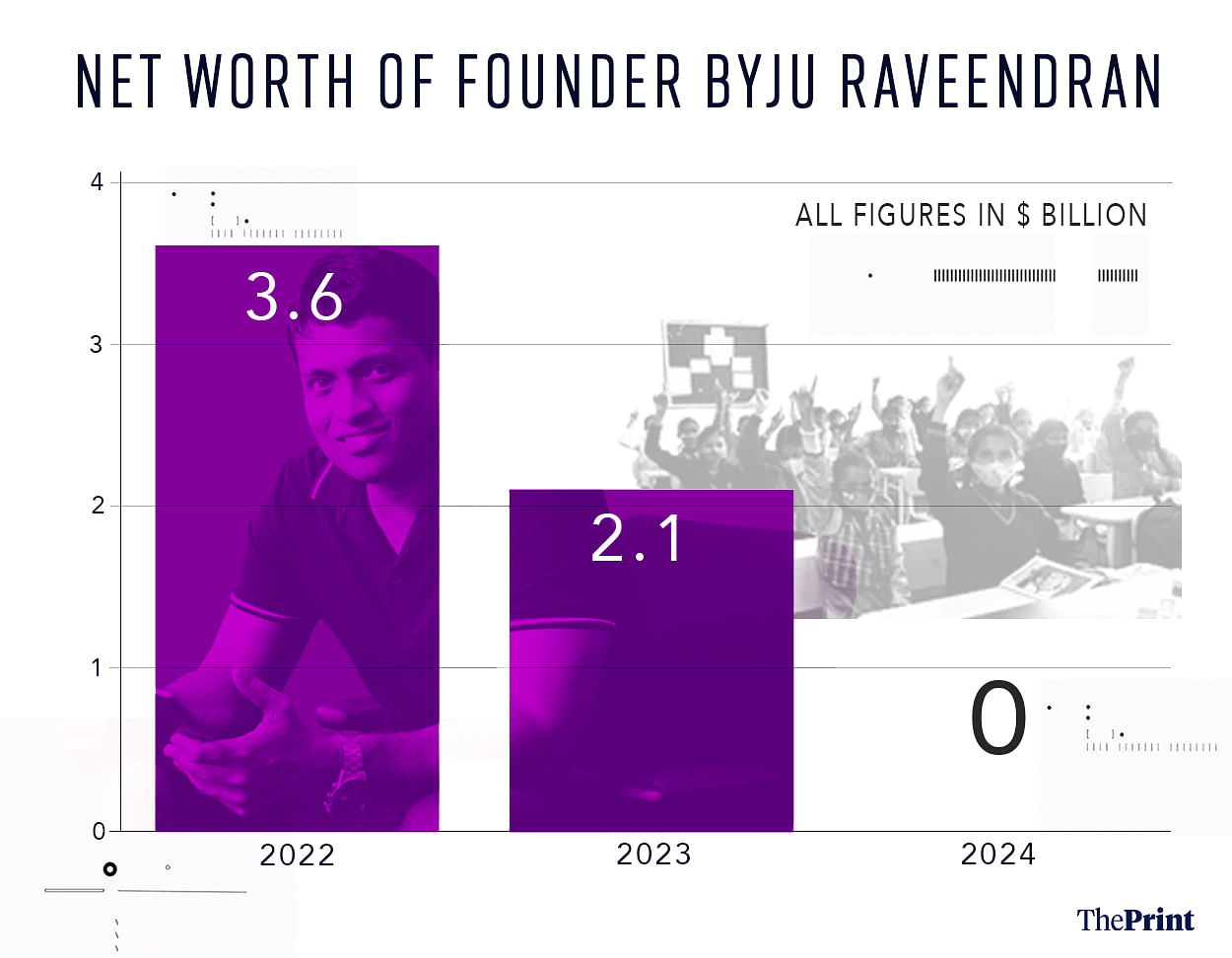

The company’s valuation, which was $22 billion in 2022, has plummeted to $250 million. Moreover, the net worth of founder Byju Raveendran, which peaked at $3.6 billion in 2022 and stood at $2.1 billion last year, has dropped to zero, according to the Forbes Billionaires’ Index 2024.

Behind the company’s near decimation is a tale of an ambitious startup that created a market it could not sustain, chased too much too quickly, guzzled cash in acquisitions, allegedly kept its books opaque, delayed financial results, and got into conflicts with a set of its investors who, on their part, perhaps didn’t ask the right questions at the right time.

The company is pinning its hopes on being able to repair much of the damage with the funds from a $200 million rights issue that it closed last month. The rights issue was raised at a rock-bottom valuation of about $20 million and the investors who did not subscribe stood to have their stake significantly diluted.

Persons close to the founders believe Byju’s has a real shot at settling all its India debt and turning itself around with the proceeds. However, this rights issue itself has been mired in controversy: a set of investors has vehemently opposed it, and there’s an NCLT order against using the funds till a suit filed by these investors — alleging oppression of shareholders and mismanagement — is settled.

“The board should have known about it. Byju’s growth was cash-guzzling. Once it becomes a cash-guzzling business, the probability of growth declines, investors start getting concerned, as once you know it is going to be a cash-guzzling business, you cannot plan an exit for the next 5-10 years. The investors shouldn’t have let the company infuse so much money, but one after another, they were trying to protect their valuation,” says Anil K. Sood, professor and co-founder at the Hyderabad-based Institute for Advanced Studies in Complex Choices.

Also read: Byju’s, Paytm Payments Bank crises are a wake-up call. But govt intervention isn’t the answer

‘The tree will flourish if you water the sapling’

Like Gupta in Bareilly, Ajay Kumar Sahoo in Odisha is waiting for a refund from Byju’s. So are Nishant Yadav from Delhi and Shashi Bhushan from Bihar. Gupta, Sahoo, Yadav and Bhushan all fell prey to the same script. Once they were tapped as potential customers, Byju’s assigned them a “counsellor” to interact with them over the phone. These counsellors used the exact same hook phrases:

“Your child is very talented. With some extra effort, he/she can achieve what they want. A tree flourishes when watered early.”

The counsellors then asked the families to buy Byjus’ tablet computers at a “discounted price” or in some cases free of cost “as a scholarship”. People like Yadav and Sahoo were told they could ask for a refund within 15 days if they didn’t like the course.

“My brother attended the course for four-five days but did not understand anything. I was told that if you cancelled in 15 days, you would get a refund. I sent a cancellation email within four days, but I received no reply. I called the counsellor, but he started abusing me and eventually blocked my number,” says Sahoo, whose brother is in the 7th standard and was shown dreams of potentially becoming an IAS officer if he goes the extra mile now.

“The counsellor had said that if the base was strong, he would perform better, that if a tree is watered from the beginning, it will prosper better,’” adds Sahoo, a mechanical engineer in Chandrapur, Odisha, who is the sole breadwinner of his house.

Byju Raveendran was born in a family of teachers in Azhikode, a coastal town in Kerala, and was initially a tutor himself. He taught maths to some of his friends while holding down a permanent job at a shipping firm, and later helped a few prepare for the hyper-competitive Common Admission Test for graduate management programmes. The legend about Raveendran is that he himself had cracked the test with a 100 percent score despite having hardly studied for it. He gradually went from teaching just a handful of learners in a room to hundreds of students in an auditorium, even taking classes digitally.

He formally launched himself as an education technology entrepreneur in 2011 when he incorporated his company, Think & Learn Pvt Ltd, with co-founders Divya Gokulnath, his wife, and Riju Raveendran, his brother.

Byju’s grew to offer all sorts of courses for all ages, right from lower kindergarten to Class 12 students and those who wanted to appear for examinations such as IIT-JEE, UPSC, NEET, and so on.

In edtech jargon, this is known as the K-12 (kindergarten to 12th) segment. The company also started selling its own hardware to deliver its courses. Marketing agents of Byju’s became a common sight outside educational stationery shops, large institutes, malls, parks and even toy shops, ambushing parents and hard selling the idea that their product could take even a four-year-old the extra mile.

The counsellor had said that if the base was strong, he would perform better, that if a tree is watered from the beginning, it will prosper better

– Ajay Kumar Sahoo

These efforts paid off during the COVID-19 pandemic, when a shift to digital education gave a boost to the edtech sector. According to an October 2020 report by Nasscom, an association of Indian technology companies, the user base for the K-12 segment showed a 40 percent increase in willingness to pay and an 83 percent jump in the number of paid subscribers. The report said that during the lockdown, Byju’s had added 7.5 million new users. With a valuation of $10 billion, it also placed Byju’s at the top of a list of 19 edtech unicorns across the world.

Teachers say digital education companies initially tried to take the market share of traditional tuition centres, and during the Covid pandemic, thought they could even become mainstream.

“When Covid hit, classroom teachers had to suddenly learn the world of online education, but these edtech companies like Byju’s or Unacademy already had their systems set up, and they expanded,” says Mumbai-based secondary school teacher Merlin Dominic.

She adds, “But, during the lockdown, conventional teachers like me also learnt the ropes of digital education, incorporating PowerPoint presentations into our teaching, interactive formats, correcting papers online, and having animated videos. When the world went back to normalcy, we started incorporating these into our classroom teaching. Once everyone had it, these companies were not so special anymore.”

Also read: Byju Raveendran’s upbringing was remarkably unremarkable—only two things stood out

What went wrong

Between 2020 and 2021, Byju’s pumped ample cash into business expansion and went on an acquisition spree.

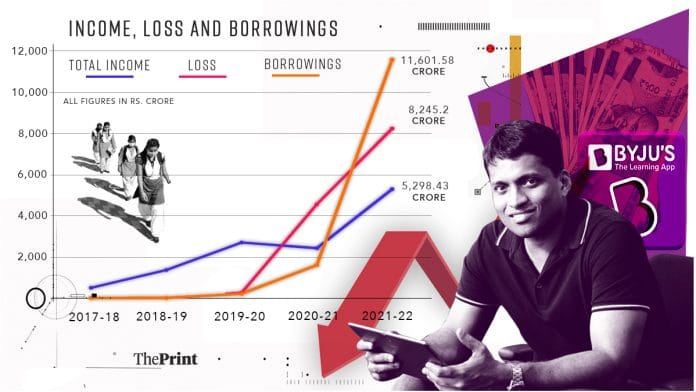

The company’s financials for the 2020-21 fiscal, which ThePrint has accessed, reflected this optimism. Byju’s widened its consolidated loss to Rs 4,599.08 crore in fiscal 2020-21 from Rs 305.50 crore a year before. Its total expenditure for the year more than doubled to Rs 7,027.47 crore from Rs 2,873.34 crore.

“The loss during the year is due to COVID-19 and attributable to various business expansion activities taken up by the company and its subsidiaries, though the actual benefit of such expansion activities will be realised in the long term,” the company said in its financial statement for the fiscal.

Between 2020 and 2022, Byju’s made 22 acquisitions, according to company sources. At least 10 of these were major assets, including firms such as Aakash Educational Services, Toppr Technologies and WhiteHat Education Technology.

It was at this peak that the company raised a now contentious $1.2 billion through its wholly owned subsidiary, Byju’s Alpha Inc. Earlier this year, the US-based subsidiary, which was trying to get the terms of the term loan (a loan given for a specified period of time that must be repaid in regular instalments) renegotiated, filed for Chapter 11 bankruptcy proceedings in a Delaware court. Also, GLAS Trust Company LLC, an administrative agent that represents over a hundred lenders that gave money to Byju’s Alpha, has now initiated insolvency proceedings against Think & Learn in the NCLT.

A person close to Raveendran’s family who does not wish to be named says the entrepreneur did make some mistakes, but the Indian edtech sector was virtually pioneered by his company. “He did not have any roadmap or precedent to rely on. The companies that are coming up now can learn from the experience of Byju’s. Moreover, the founders do not come from a business background. They are passionate about what they do. They were simply learning on the go.”

Meanwhile, there were consistent delays in finalising and filing financial results. The 2020-2021 results were approved for issue by the company’s board only on 30 August, 2022, while the results for 2021-2022 were finalised and approved by the board only on 1 November, 2023.

In its results statement, the company attributed the delay in finalising the 2020-21 results to disruption caused by the COVID-19 pandemic. It also attributed the delay to the number of acquisitions it completed subsequent to 31 March, 2021, saying they required “significant effort and focus in integrating and streamlining the operations of the various entities acquired”.

There was no concrete explanation for the delay in the 2021-2022 statements. The above-mentioned source close to Raveendran’s family says results were delayed beyond a point because the auditor, Deloitte, resigned around June last year. “The founders intended to wrap up the fiscal 2023 results, too, in the first quarter of 2024, but all the legal issues are causing a delay,” he said.

Filing any company’s financials by a certain date is more than just a regulatory requirement. Under most standard loan documents, failure to do so is a trigger for default or covenant breach.

A source with direct knowledge of the matter says, “The breaking point in the relations (between the scorned investors and the promoters) was the delay in the fiscal 2022 audited results that were committed to them a long time ago. No financials were shared with the investors. Showing screenshots in Zoom meetings doesn’t translate into opening the company’s books for investors. Finally in June or July last year, something snapped.”

On 6 June last year, G.V. Ravishankar of the venture capital firm Peak XV Partners, Vivian Wu of the Chan Zuckerberg Initiative — a philanthropic company set up by Meta CEO Mark Zuckerberg and his wife, Priscilla Chan — and Russell Dreisenstock of the investor group Prosus all stepped down from the Byju’s board. Around the same time, Deloitte also resigned as the company’s auditor, citing delays in the preparation of financial statements and the inability even to start an audit.

In a statement dated 25 July last year, Prosus said the Byju’s leadership had regularly disregarded its director’s advice and recommendations related to “strategic, operational, legal and corporate governance matters”.

“The decision for our director to step down from the Byju’s board was taken after it became clear that he was unable to fulfil his fiduciary duty to serve the long-term interests of the company and its stakeholders,” the investor said in the statement.

Now, investors such as MIH Edtech Investments (a Prosus entity), Peak XV Partners, Sofina and General Atlantic, who had all once confidently pumped in capital into the education startup, are wary of putting in a penny more and have dragged Byju’s to the NCLT for “shareholder oppression and mismanagement”. In an extraordinary general meeting (EGM) on 23 February, they voted for the founder and chief executive, Raveendran, and the company’s other founders to step down.

Spokespeople for Prosus, Sofina, Peak XV Partners and General Atlantic did not respond to ThePrint’s emails asking for comments.

Raveendran, meanwhile, has dug in his heels. He approached the Karnataka High Court and got a stay on the resolution that attempted to oust him. He has asked the NCLT to refer the matter for arbitration.

He did not have any roadmap or precedent to rely on. The companies that are coming up now can learn from the experience of Byju’s. Moreover, the founders do not come from a business background. They are passionate about what they do. They were simply learning on the go

-A source close to Raveendran’s family

He also drove the contentious $200 million rights issue that these investors wanted to have stayed. The NCLT has, however, directed him not to use the proceeds till the matter is resolved — an order the founders are citing to blame investors for being unable to pay employees’ salaries on time.

On 1 April, instead of salaries in their bank accounts, the employees of Byju’s got an apology in their inbox. “…We regret to inform you that there will again be a delay in the disbursement of salaries. A few misguided foreign investors in Byju’s have obtained an interim order in late February which has restricted usage of the funds raised through the successful rights issue. This irresponsible action by the 4 investors has compelled us to temporarily hold the disbursal of salaries until the restriction is lifted,” founder Byju wrote in an email to his firm’s employee base of about 13,000 people.

Also read: ‘Deliberately indifferent’: Consumer panel order to Byju’s to refund ‘dissatisfied’ customer Rs 65k

The contentious rights issue

There is a long sequence of events that, bit by bit, withered relations between the founders and the scorned investors, but the most recent standoff has been over the latter’s push to remove the founders from the management, as well as the controversial rights issue.

The above-mentioned source says, “None of the investors who approached the NCLT have participated in the rights issue. More than not wanting to pump in more money in the company in its current form, it is more to do with the fact that the company has not disclosed its latest financials. With that background, it is foolhardy to put in money.”

He adds that the investors who’ve been asking questions fear the rights issue is Raveendran’s way of increasing his own shareholding and diluting theirs.

In the NCLT, the advocate for Peak XV Partners argued that if the rights issue went ahead, the petitioners’ shareholding would be reduced from 24.5 percent to 2 percent if they did not subscribe. “And there is the apprehension that if they subscribed, the money will be lost,” the advocate said.

Those directly associated with the founders of Byju’s emphasise just how much the company needs the money from the rights issue. “The firm needs to pay the Board of Control for Cricket in India (payments are pending for a jersey sponsorship deal, and this has led to proceedings before the NCLT), the full and final settlement of many employees is pending, provident fund contributions are pending, salaries are pending, payments of vendors who have stopped working with us months ago are pending,” says the above-mentioned source close to Raveendran’s family.

In a statement issued in January this year about the company’s intention to raise money through a rights issue, Byju’s said its founders had already infused $1.1 billion of their personal wealth into the company in the preceding 18 months.

“This is all the money that they had made when the going was good. They have even mortgaged their homes,” adds the source.

The company has worked out its internal calculations for a rebound with the rights issue as the fulcrum. About 50 percent of the $200 million from the rights issue will be used to settle Byju’s India debt (not the overseas term loan) and pay its domestic vendors. With this, the company hopes that all NCLT cases, except for the one filed by the investors, will vanish. The rest will be infused into the company as a runway for the next six-seven months. In this time, if the company also files its results for 2022-23, it will become compliant with the Registrar of Companies.

“All this will go a long way to help, especially for the optics,” says the source.

According to the last available financial statement of the company (for 2021-2022), Byju’s consolidated borrowings, which include the contentious term loan, stood at Rs 11,601.58 crore (roughly $1.39 billion).

Persons working closely with the company also talk about how the firm has been restructuring itself and cutting down expenses since about October last year. It has laid off about 3,000 employees since then, shut down offices, and slashed its monthly burn to Rs 50 crore from about Rs 200 crore, they say.

In July 2023, Byju’s had constituted an advisory council comprising T.V. Mohandas Pai, one of the company’s earliest investors, and former State Bank of India chairman Rajnish Kumar, to mentor the firm’s board. The council, however, could not break the impasse between the disconcerted investors and Raveendran, say multiple sources.

Consistent requests by investors to make some key appointments with a financial background went unheeded, according to people familiar with the sequence of events.

“In hindsight, one can say that the investors should have spoken out much earlier, but it is like in a marriage. You cannot start making accusations of mismanagement without evidence,” says a source with direct knowledge of the developments.

The paring of billion-dollar relations

Those who know Raveendran describe him as like any passionate startup founder who is willing to move mountains for his product, but one who was, at the very least, misguided.

A source close to him says those rallying for the founder believe he has “fallen victim to the greed of investors”. He says the investors encouraged all the acquisitions, promised Raveendran capital and got secondary investments. All decisions were taken with board approval, and when the going was good, Raveendran put money back in the company at a high valuation.

He adds: “The three directors resigned and went public with their grievances. That shouldn’t have been done. Based on whatever they wrote, the ED also went after the company. The Rs 9,000 crore (ED notice) was all for acquisitions done through proper channels. This is a classic case of investors trying to ride roughshod over a great entrepreneur.”

The ED is probing Byju’s in connection with an alleged foreign exchange violation case. In November last year, the ED issued a show-cause notice for alleged foreign exchange violations of more than Rs 9,300 crore against Byju’s and Raveendran. It alleged that the company and its chief promoter had failed to submit documents of imports against advance remittances made outside India, delayed filing of documents against foreign direct investment received into the company and so on. In February this year, it upgraded a lookout circular it had issued against Raveendran.

Byju’s in a statement explained this as a “technical issue” that arose from a delay in filing annual performance reports.

During its last funding round in 2022, Byju’s, which was incorporated in 2011, was valued at $22 billion. In January this year, US-based investment fund BlackRock, which owns less than 1 percent in Byju’s, cut the firm’s implied valuation to $1 billion. In November last year, Prosus valued the company at less than $3 billion. The Economic Times had in July last year reported that Peak XV Partners had told its limited partners that it would have to significantly mark down the value of its holding in Byju’s due to the lack of visibility in the firm’s audited financial results.

In their petition in the NCLT, the investors have said Byju’s is facing serious allegations of “syphoning off funds by the promoters” and that the Ministry of Corporate Affairs and agencies such as the ED have initiated investigations, according to the tribunal’s order dated 27 February.

The latest twist in the tale came when billionaire Ranjan Pai, who was among the earliest believers in Byju’s and was seen as a white knight (a friendly investor who acquires a stake to protect a threatened firm) for the company, initiated arbitration proceedings against the firm through his Manipal Education and Medical Group (MEMG) Family Office for allegedly breaching the terms of a loan agreement worth $42 million.

An arbitrator appointed by the Singapore International Arbitration Centre, in an order dated 4 April, directed Byju’s not to dispose of 4 million shares of Aakash Educational Services, one of its group companies.

A Byju’s spokesperson did not respond to a request for comment via text message.

Aarin Capital, of which Pai was a co-founder, was the first institutional investor in Byju’s, coming on board in 2013. In November last year, Pai through his family office gave Byju’s a major breather by acquiring a Rs 1,400 crore debt the company owed to US-based asset management firm Davidson Kempner. Kempner had extended a $250-million loan to Byju’s in May 2023, of which it only released the first tranche of $100 million. It withheld the rest, saying Byju’s was not able to meet some of its loan agreement covenants.

In January this year, much to the chagrin of some other investors, the Aakash Educational Services board allowed Pai to convert his debt into equity, which led to him having a 40 percent stake in the company, considered the crown jewel of the Byju’s umbrella. Some investors challenged the move in a Bengaluru civil court, which turned down their request to halt the transaction.

Also read: Haryana Bill puts edtech sector at risk of micro-management. Specify ‘online coaching centres’

A Gulf deal, a requisition for an EGM

According to sources close to the developments, one of the questions raised by the warring investors who have gone to the NCLT was regarding a deal that Think & Learn had struck in Dubai with an entity called More Ideas General Trading LLC as its sole selling agent in the Gulf Cooperation Council. They alleged that Byju’s paid the entity large amounts in commission but failed to recover the revenue.

The statutory auditor, MSKA & Associates — the audit arm of accounting firm BDO Global — had in the company’s 2021-22 statements said revenue totalling Rs 260 crore from the firm had not been realised. The company in its statements responded saying the customer had provided a quarterly payment plan to clear past dues.

“In the event of non-payment per the agreed payment plan, the company is also evaluating alternative recovery mechanisms including takeover of the customer’s operations and/or legal interventions,” Byju’s said in the audited statements.

Byju’s financials show that it has been paying about a 47 percent commission on the revenues billed to the Dubai-based firm for sales in the Gulf. In fiscal 2020, it paid a commission of Rs 115 crore and billed revenue of Rs 245 crore. In fiscal 2021, the commission was Rs 237 crore against a revenue of Rs 497 crore, and in fiscal 2022, the commission stood at Rs 300.37 crore on revenue of Rs 634.18 crore.

In a statement, Byju’s said the company has not paid any commission to the vendor since it started defaulting on payments. “The outstanding net amount due was $74 million. In recent months, the company started recovering some of the dues after persistent legal pressure,” the company said, adding that it had not booked any fresh sales from this vendor in 2022-23 or 2023-24.

The auditor also said the results were prepared on a “going concern basis” albeit with a disclaimer. It flagged a “material uncertainty related to going concern” flagging continued net losses from operations, accumulated losses and the uncertainty related to litigation around the $1.2 billion term loan taken by Byju’s Alpha Inc and guaranteed by Think & Learn.

According to a statement by Prosus dated 1 February, the investor group, which has now approached the NCLT, had requisitioned an EGM first in July and later in December, but the notices were “disregarded”. Eventually, these investors called for one in January and, when it was held the following month, voted for a change in the company’s leadership.

The EGM itself turned out to be a high-voltage event where 147 people logged in, of whom only about 30 were real shareholders, say sources. In a letter to Byju’s employees, Raveendran called the EGM a “farce.” He further said, “Regardless of this uncalled-for drama, the management is devoting its full attention to the Company’s operations, with our vision for the Company unmarred. The sun will rise again tomorrow, and we will continue our business, undeterred by the rumours and false narratives being circulated.”

The above-mentioned source close to Raveendran, however, admits that the entrepreneur did make a few mistakes. It is “partially true” that he was opaque with his books and should have put a chief financial officer in place years ago, according to the source.

He adds: “It is a chain of events that happened. You cannot blame one person. You have to blame both sides for not working together. You need a good, assertive board and founders who do not go overboard.”

Regardless, the company and its shareholders are looking at a protracted legal battle.

Sood says, “In this start-up mania, the whole sector suffers, even those companies that actually need the funding. But now, the writing is on the wall. The edtech sector will need investors who are willing to believe in the business model and put in money for a good decade or two. Exit-focused investors are not needed in this sector.”

Meanwhile, in Bareilly, Gupta was finally sanctioned a refund of Rs 57,000. Five months on, he is still waiting for the money. Sahoo from Odisha has been waiting for six months. For Yadav from Delhi, the wait has been eight months long, while in Bihar, Bhushan is still struggling to get his subscription cancelled.

(Edited by Rohan Manoj)

Also read: EdTech should be driven by science and not hype. And it must look beyond UK, US

Byju & Divya are frauds. Taking investors for a ride and then hiding in Dubai. They should be in jail.