New Delhi: The number of individuals engaging in intraday trading in the cash equity markets surged 4.6 times, from 1.49 million in FY 2018-19 to 6.89 million in FY 2022-23, peaking at 7.83 million in FY 2021-22. Coinciding with this rise in trading activity was the increase in the proportion of traders losing money, although the average amount lost has fallen.

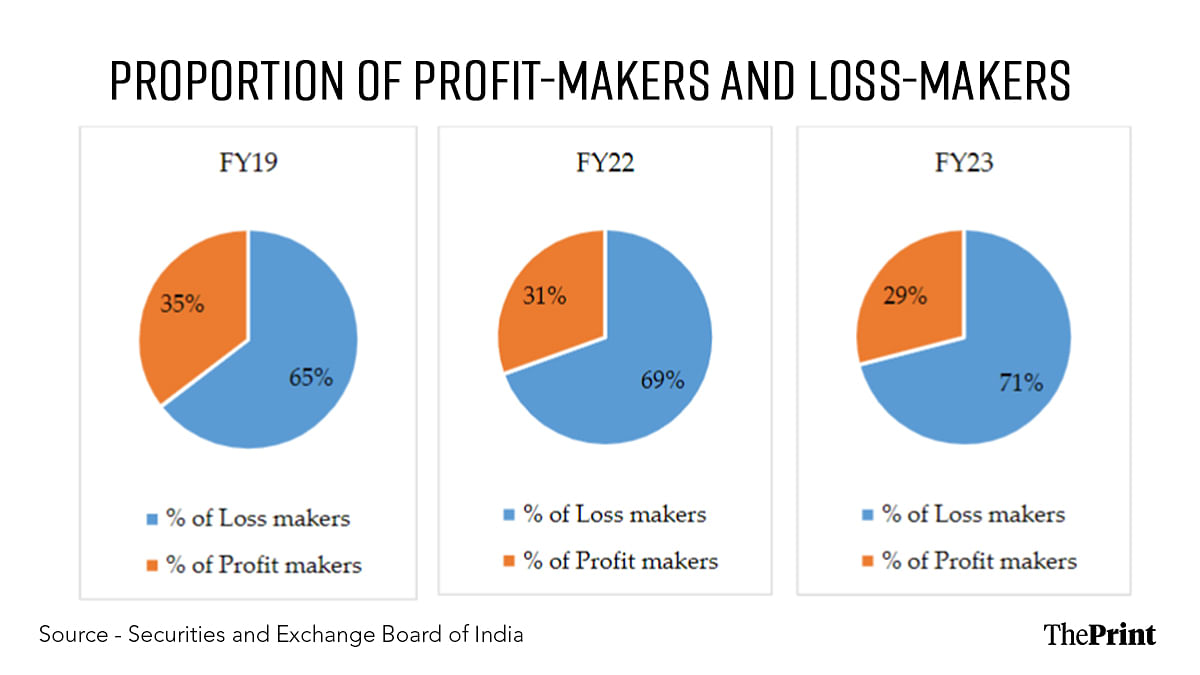

According to a report by the Securities and Exchange Board of India on the intraday trading system, over 70 percent of individual investors involved in intraday trading incurred losses in FY23, up from 65 percent in FY19. The average loss, however, fell drastically to Rs 5,371 during FY23 from Rs 20,701 in FY19.

The markets regulator attributed the increase in the number of traders engaged in intraday trading activities to several factors.

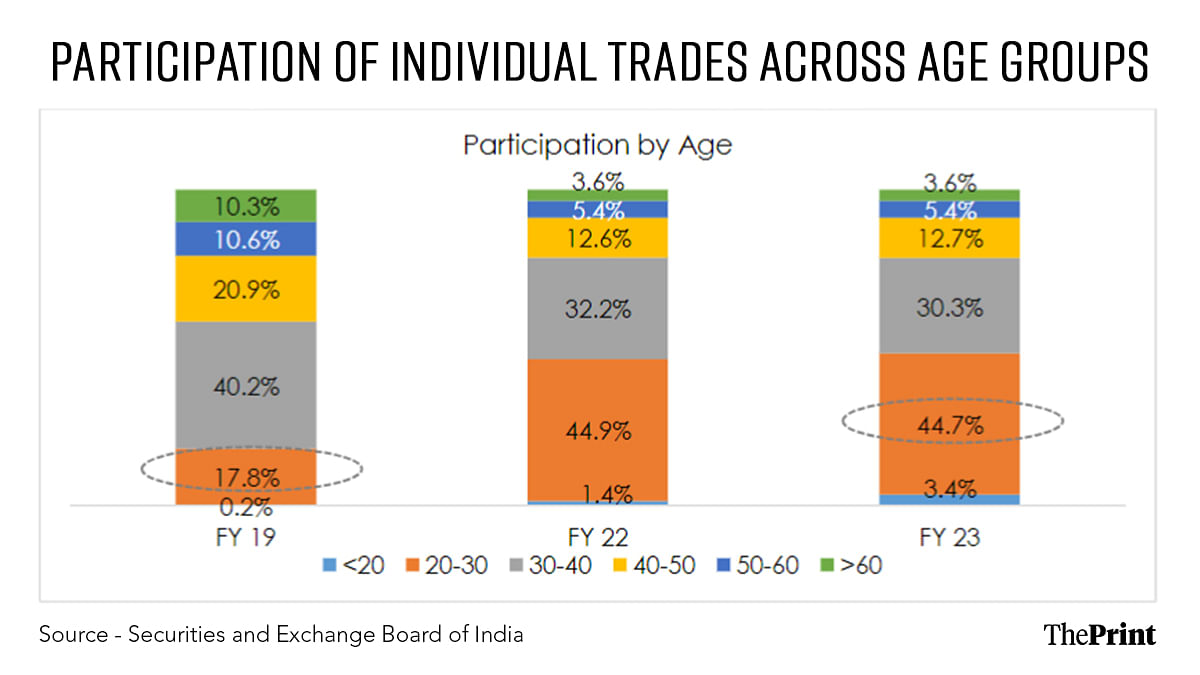

“This surge in participation has been associated with a rise in: (i) traders with low turnover, (ii) traders who trade less frequently, (iii) young traders, and (iv) traders from Tier-2 and Tier-3 cities,” read the SEBI report.

The report profiled the average intraday trader as someone under the age of 30, with the percentage of such traders rising to 48 percent in FY23 from 18 percent in FY19. Notably, it was the younger traders who account for the overwhelming majority of losses.

“In FY23, traders under the age group of more than 60 years had lowest loss-makers (53 percent), while those under 20 years of age had the highest proportion of loss-makers (81 percent),” the study highlighted.

Also Read: 6 govt-run banks with public shareholding below 25% likely to hit the market in ‘next few months’

Before and after the pandemic

Covering FY19, FY22 and FY23, the SEBI study compares trends before and after the pandemic, based on data from the top 10 stock brokers, representing about 86 percent of individual clients in the equity cash segment.

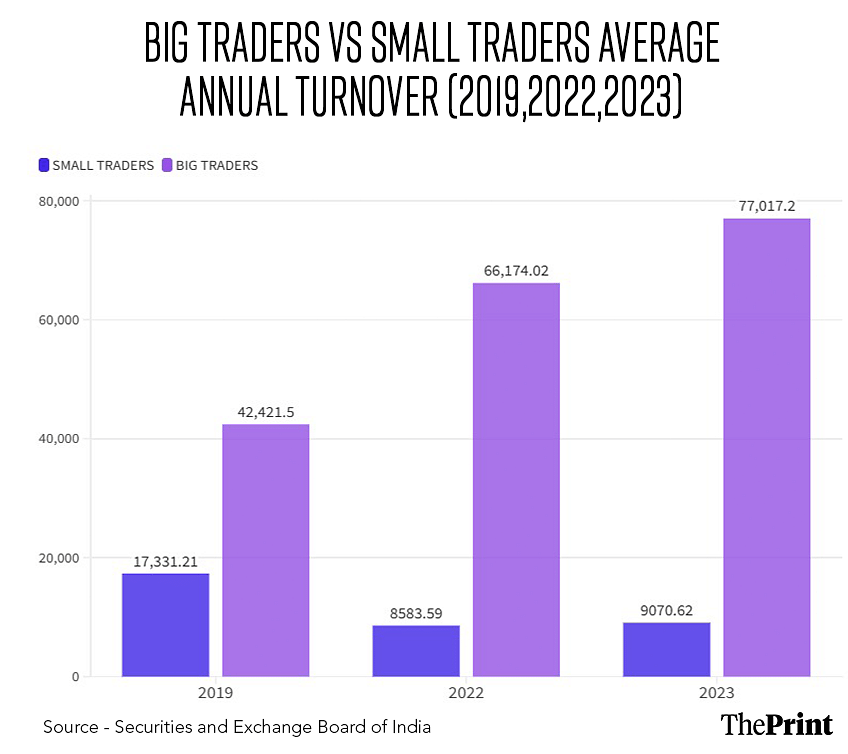

The markets are increasingly attracting small-scale traders willing to take short-term risks, according to the report. The share of these traders, with annual turnovers less than Rs 50,000, increased from 27 percent in FY19 to 56 percent in FY23. These small traders also faced the highest losses.

“During FY23, the ‘Very Small’ turnover group had the highest proportion (77 percent) of lossmakers as compared to other turnover groups,” the study noted. The top 5.6 percent of ‘very large traders’ (annual turnover of over Rs 1 crore) accounted for 90 percent of total turnover and 76 percent of the losses.

This highlights the fact that the very small traders formed a smaller proportion of the trades, but a higher proportion of losses, while the very large traders generated a higher proportion of the trades, but a relatively smaller proportion of the losses.

Interestingly, the number of trades undertaken by individuals has decreased despite the rise in participants.

“The proportion of individual traders carrying out less than 10 trades in a year rose from 41 percent in FY19 to 63 percent in FY23, indicating the influx of individuals trading with very low frequency in recent years. Individual traders undertaking more than 500 trades in a year, accounted for just 2 percent of all individual traders in FY23, as compared to 10 percent in FY19,” the report stated.

While the share of women among intraday traders fell — from 20 percent in FY19 to 16 percent in FY23 — the women that did engage in trading, did so more frequently than males, averaging 74 trades a day, compared with 64 for men.

Further, the average loss for female traders was Rs 1,281 in FY23, lower than the Rs 2,245 for male traders.

The report also noted a significant rise in the number of traders from Tier-3 cities, with their share increasing tenfold from 0.02 percent in FY19 to 0.2 percent in FY23. The report also found that a rising proportion of these traders — from 66 percent in FY19 to 70 percent in FY23 — lost money on their trades.

(Edited by Mannat Chugh)