Investors have scrutinized Mutuum Finance (MUTM) closely as this DeFi crypto navigates presale hurdles toward its Q4 2025 launch. Phase 6 has reached 75% allocation at $0.035 per token, up 250% from phase one’s $0.01 entry. The project has raised $17,850,000 since inception, drawing 17,400 holders amid crypto market turbulence.

Analysts now project MUTM’s trajectory into 2026, factoring audited contracts and dual lending models. This altcoin stands out as the best crypto to buy now for those eyeing resilient yields. Early backers anticipate 412% returns post-launch at $0.06, blending utility with measured growth. Such momentum underscores why MUTM merits attention in volatile cycles.

Presale Momentum Surges

Developers at Mutuum Finance (MUTM) have accelerated phase 6 sales, filling 75% of allocations swiftly. Tokens linger at $0.035, yet urgency mounts as this window narrows. Buyers grasp the final shots at this rate before phase 7 hikes prices 14.3% to $0.04. Launch beckons at $0.06, promising current investors a 412% uplift from today’s entry.

Raised funds hit $17,850,000, while holders climbed to 17,400. Phase 6 vanishes fast. Thus, the bargain evaporates soon. Moreover, the team unveiled a dashboard tracking top 50 holders via a 24-hour leaderboard. Daily resets occur at 00:00 UTC. The top user claims a $500 MUTM bonus after one transaction. Recent leaders posted buys of $8,601.92, $500, $7,000, and $256.83.

Community Giveaway Ignites Interest

Mutuum Finance (MUTM) has rolled out a $100,000 MUTM giveaway, splitting prizes among 10 winners at $10,000 each. Participants submit wallet addresses, complete quests, and invest at least $50 in the presale to qualify. This initiative has spiked engagement, fostering loyalty as the DeFi crypto gains traction.

Such efforts compound presale heat. Consequently, holders multiply. The best crypto to buy now draws crowds through tangible rewards. Yet, focus sharpens on core mechanics next.

Dual Lending Models Advance

Engineers have crafted Mutuum Finance (MUTM)’s peer-to-contract pools for assets like ETH and USDT. Users deposit funds, earning APYs up to 8% passively as borrowers tap liquidity. For instance, a $10,000 ETH stake yields $800 annually at steady rates.

Peer-to-peer lanes handle niche tokens, letting lenders set 5-12% terms directly. Borrowers collateralize at 75% LTV, accessing $7,500 against $10,000 without selling. mtTokens track yields, redeemable with principal plus gains. The platform launches with the token per roadmap, eyeing top-tier exchange listings.

These features promise stable income streams. Therefore, passive earners thrive. As an altcoin, MUTM integrates buy-and-distribute fees, repurchasing tokens for stakers. This loop sustains value amid expansions like Layer-2 scaling.

Security Protocols Solidify

Mutuum Finance (MUTM) has initiated its bug bounty program alongside CertiK. Rewards total $50,000 USDT, divided into critical, major, minor, and low tiers based on severity. Critical finds fetch up to $2,000, ensuring rigorous vetting before mainnet.

The CertiK audit scored 90/100, affirming contract robustness. Ethical hackers probe vulnerabilities now. Hence, trust builds steadily. This DeFi crypto prioritizes safeguards, appealing to risk-averse participants. Early testing on Sepolia incorporates liquidity pools and liquidation bots with ETH, USDT.

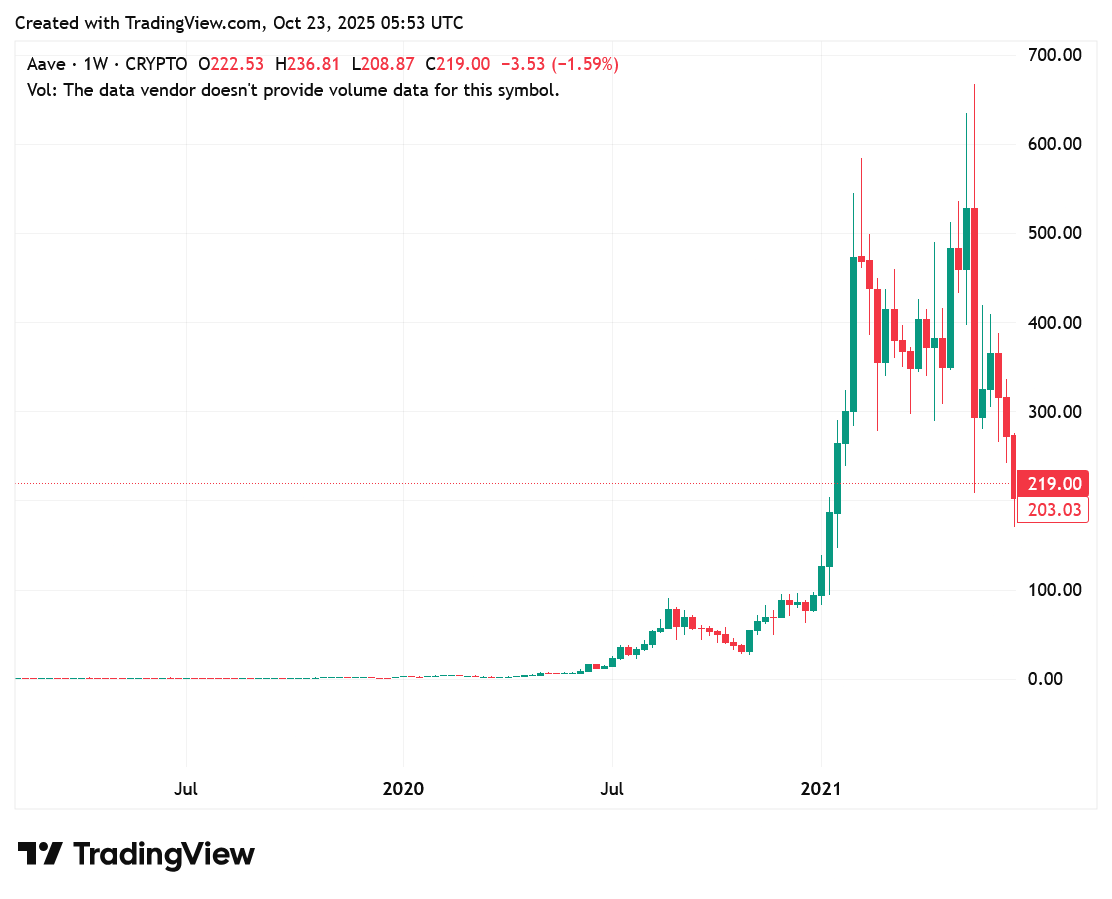

Aave’s Historic Surge Offers Parallels

Borrowers in 2020 eyed Aave amid DeFi’s dawn, when its token dipped to $26 lows. By May 2021, prices soared to $661 highs over six months, delivering 2,542% ROI. Lenders harvested yields as adoption exploded, mirroring pooled efficiencies.

Mutuum Finance (MUTM) echoes this path logically. Its dual models and audited base project similar catalysts. Analysts forecast $0.45 by mid-2026, a 1,186% climb from $0.035. Community growth and listings propel this, outpacing Aave’s tempo through stablecoin anchors. Yet, MUTM tempers risks with oracles like Chainlink.

Projections signal the best crypto to buy now for yield hunters. Utilization rates, projected at 70%, drive APYs higher. Thus, 2026 valuations hinge on execution.

Stakeholders have weighed Mutuum Finance (MUTM)’s blueprint against peers, affirming its DeFi crypto edge. This altcoin recaps as the best crypto to buy now, blending presale gains with lending utilities. Secure your position before phase 7 locks in higher entries.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance