PNN

Ahmedabad (Gujarat) [India], February 13: VMS TMT Limited (BSE: 544521 | NSE: VMSTMT), a fully integrated steel manufacturer engaged in TMT Bars, Billets, and Binding Wires, announced its Unaudited Financial Results for the Quarter and Nine Months ended 31 December 2025.

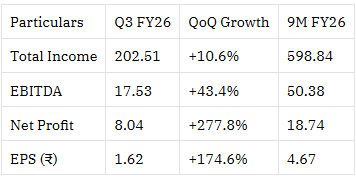

Key Financial Highlights – Q3 & 9M FY26 (₹ in Crores)

Operational & Business Highlights

– Strong sequential growth in Q3 supported by improved plant utilization and stable demand across retail and institutional segments.

– Backward integration through the billet (CCM) facility continued to enhance cost control and raw material availability.

– Retail-led distribution network of 227+ dealers and 3 distributors sustained steady offtake across Gujarat.

– Automation and process optimization at the Bhayla plant improved productivity and operating leverage during the quarter.

– Completion of IPO-related debt repayment strengthened balance sheet and reduced finance costs.

– Progress continued on the 15 MW captive solar power project to structurally lower energy costs.

– Healthy order pipeline maintained across housing and infrastructure-driven demand segments.

Mr. Varun Jain, Chairman & Managing Director, VMS TMT Limited, said:

“Q3 marked a strong sequential improvement for VMS TMT, with double-digit revenue growth and a sharp increase in profitability driven by operating leverage and efficiency gains across our integrated operations. The successful stabilization of our billet facility, improved plant utilization, and consistent retail demand supported performance during the quarter.

Over the first nine months of FY26, we have strengthened our integrated manufacturing platform, expanded dealer engagement, and completed key balance-sheet milestones following our IPO. With healthy order visibility, continued infrastructure demand, and ongoing cost-optimization initiatives including captive solar power, we remain confident of sustaining growth momentum and improving margins over the medium term.”

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PNN. ANI will not be responsible in any way for the content of the same.)

This story is auto-generated from a syndicated feed. ThePrint holds no responsibility for its content.