NewsVoir

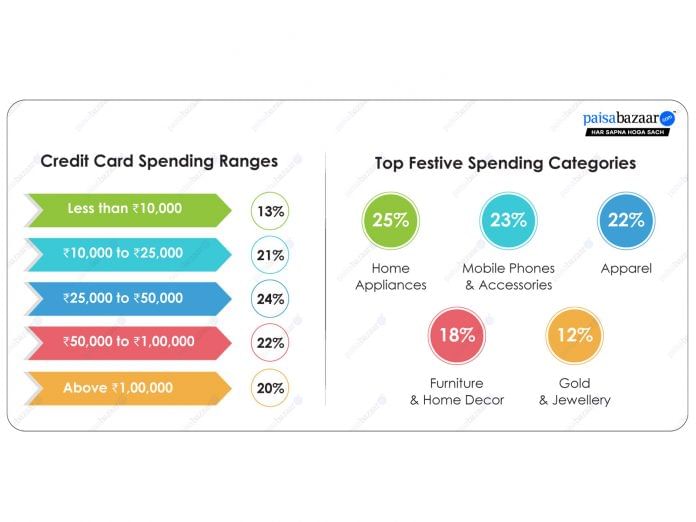

Gurgaon (Haryana) [India], October 30: A survey by Paisabazaar, India’s leading marketplace for consumer credit and other financial products, revealed that over 42% of credit card users spent more than Rs. 50,000 on festive shopping this year, underscoring a growing appetite for high-value purchases. 22% of the respondents spent between Rs. 50,000 and Rs. 1 lakh, while 20% spent above Rs. 1 lakh on their credit cards during Diwali.

The survey with over 2300 respondents revealed that home appliances (25%), mobiles, gadgets & accessories (23%), and apparel (22%) were the top three spend categories on credit cards in the festive season, followed by furniture and decor (18%). Gold & jewellery also accounted for 12% of credit card spends during Diwali. The survey indicated increasing use of credit cards to make high-ticket purchases more rewarding.

Santosh Agarwal, CEO, Paisabazaar, said, “The surge in high-ticket festive purchases through credit cards reflects a growing affinity towards value and convenience. Consumers are using credit cards more strategically, timing their big-ticket buys to coincide with festive season deals and card-specific rewards. Our survey clearly shows rising consumer awareness along with growing popularity of credit cards.”

The survey findings also showed that over 91% of the credit card users planned their purchases around card offers, whereas less than 10% said that they shopped without waiting for specific deals and relied on their card’s standard cashback or rewards structure. This shows that festive buying decisions are becoming increasingly value-driven, with consumers aligning their larger purchases to maximise benefits from credit card offers and ongoing promotions.

Credit card benefits continued to be a key motivator for using cards in festive spending. A majority (71%) of respondents held shopping-specific credit cards offering cashback and rewards. Another 15% received festive offers despite not owning such cards, while 14% did not gain any shopping-related benefits.

With nearly 20% of the respondents opting for it, cashback came out as the most popular credit card incentive. Co-branded offers (19%) and accelerated reward points (18%) were the other major motivators. Among those opting for EMIs, No-Cost EMI remained the top motivator with 56% opting for it, followed by 29% who were attracted by better discounts and 10% using just EMIs to spread payments over time.

The survey also revealed 48% respondents preferred a mix of online and offline shopping, signalling a clear shift in how cardholders approach festive spending. Channels no longer limit consumers; instead they seek savings and convenience – often using e-commerce platforms for better offers and offline stores for product experience before purchase.

Rohit Chhibbar, Head of Credit Cards, Paisabazaar, said, “This year’s survey reflects the rise of the strategic and value-aware shopper, who plan their purchases around credit card offers and are comfortable across both online and offline channels, seeking to maximize the value of the cards they hold. Cashback, rewards, no-cost EMI, coupled with merchant discount, continue to make credit cards an essential part of festive shopping.”

Furthermore, 83% of the respondents said that they found the best deals and discounts on e-commerce platforms like Amazon and Flipkart as compared to only 7% of the cardholders who found more value at physical stores.

The survey reaffirmed the dominance of Amazon and Flipkart as the two leading e-commerce platforms; 43% of the respondents revealed their preference for these two platforms. Myntra and Meesho followed closely at 15% and 10% respectively, whereas Ajio, Nykaa, Zepto and Tata Cliq collectively accounted for a 32% share.

Paisabazaar, a part of PB Fintech (listed since 2021), is India’s largest marketplace for consumer credit and free credit score. Over the last 11 years, Paisabazaar has earned the trust of over 50 million consumers and it handles 20 lakh+ monthly enquiries from 1000+ cities. Paisabazaar has built 65+ partnerships withBanks, NBFCs, and fintechs to offer a broad range of credit products. Paisabazaar is ISO (27001:2013) and PCI DSS certified organisation, with industry-best controls, to safeguard the best interest of consumers.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by NewsVoir. ANI will not be responsible in any way for the content of the same)

This story is auto-generated from a syndicated feed. ThePrint holds no responsibility for its content.