VMPL

Mumbai (Maharashtra) [India], February 14: Fractal Industries Limited has successfully completed the Anchor Investor allocation in connection with its proposed Initial Public Offering (IPO), ahead of the issue opening for public subscription.

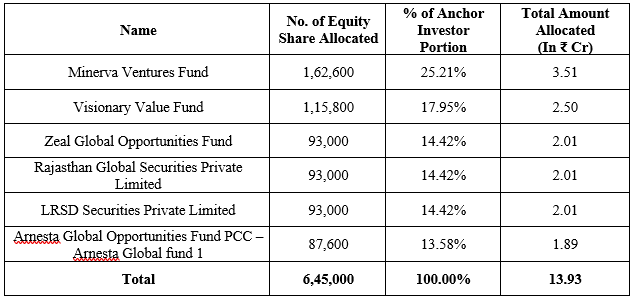

Pursuant to the resolution passed by the Board of Directors and in consultation with the Book Running Lead Manager, the Company has allotted 6,45,000 equity shares to Anchor Investors at an Anchor Investor allocation price of ₹216 per equity share, aggregating to ₹13.93 crore.

Anchor Investor Allocation Details

IPO Details

– Total Issue Size: Up to 22,68,600 equity shares

– Price Band: ₹205 – ₹216 per equity share

– Face Value: ₹10 per equity share

– IPO Size: ₹49.00 crore (at upper price band)

– Anchor Portion: 6,45,000 equity shares

– Issue Opens: February 16, 2026

– Issue Closes: February 18, 2026

– Listing Platform: BSE SME

About Fractal Industries Limited

Fractal Industries Limited is a specialized, technology-enabled supply chain management company focused on the e-commerce fashion industry. The company provides end-to-end solutions spanning:

– Procurement and inventory handling

– Warehouse management

– Order processing and fulfilment

– Packaging and returns management

– Regulatory compliance

The company operates across India and supports high-volume, multi-category operations.

Backed by a management team with over 22 years of industry experience, the company has built strong execution capabilities and technology-driven operations

Disclaimer

This press release does not constitute an offer to sell or a solicitation to purchase securities. The equity shares of the Company are being offered only through the Red Herring Prospectus filed with BSE SME. Investors should refer to the prospectus, including the section titled “Risk Factors”, for a detailed understanding before making any investment decision.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)

This story is auto-generated from a syndicated feed. ThePrint holds no responsibility for its content.