New Delhi: Ruja Ignatova, better known as the ‘cryptoqueen’, is now the only woman on the US Federal Bureau of Investigation’s (FBI) list of Ten Most Wanted Fugitives, alongside murderers and gang leaders. But Ignatova is no murderer.

She is the founder of OneCoin, a Bulgaria-based virtual currency the 42-year-old set up in 2014 and marketed as the “Bitcoin killer”. Only the 11th woman to be placed on the FBI’s most-wanted list, Ignatova vanished into thin air in 2017, allegedly with billions of dollars of investors’ money.

Ignatova — a former consultant with McKinsey & Company, she also had a law degree from the University of Oxford — has been accused of defrauding investors to the tune of over $4 billion (Rs 31,000 crore).

“Ignatova and her partner promoted OneCoin through a multi-level marketing strategy that urged OneCoin investors to sell additional packages to friends and family. Ignatova capitalised on the excitement surrounding cryptocurrencies to draw in new investors,” the FBI said on 30 June. announcing her addition to the list and offering a reward of “up to $100,000 for information”.

Ignatova, who had claimed that OneCoin was the “most transparent, most legal” virtual currency in the market, now faces multiple federal charges, including that of “wire fraud, conspiracy to commit money laundering and securities fraud”.

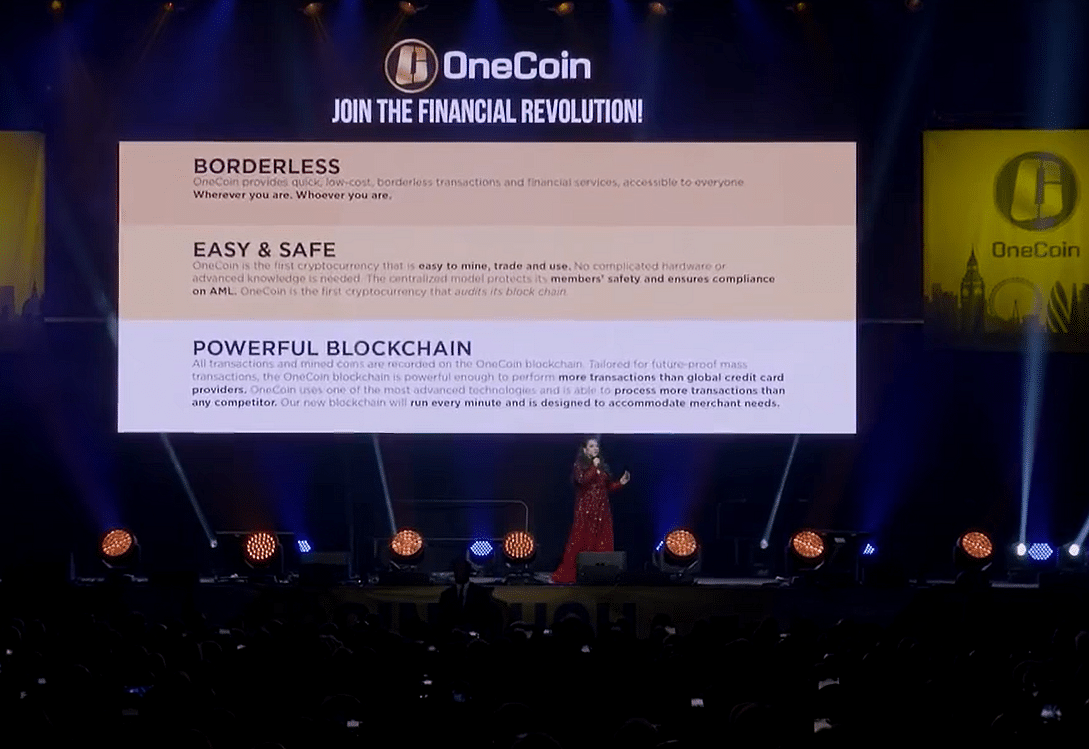

But the meteoric rise of OneCoin, which the FBI has now termed an “international pyramid scheme”, was not something that happened behind closed doors. In 2016, a grand event was held to mark two years of OneCoin.

As she stepped onto the stage amid lights, music and thundering applause, Ignatova claimed: “Today, we have two million active users. No other cryptocurrency has as many users as us.”

Mocking other virtual currencies as “Mickey Mouse coins”, it was during this event that Ignatova laid out her vision for OneCoin, which she described as a “global currency for global businesses”.

Also Read: Stock market turmoil, crypto craze proof of human ‘fear, greed’ says chief economic advisor

‘Pyramid scheme’

Unlike conventional cryptocurrencies, OneCoin was not mined through public blockchains, which is a shared ledger that tracks transactions and distributes them across an entire network of computers.

According to the FBI special agent investigating the case: “OneCoin claimed to have a private blockchain. This is in contrast to other virtual currencies, which have a decentralized and public blockchain. In this case, investors were just asked to trust OneCoin.”

In other words, unlike most cryptocurrencies, the prices of OneCoin did not fluctuate in tandem with demand and supply, giving proprietors the sole authority to decide the price of a single OneCoin. And owing to the kind of cryptocurrency it was, it could not be used to make any purchases anywhere in the world; OneCoin was essentially worthless.

Damian Williams, the U.S. attorney for the Southern District of New York, during a news conference Thursday, said that more than three million investors from more than 100 countries had invested in OneCoin.

Investors were largely encouraged to convince more and more people to invest in the ‘OneCoin community’, for which they were offered incentives.

OneCoin, which was promised to investors as the gateway to a new community, was allegedly always a pyramid scheme — a fraudulent system in which money is collected from investors based on a recruitment model and routed straight to the top; in this case, to Ignatova.

Ignatova’s disappearance

According to The Washington Post, Court documents show that in an email she reportedly wrote to a co-founder in 2014, Ignatova said, “take the money and run and blame someone else for this” — suggesting that this was her plan from the get-go.

According to a report by MarketInsider: “From the start, regulators sensed something was off. Bulgaria’s Financial Supervision Commission (FSC) warned of risks involved with cryptocurrencies like OneCoin in 2015 when the cryptocurrency was just getting started.”

The report added that in 2016, authorities in Croatia, Sweden, Norway, Latvia, Hungary, Italy, and several other countries either started warning investors or cracking down on OneCoin in their respective countries.

In 2017, investigating agencies in India registered a case against OneCoin; Ignatova was identified as an accused in the chargesheet by Navi Mumbai Police later that same year.

Days after the first arrest warrant against her was issued in the US on October 12, 2017, Ignatova fled from Sofia in Bulgaria to Athens in Greece on October 25 that same year, and hasn’t been seen since.

Apart from the arrest warrants issued against her in multiple countries, another factor that reportedly might have prompted Ignatova to flee was distrust of her boyfriend.

According to her brother’s testimony in court, after she began to suspect her boyfriend of “stringing her along” in 2017, Ruja rented an apartment in Florida to ease her suspicion. But to her complete surprise, she discovered that her boyfriend had been cooperating with the FBI. Ignatova eventually disappeared a few weeks later.

Ignatova’s brother, Konstantin Ignatov — who became the face of the company after she disappeared — was arrested in 2019 and later pleaded guilty to multiple charges, including money laundering and fraud. That same year, Mark Scott, a lawyer employed by OneCoin, was also convicted of laundering $400 million.

(Edited by Amrtansh Arora)

Also Read: Can’t stop talking about crypto? You might be an ‘impulsive psychopath’, study says