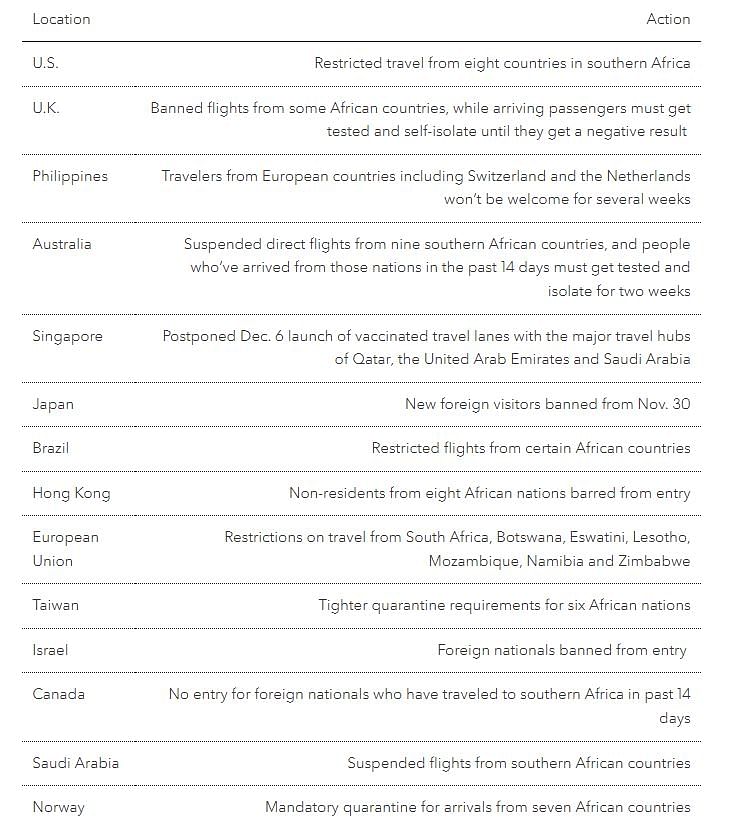

Airlines, passengers and businesses had to respond to a deluge of travel restrictions introduced to slow the spread of the omicron coronavirus variant.

An initial spate of flight bans from southern Africa, where omicron was first detected, gave way to wider-ranging measures that will make travel more expensive and less convenient — if possible at all — recalling earlier days in the pandemic.

From Tuesday, Japan will ban foreign visitors until more is known about the variant, Prime Minister Fumio Kishida said in Tokyo on Monday.

The U.K. reintroduced mandatory PCR tests for all arriving passengers and said they must self-isolate until receiving a negative result. Israel closed to all inbound foreign nationals for 14 days, the Philippines said travelers from European countries including Switzerland and the Netherlands won’t be welcome for several weeks and Singapore delayed the launch of vaccinated travel lanes with Qatar, the United Arab Emirates and Saudi Arabia.

Spain and Switzerland tightened access for arrivals from Britain, whose travel comeback has quickly been thrown into reverse. U.K. low-cost carrier EasyJet Plc said Sunday its flight schedule was operating as normal, “however we continue to monitor the situation closely.”

While the full impact will get clearer over coming days, “this will be problematic for business travel — particularly inbound into the U.K.,” said Martin Ferguson, a spokesman for American Express Global Business Travel.

Also read: US imposes travel ban on South Africa and 7 other countries over Omicron variant

Travel dilemma

Organizers of the World Aviation Festival in London told attendees the event will go on as scheduled starting Tuesday, the day the new U.K. rules come into effect. The group arranged for testing at two nearby hotels where delegates who are guests can self-isolate while awaiting results.

A separate, internal corporate event in the U.K. was shifted to hybrid from in-person, because the new testing and isolation requirements would have caught out some attendees set to arrive on Tuesday, according to a person familiar with the matter.

Negative incentives

Leisure travel will also see an impact, while friends and relatives visiting loved ones after long absences are more likely to go through with a trip, said Alex Irving, an analyst at Bernstein in London.

“Christmas bookings will obviously be weaker than we had expected prior to the omicron variant,” he said. “As you add barriers to travel such as the PCR tests and isolation requirements, all that does is changes the incentives.

Step backward

Airlines face a return to the uncertainty of shifting rules and public-health developments that threw customer plans into chaos and undermined demand earlier in the pandemic.

British Airways, for example, halted flights to Hong Kong through at least Nov. 30 after one employee tested positive for Covid-19 and staff were sent into quarantine. The airline said it is keeping its operations under review as the situation evolves.

The risk of a second lost winter has already tanked shares of airline stocks, with the Bloomberg EMEA Airline Index down 18% for the month as of Friday. They made up some of the losses on Monday, amid reports that some people infected with the omicron variant developed mild symptoms.

British Airways parent IAG SA was up 3.8% at 8:04 a.m. in London, Ryanair Holdings Plc rising 4.3% in Dublin, Air France-KLM advancing 1.9% in Paris and Deutsche Lufthansa AG up 3.5% in Frankfurt.

“Friday’s dramatic share price moves have already more than factored in a realistic downside case from the Omicron variant for most of our stocks,” James Ainley, an analyst with Citigroup, said in a research note.

The share-price drops will make it harder to raise fresh capital to repair balance sheets — IAG has 12.4 billion euros ($14 billion) in net debt, for example.

“This comes at a time of year when airlines will seek to bolster liquidity and to a modest extent profitability, and is after an already arduous 18 months of revenue depletion,” said John Strickland, who heads London-based JLS Consulting.—Bloomberg

Also read: Amid Omicron threat, PM Modi says ‘monitor international arrivals, focus on at-risk countries’