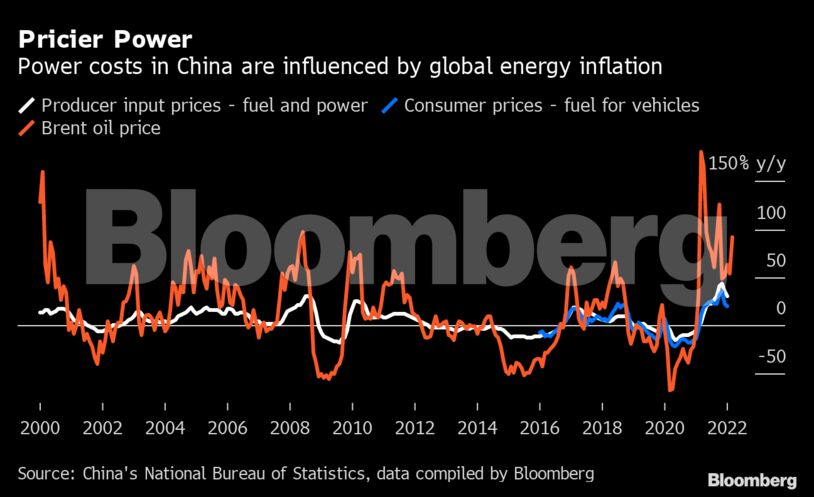

Soaring oil prices triggered by possible sanctions on Russia’s energy supplies will make China’s already-challenging economic growth target for the year even tougher to achieve.

Beijing is betting that its large domestic energy supplies, close ties with Russia and low consumer inflation will insulate it from surging crude prices. But, with oil costs now 40% higher than they were two weeks ago, Chinese businesses are facing a profit squeeze, consumers’ spending power could be hit, and global growth will take a knock, curbing demand for Chinese-made goods.

Barclays Plc’s chief China economist, Jian Chang, estimates a global energy shock could subtract between 0.3 and 0.5 of a percentage point from China’s economic expansion this year by suppressing consumption and external demand. To prevent a large fallout, “authorities will intervene to mitigate the negative impact from surging oil prices,” she wrote in a note.

China is the world’s biggest oil importer, purchasing more than $257 billion worth of crude last year, according to official statistics. Chang expects Beijing to order state-owned oil refiners to cut profits and use price controls on fuel to cushion consumers. China imports about 15% of its oil from Russia and may be able to pay lower prices for those imports due to reduced demand from the U.S. and Europe, she added.

Underlining China’s continued interest in Russian commodities as part of efforts to maintain energy security, Beijing is in talks with state-owned firms including its oil majors on opportunities for potential investments in Russian companies or assets, according to people familiar with the matter.

The implication of higher oil prices is that Beijing will need to add more fiscal and monetary stimulus to the economy to meet its ambitious growth target of around 5.5% for the year, which was announced just three days ago. The dilemma for policy makers is that the threat of inflation may make central bank easing more challenging.

“It will certainly be a constraint on China’s monetary policy,” said Bruce Pang, head of macro and strategy research at China Renaissance Securities Hong Kong. “There’s less monetary policy space with the mounting risks and uncertainties, and as the Federal Reserve hikes, there’s a shorter window for the People’s Bank of China to ease monetary policy.”

China’s benchmark CSI 300 Index dropped as much as 2.2% Tuesday on fears that commodity inflation may interfere with the pace of loosening policy.

Subdued Inflation

Consumer inflation in China has been relatively subdued, partly due to the fact that sporadic coronavirus outbreaks and restrictions introduced to control them have slowed growth in consumer demand. Producer inflation has also eased in recent months after surging last year on the back of soaring costs for metals and coal.

Pang expects producer-price inflation to reach 5% this year, 2 percentage points higher than previously estimated before the Ukraine crisis. The impact on consumer inflation will be more moderate, given the weaker pass-through from producer to retail prices. Grain and pork prices have also been trending lower, which would help to keep consumer inflation below the government’s target of 3%, he said.

Chinese officials have played down the threat. The nation’s sources of crude oil, natural gas are diversified and a “very high” share are on long-term contracts, Lian Weiliang, vice chairman of the National Development and Reform Commission, told a briefing Monday.

There are a number of uncertainties about the trajectory of the war in Ukraine, including whether the U.S. and Europe extend sanctions or ban energy imports, and whether China will boost imports from Russia.

“The long-run impact depends on the length and impact of sanctions and China’s relationship with Russia,” said Xu Jianwei, senior greater China economist at Natixis SA.

Another factor that could cushion the impact of the oil price surge is that coal and renewables constitute the bulk of the country’s electricity generation.

“Power prices will be stable as long as coal prices stay stable, and thus the base of energy prices will be stable,” Hu Zucai, a vice chairman at the NDRC, said on Monday.

Louis Kuijs, chief economist for Asia Pacific at S&P Global Ratings, said unlike economies such as South Korea and Taiwan, China produces a substantial share of its fossil fuel energy consumption. However, higher oil prices “mean that achieving the relatively ambitious growth target for 2022 of ‘around 5.5%’ will require more measures to support growth,” he said. —Bloomberg

Also read: Oil shock risks becoming ‘nightmare’ for RBI, it could raise inflation forecast