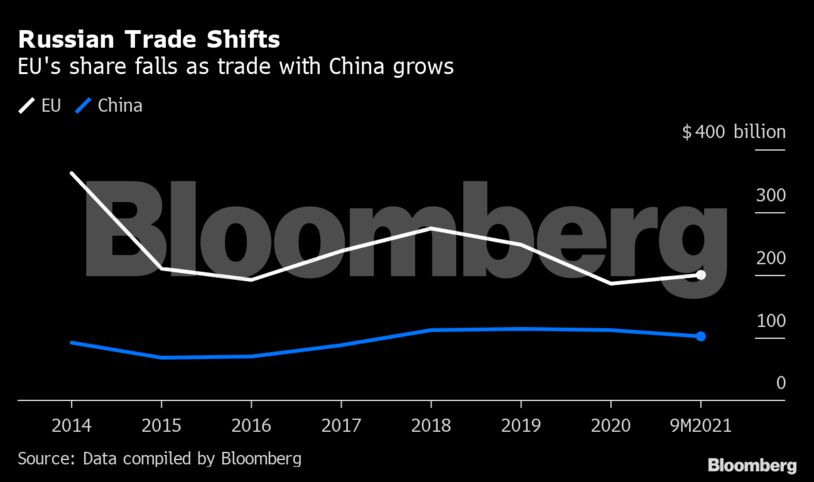

Russia’s invasion of Ukraine poses a difficult question for China: How can it support a key strategic partner when relations with the U.S. and Europe are so much more important for its economy?

An important energy supplier to China, Russia has strengthened trade ties with Beijing over the past decade. However, Russia’s economic weight pales in comparison to Western nations, who are much bigger export customers for China, major sources of technology and investment, and also control China’s access to the international dollar system.

“For China, the economic relationship with the European Union is much more important than with Russia,” said Iikka Korhonen, head of the Bank of Finland Institute for Emerging Economies, which specializes in analysis of China and Russia. “That feeds into policy making that is cautious about what is happening in Ukraine.”

For now, China has pledged to maintain normal trade with both Russia and Ukraine despite a ratcheting up of sanctions by the U.S., Europe and other Western allies, as well as by Asian economies like Japan and Taiwan.

Here’s a deeper look at China’s economic ties with Russia and what’s at stake for their economies:

Trade boom

The two countries set their bilateral relationship on a stronger footing in 2014 following Russia’s invasion of Crimea. Presidents Vladimir Putin and Xi Jinping agreed at the time on a “new stage in the China-Russia comprehensive strategic partnership,” signing deals on energy, electricity, aviation, telecommunications, and other areas.

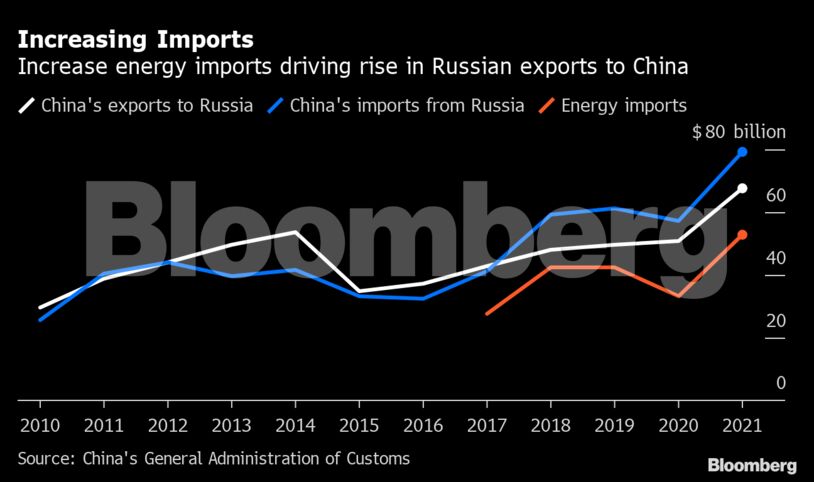

Since then, Chinese imports from Russia jumped to a record $79 billion last year, driven mostly by energy purchases. China is a key market for Russia, buying 17% of its exports in 2020, behind only Europe.

Chinese exports to Russia also hit a record last year, although Russia makes up only 2% of shipments, about the same amount as Australia buys and well below the U.S.’s share of 17%.

At a Xi-Putin meeting earlier this month in Beijing, the Chinese leader said the two countries should aim to raise bilateral trade to $250 billion from $140 billion last year.

Still, on foreign direct investment, China’s inflows into Russia has generally been very low.

Currency trade

Russia has been cutting the role of the dollar in its economy and trade since the imposition of sanctions following its invasion of Crimea. The dollar’s share of Russia’s $640 billion foreign-currency reserves declined to 16% in 2021 from 46% in 2017.

In comparison, the yuan’s share in reserves rose to 13%, from less than 3%, while the euro’s gained to 32% from 22%.

The U.S. currency’s dominance in Russia’s trade payments has also diminished, with 56% of export receipts in dollars in the first half of last year, down from 69% in 2016, according to a study by UBS AG’s economist Anna Zadornova.

The de-dollarization trend is more clear in Russia’s trade with China, where the dollar’s share in Russia’s exports to China has declined to about 40% now from nearly 100% in 2013. The two nations’ central banks also agreed a 150 billion yuan ($24 billion) currency swap in October 2014, with the agreement renewed every three years since then to help facilitate trade financing.

Banking ties

Sanctions on Russian banks and other entities put China’s state-owned financial institutions in a tough spot since many have established close ties with Russian counterparts over the past decade. Industrial & Commercial Bank of China Ltd., the nation’s largest lender, is currently the biggest Chinese bank in Russia with branches in Moscow and St. Petersburg.

The Moscow branch alone had close to $1 billion of assets by the end of 2020 and offered an extensive range of yuan-denominated services, including deposit, lending, cross-border settlement and trade finance. Bank of China Ltd., Agricultural Bank of China Ltd. and China Construction Bank Corp. all have operations in Russia.

China’s largest policy banks, China Development Bank and Export-Import Bank of China, have also provided tens of billions of dollars of credit to Russia as part of Xi’s Belt-and-Road Initiative, funding everything from infrastructure to oil and gas. By the mid 2019, China Development Bank had committed $65.4 billion of credit to Russia and issued a total of $48.2 billion in loans, focusing on supporting more than 60 projects in areas including oil and gas, telecommunications, mining and forestry, according to the Banking Association of China.

Commodities and energy

During the Xi-Putin meeting this month, the two leaders signed a series of deals to boost Russian supply of gas and oil, as well as wheat.

Gazprom PJSC signed its second long-term gas deal with China National Petroleum Corp. to deliver 10 billion cubic meters per year over 25 years via a new pipeline from Russia’s Far East. That will be settled in euros, according to reports in local Chinese media, instead of dollars. Gazprom is currently in talks with China over supplying via a third route.

At the same time, Rosneft PJSC reached an agreement to deliver 100 million tons of crude oil to CNPC via Kazakhstan within 10 years. –Bloomberg

Also read: Russia to Riyadh — Imran Khan now has a history of being in the wrong place at the wrong time