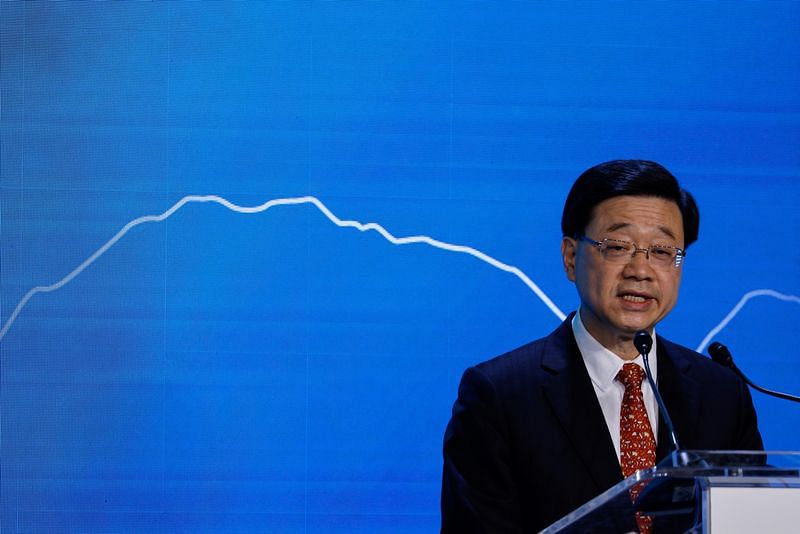

(Reuters) -Hong Kong leader John Lee pitched the city’s connection with China in an address to some of the world’s top financial executives, as he pushes to rebuild the COVID-ravaged city’s image as a major financial hub.

Chief Executive Lee told the Hong Kong Monetary Authority’s Global Financial Leaders’ Investment Summit on Wednesday the city would continue working towards lifting COVID restrictions.

Some of the world’s biggest banking bosses, including Goldman Sachs’ David Solomon and Morgan Stanley’s James Gorman, are in Hong Kong for the first time in almost three years.

For foreign financial firms operating in China and Hong Kong, the summit comes as they navigate tensions between the United States and China while a depleting pool of talent in what is touted as “Asia’s world city” is creating a major challenge, analysts previously told Reuters.

“Hong Kong remains the only place in the world where the global advantage and the China advantage come together in a single city,” Lee said.

“This unique convergence makes Hong Kong the irreplaceable connection between the mainland and the rest of the world,” Lee added at the summit.

In the summit’s first session, China Securities Regulatory Commission (CSRC) Vice Chairman Fang Xinghai said Hong Kong was a ‘very, very important’ financial centre for China.

Authorities, he said, were keen for more international companies to list in Hong Kong to grow the city’s capital markets activities.

Hong Kong new shares are worth $10.77 billion so far in 2022, the lowest level since 2017, compared with $37.7 billion at the same time last year, according to Refinitiv figures.

Global investors are grappling with several challenges this year, with the Ukraine war, rising inflation, soaring energy prices and tightening interest rates all hammering risk appetite.

Goldman Sach’s Solomon told the summit it could take up to six quarters for the world to ‘rebalance’ after a period of uncertainty.

“There’s still a significant amount of uncertainty as we get into 2023,” he said.

“And we’ll start to have a clearer understanding of the trajectory of the capital markets .. My expectation is that equilibrium will come more into balance in the coming quarters.”

Earlier, Lee said that Hong Kong was working to attract top talent to offset a major brain drain seen in the past three years due to the strict coronavirus rules.

“As have many other major cities worldwide, Hong Kong has been through ups and downs over the years but our resilience remains remarkably unmatched,” he told the summit.

(Reporting by Scott Murdoch in Sydney, Selena Li, Kane Wu, Xie Yu in Hong Kong and Samuel Shen in Shanghai; Editing by Himani Sarkar & Shri Navaratnam)

Disclaimer: This report is auto generated from the Reuters news service. ThePrint holds no responsibilty for its content.