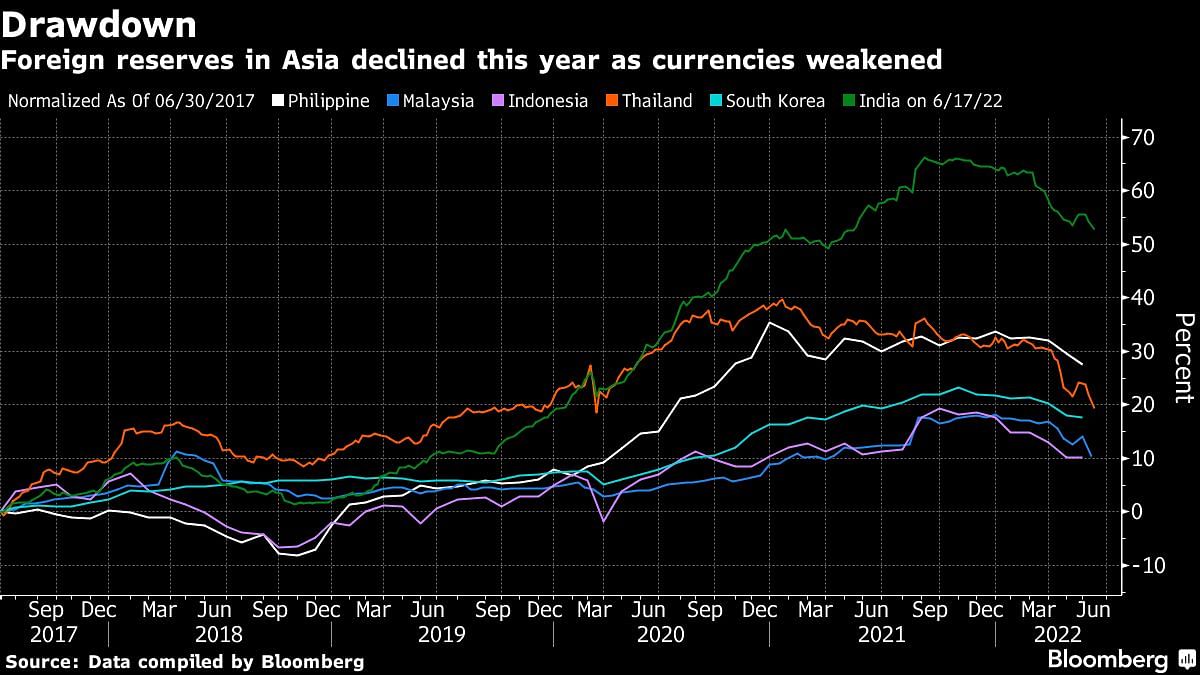

Phillipines [Manila]: After years of building their foreign-exchange reserves, central banks in Asia are tapping into their stockpiles to bolster their weakening currencies against a rising US dollar.

Thai reserves slid to $221.4 billion as of June 17, in data released late last week. That was the lowest in more than two years. Monthly figures show that Indonesia’s stash is at the smallest since November 2020. Reserves in South Korea and India are at their lowest in more than a year. Malaysia’s stockpile, meanwhile, has fallen the most since 2015.

“Some countries would have used their reserves to stabilize their currencies when moves were excessive,” said Rajeev De Mello, a global macro portfolio manager at GAMA Asset Management in Geneva. “They know that they can’t reverse their currencies’ weakness against the USD, but they can smooth the declines.”

Learning from the 1997 Asian financial crisis, central banks have been accumulating dollars to help defend their currencies during periods of wild market swings.

This year, as the hawkish Federal Reserve boosts the US dollar, central banks have reversed the buying: Thailand and Indonesia are among those which have pledged to reduce volatility in their currencies. The Bangko Sentral ng Pilipinas said it is letting the market determine the peso’s value against the dollar, and is only intervening to curb volatility.

High-yielding emerging-Asia currencies may see little reprieve soon. They may continue to reel on their deteriorating external finances and the risk-off sentiment spurred by the Fed’s tightening moves, according to strategists at Goldman Sachs Group Inc. The US central bank has signaled another big hike in July, with traders pricing a 75 basis-point increase.

Already, regional currencies are hovering at multi-year lows: the Philippine peso on Monday slumped to its weakest since 2005, while the India rupee declined to a record low last week.

“Central banks in Asia tend to ‘lean against the wind’, using FX interventions to smooth exchange-rate adjustments,” said Frederic Neumann, co-head of Asian economics research at HSBC Holdings Plc. “A trend reversal requires far more: a broader pull-back in the US dollar that may only begin to set in once investors can make out more clearly the end of the Fed tightening cycle.” —Bloomberg

Also read: Russian coal seeks new market in India as war upturns previous commodity flows