Thirty years on, still no spring for the Pandits

Amitabh Mattoo| Professor at Jawaharlal Nehru University

The Hindu

Mattoo starts off by stating that the promise and possibility of Kashmiri Pandits returning to the Valley is just as elusive as it was in 1990. He notes the recent changes that have taken place in the Valley, including the scrapping of Article 370 and restructuring of the state and writes that neither increase the possibility of a homecoming for Pandits.

Talking about the sense of loss that the Kashmiri Pandits experienced, Mattoo writes, “Returning home then is not just about atavistic roots of longing, but as much about reclaiming an intellectual space of belonging.” He adds that for liberal thinkers and analysts the exodus of Kashmiri Pandits became part of the larger tragedy in Kashmir, while the community itself struggled, adapted, built new lives, in the midst of adversity.

“Apart from those who live in camps or makeshift accommodation, they are today a model of material success,” writes Matoo but adds that in many ways “the continuing displacement of the Kashmiri Pandits represents not just the continuous failure of successive governments, but is also a stark shortsightedness of the failures of the liberal Indian state. He then recalls how former chief minister Mufti Mohammad Sayeed worked towards a dignified return of Pandits, telling their leadership that “You do not need us. We need you… without the diversity you contributed to the Valley, without our syncretic culture, we are the ones really exiled.” However with his demise those dreams also frittered away. Ending on a sombre note, Mattoo notes that the divide between Kashmiri Muslims and Pandits shows no signs of being bridged anytime soon.

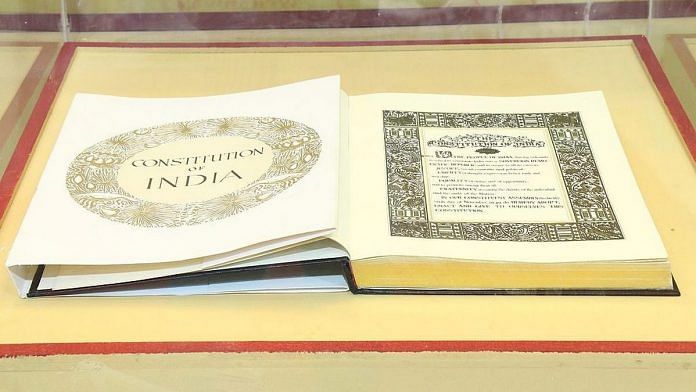

Republic at 70: Greatest strength of India’s Constitution

Raju Ramachandran| Senior advocate

Shankar Narayanan| Advocate

Hindustan Times

The authors state that as the Constitution turns 70, people must not lose sight of one of its greatest strengths, which is its flexibility. They write, “The framers of our Constitution displayed remarkable foresight while drafting its amendment provisions. They were acutely aware that the Constitution they had drafted should neither be too rigid nor too flexible.”

They talk about amendments to the Constitution and its composition and note that the Constitution has seen governments of many shades and hues. “Despite divergences in views on socialism, federalism and secularism, each of these Governments have thought of the Constitution as offering them adequate space to pursue their political agendas,” write the authors.

The authors note that “as the Constitution faces a fresh set of challenges from a government with a large majority in Parliament, the doctrine which posits that federalism and secularism as they find expression in our Constitution are unalterable, may yet come in handy.”

Why India needs many Modis

Sangeeth Varghese | Management Consultant

The Times of India

Varghese states that in 2014 many people were willing to give Narendra Modi their vote as he presented a definite message and promised better times, as India was going through a period of uncertainty from 2012-2014. He goes on to list three reasons why Modi won the confidence of so many people. First, people prefer certainty to uncertainty. Second, “a set of people with more of their religious and caste skin in the game, realised that Modi is the messiah enabling their redemption of historical wrongs”. And finally, big businesses used “their power and money to manipulate and actuate the opinions of the ‘have-nots’.”

However as time has passed, many have realised that it was not correct to give one person disproportionate influence, writes Varghese. This was exemplified in the fact that “complex economic and social challenges were treated with utter callousness in chambers that echoed and confirmed a single voice of command.”

Varghese then goes on to state the problems with the “great man idea”. He notes that leadership is a shared endeavour as opposed to a single individual acting and thinking in isolation. Using the example of the Citizenship Amendment Act, Varghese states, “Modi and his party would enjoy the benefits, while for those with divergent views, this cost is high or even unbearable, which is the reason many are hitting the streets in protest.”

He concludes by saying, “If a leader does not carry along with him a set of other leaders with divergent views and diverse perspectives, the shocks and costs would eventually weigh all the benefits down.”

The truth about the Trump economy

Joseph E. Stiglitz | Nobel laureate in economics, University Professor at Columbia University & Chief Economist, Roosevelt Institute

Business Standard

Stiglitz argues that US President Donald Trump “deserves failing grades not just on essential tasks like upholding democracy and preserving our planet” but “he should not get a pass on the economy, either”.

He first points out the dramatic declines in health during Trump’s presidency comparable “to the dismal state of the post-Soviet Russian economy”. He writes that Trump’s administration brought “tax cuts that disproportionately benefit the ultrarich and corporations” and missed the mark on spurring investment. This meant that the US “borrowed massively abroad”. Foreign borrowing increased more than 10 per cent in America’s net indebtedness position in one year alone, observes Stiglitz.

Stiglitz also points out that “despite Trump’s vaunted promises to bring manufacturing jobs back to the US”, the increase in manufacturing employment and the “pace of job creation” is still lower than it was under Barack Obama.

Sitharaman should fix the tax system to boost confidence

Niranjan Rajadhyaksha| Academic board member, Meghnad Desai Academy of Economics

Mint

Rajadhyaksha points out a set of three problems that have emerged from India’s “GST tangle”, which is so complex it “almost defeats the purpose of the national value added tax”. He argues that given the current slowdown, “market fears about fiscal profligacy” can be first assuaged by “a commitment to fix the tax system”.

Rajadhyaksha notes that 49 countries have a single-rate GST, 28 countries have two rates and only five countries have four rates other than zero, including India. “Federal bargaining that preceded the launch of the new tax” could be the reason for this, he adds.

The first problem borne out of the “haphazard rationalization of the GST structure” is an unstable system that calls for “a proper roadmap to transition to a more efficient GST”, he writes. The second is an “inverted tax structure” which can be solved with a 12 per cent “GST rate on all capital and intermediate goods”, he adds. Third, the complex GST structure has effectively brought the tax rate below what the “finance ministry had accepted as the revenue neutral rate”. “This requires more careful study by fiscal economists at a time when the Indian economy has lost momentum,” he adds.

Making Budget numbers relevant

Nikhil Gupta| Chief economist, Motilal Oswal Financial Services

Financial Express

Gupta argues that the only expectation from Budget FY21 “is to bring back the relevance of budgeted numbers by introducing public sector borrowing requirement (PSBR)”. PSBR includes both the central government’s planned borrowings and (net) borrowings of central public sector enterprises (CPSEs).

The argument that the central government should relax the fiscal deficit target and go ahead with spending about 1 per cent of GDP on infrastructure investment “is totally faulty”, writes Gupta. This is because the government’s true investments are “double of the reported numbers” and the adjusted deficit is higher than 4 per cent of GDP, he observes. “Additional borrowings are, therefore, likely to tighten financial markets further”.

Gupta points out that CPSEs like the National Highways Authority of India and the Indian Railway Finance Corporation “have borrowed off-the-budget”. This suggests the fiscal deficit was 6.3% of GDP, not the “reported 3.4% in the Union Budget”, he adds. This also means that “if CPSEs have become so important, then the Budget numbers are increasingly losing their relevance”, argues Gupta. “Shifting away from cash to accrual-based accounting would help streamline this change,” he concludes.