New Delhi: The US’ decision not to renew the waiver given to eight countries on importing crude oil from Iran is likely to have more of a strategic impact on India than economic.

The US had announced in November last year that it would grant a waiver for six months to China, India, Japan, South Korea, Taiwan, Greece, Italy and Turkey, which would allow them to continue their import of crude oil from Iran. The waiver, known as ‘Significant Reduction Exceptions’, was given to these countries so as to avoid a knee-jerk reaction by way of sudden change in supplies and surging oil prices, because they depend heavily on Iranian oil.

The waiver allowed India to buy almost 300,000 barrels of oil per day from Iran, according to Bloomberg data. India is the second-biggest buyer of Iranian crude, with purchases reaching 290,000 barrels per day in April.

However, the Trump administration now wants to stop these imports entirely. Barring China and India, others have already brought their down purchases to almost zero. The US has said if these counties continue with their imports, they will be subject to penalties.

Also read: India unlikely to stop oil import from Iran despite US move to end waivers

Why did US impose sanctions on Iran?

In May 2018, the Trump administration walked out of the Joint Comprehensive Plan of Action (JCPOA), also called the Iran nuclear deal, which was signed by the Obama administration in 2015, along with UK, France, China, Russia and Germany. However, Trump walked out of it as he found it inadequate and lacking in teeth to stop Iran from pursuing its nuclear ambitions.

Then, in November last year, the US imposed sanctions on Iran, which were followed up with a new set of restrictions again in March. It declared Iran’s Revolutionary Guards a foreign terrorist organisation. US Secretary of State Mike Pompeo said the main objective of the US is to “deprive” Iran of funds that President Hassan Rouhani’s regime has utilised to “destabilise” the region.

How does it impact India?

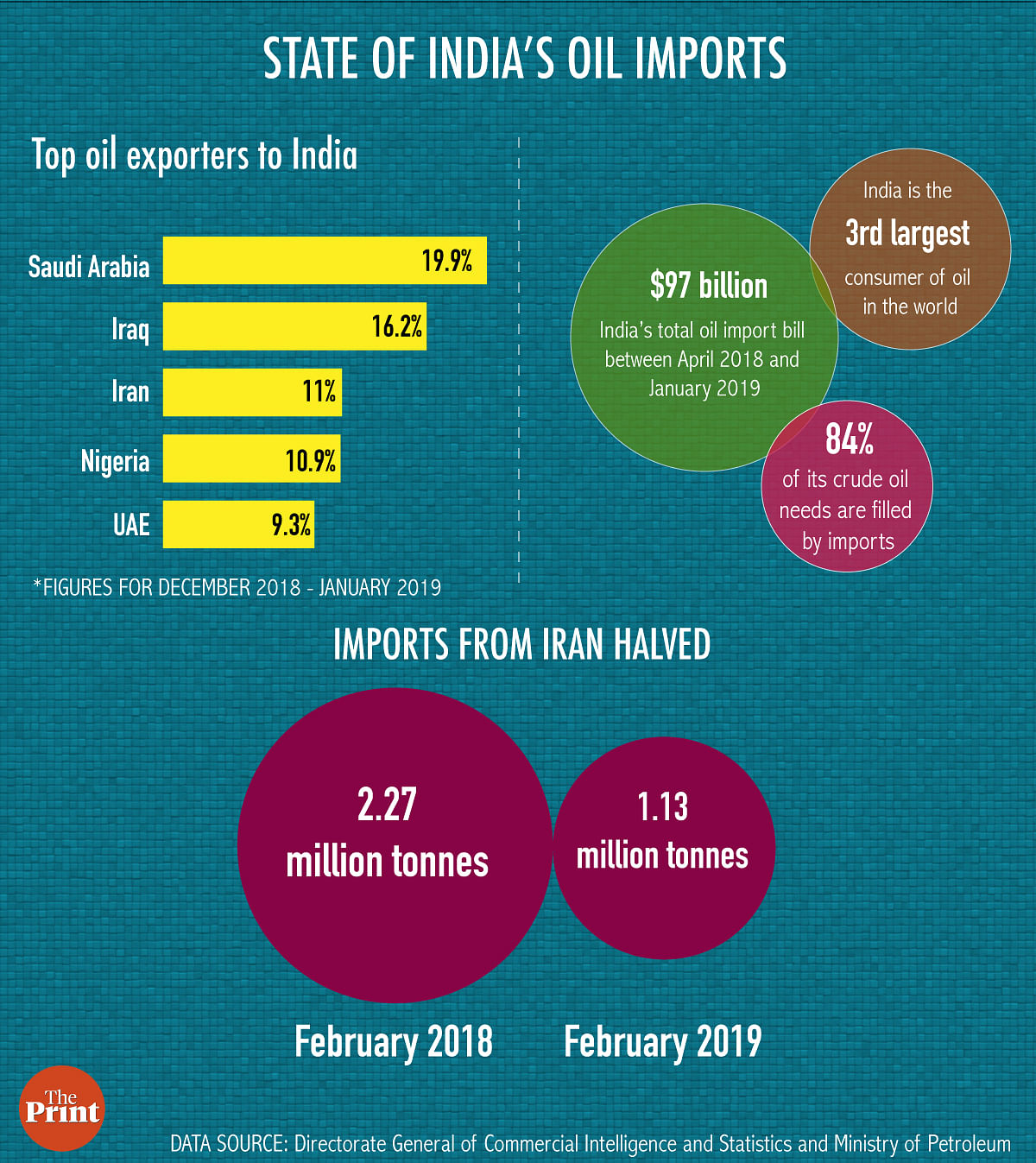

Between April 2018 and January 2019, India imported oil worth $97 billion. Imports accounted for about 84 per cent of the country’s oil consumption.

At present, Saudi Arabia is India’s biggest source of oil, followed by Iraq. Together, they account for 38 per cent of India’s imports.

Iran remains an important supplier, despite the fact that India has reduced its import of Iranian oil by 50 per cent compared to last year — according to the latest data from the Directorate General of Commercial Intelligence and Statistics (DGCIS), India purchased 1.13 million tonnes (MT) of oil from Iran in February 2019, compared to 2.27 MT in the same month last year.

A big factor behind this is that local and international shipping companies have refused to carry Iranian cargo to India due to restrictions put in their delivery contracts.

When the US granted a waiver to India, there was a tacit understanding that it may be renewed owing to New Delhi’s strategic ties with Tehran. But now, in order to avoid penalties from the US, India may have to look for alternative markets to make up for the oil it sources from Iran.

The US has also imposed sanctions on Venezuela owing to civil disturbance, which makes it a double whammy for India. The South American country is another important crude oil exporter, from which India sourced 620,000 barrels per day in February 2019.

Taken together, India imports about 18 per cent of all its oil from Iran and Venezuela. To make up for this, it would need to ramp up its purchases from Iraq, Saudi Arabia, African and Latin American countries and the US. However, if the US implements its announcement with full force, it could put pressure on oil prices.

Also read: US pressure forces Reliance to cap its oil purchases from Venezuela

What does the US want?

The US is now pushing India to buy more of shale oil, which is extracted from rocks and is regarded as the precursor to crude oil, which comes in liquefied state. With the export of shale oil globally to many countries, the US has gone from being one of the largest importers of oil to becoming a net exporter of crude oil and oil products. It plans to address half of Asia’s oil needs by selling shale oil to this oil-thirsty market.

What happens next?

India has said it is studying the impact of the US decision, but it will be difficult for it to stop all imports from Iran because New Delhi enjoys a robust strategic relationship with Tehran. India has invested $500 million in Iran’s Chabahar Port project, which is seen as India’s answer to Pakistan’s Gwadar Port that has been built with the help of China.

India is also building rail and road links connecting Chabahar. Iran also acts as India’s gateway to the Central Asian markets.

During the visit of President Rouhani to India in February 2018, both sides had agreed to establish an international transport and transit corridor, along with Afghanistan. Prime Minister Narendra Modi and President Rouhani had also vowed to build a north-south transport corridor under the Chabahar framework.