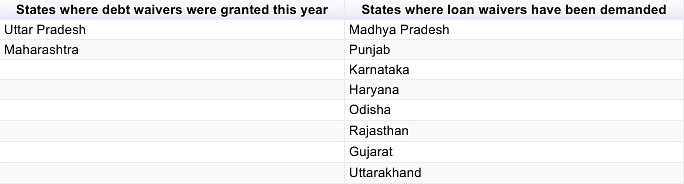

Maharashtra Chief Minister Devendra Fadnavis has finally cleared a Rs 30,500 crore debt waiver for farmers, but has been told by the Union finance minister to figure out how to fund it. Uttar Pradesh has also handed one out. Madhya Pradesh has ruled one out. And there are demands for it in multiple states.

Here’s a quick round-up of where each of the states stands on the issue of debt waivers:

But then farm debt waivers are hardly new to India, here’s a look back at some of the loan waivers granted over the years.

What economists have had to say about it

Economists have been criticising such broad debt waivers for some time now.

In response to the debt waiver announced by Uttar Pradesh chief minister Yogi Adityanath, RBI Governor Urijit Patel said in April that such waivers were a “moral hazard” to society.

“Crowding out of private borrowers as the government borrows most of the available funds, increases the cost of borrowings,” he said.

Chairman of National Bank for Agricultural and Rural Development (NABARD) Harsh Kumar Bhanwala had a similar assessment.

“Debt waivers create a moral hazard from a credit repayment perspective and we cannot have omnibus waivers,” Bhanwala said in April.

Bhanwala also pointed out that every time this kind of debt waiver was announced it was tax payers who have to bear the brunt of it.

According to a 2015 World Bank blog post, the problem lies with drafting the debt relief policy. It points out that the moral hazard cost of debt relief is fueled by the future government interference in the credit market and is likely to be severe in the environments with weak legal structure and a history of politically motivated credit market interventions.

A working paper published by ICRIER in June 2015 said that “generalized loan waivers, which have been announced by governments from time to time, constitute a moral hazard and seriously impair the system as far as agricultural credit is concerned.”

The report said:

“Such waivers create expectations of future waivers of loan or interest payments and are a disincentive to pay back loans that farmers have obtained in the past. Expectations of rising defaults have led financial institutions to scale down their lending operations. General waivers have the potential to trigger a cycle of events that could dry up the channels of institutional credit.”

The report said that in order to improve the effectiveness of waivers, a case-by-case examination must be conducted in order to reduce agricultural distress. The report also recommended that generalized waivers must be avoided. But most state governments presently don’t seem inclined to heed to such advice.