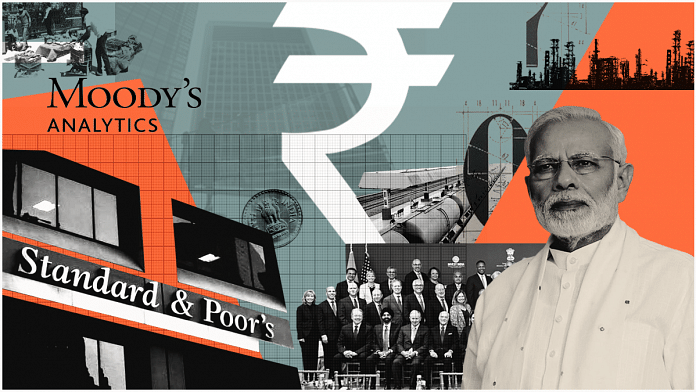

S&P Wednesday retained India’s sovereign credit rating at “BBB-” with a stable outlook. This comes as a relief to the Narendra Modi government after last week’s downgrade by Moody’s, citing weak implementation of economic reforms since 2017 and relatively low growth. Fitch Ratings has said that the Indian economy is likely to recover with a growth rate of 9.5 per cent next year, if it can avoid further troubles in the financial sector.

ThePrint asks: S&P, Moody’s: Are ratings relevant in uncertain economy or needed to keep govts in check?

Ratings are disciplinary devices. They don’t become irrelevant during downturns or recessions

Ajit Ranade

Ajit Ranade

Economist

The job of a sovereign rating agency is to convey to investors the sustainability of a country’s debt and the deficits. Such ratings do not become irrelevant during downturns or recessions. Since government-provided fiscal stimulus is critical to revive the economy, it is equally important for the rating agencies to evaluate the former’s ability to meet current and future debt obligations.

Since India’s currency is not an international reserve currency, it doesn’t have the flexibility of a country like the US, which can literally print its way out of a recession and borrow internationally. Thankfully, India’s sovereign has almost zero dependence on foreign money, and its debt is mostly internal and in domestic currency. This considerably reduces the risk of sovereign default. India’s sovereign debt is like the left pocket owing to the right pocket. Or the present generation owing to the future unborn generation.

Rating agencies are like disciplinary devices to keep fiscal profligacy in check. Some countries have even gone to the extent of imposing legislative limits on fiscal deficits so that the spending does not go out of control and the debt doesn’t become unsustainable. For example, India had the FRBM Act passed in 2003, and again a revised one in 2018. Such devices, whether ratings or legislation, help keep government spending in check. A rating downgrade not only affects the sovereign but raises the cost of funding for the private sector as well. Runaway government spending can cause high inflation, crowding out of private investment and ultimately derailing economic growth.

Rating agencies are often behind the curve. They act after the markets have punished a borrower

Ajay Bodke

Ajay Bodke

CEO & chief portfolio manager (PMS), Prabhudas Lilladher Pvt Ltd

Sovereign and corporate credit ratings are important for investors who allocate capital across various jurisdictions and asset classes. It helps them assess the financial stability of various countries and corporates and their ability to discharge financial obligations to lenders. Ratings are, therefore, a kind of ready-reckoner for any investor to start due diligence. For instance, if a credit rating is not investment grade, then many funds might not consider that country as part of their investable universe, because they have a basic threshold. Likewise, there are funds which only invest in bonds rated AA and above and would ignore any corporates rated below that threshold.

One of the charges against credit rating agencies is that they are often ‘behind the curve’. It has been observed that many times rating agencies downgrade/upgrade a rating well after the market has punished or rewarded a particular borrower. It seems that only after the market has exposed the vulnerabilities, do the rating agencies change the outlook. Ideally, ratings should be a leading indicator to sensitise or forewarn investors about emerging financial vulnerabilities and in the case of sovereign ratings even emerging political risks. They are meant to preempt the market but can also end up being a lagging indicator.

In uncertain times, the assessment by rating agencies is all the more relevant for the govt

Radhika Pandey

Radhika Pandey

Fellow, National Institute of Public Finance and Policy (NIPFP)

The assessment of rating agencies should be considered as a feedback mechanism. The agencies give their opinion on the economy based on a number of pre-defined parameters like fiscal health, economic growth, monetary and external conditions, and long-term structural reforms. Their ratings are relative and provide a comparative assessment with other similarly ranked economies. They give an immediate assessment, as well as a statement on a medium-term outlook of the economy. Their ratings and assessments may be used by foreign investors to frame their investment strategy about the economy.

Their latest assessment on India provides a signal that the Narendra Modi government’s actions and reform measures are being watched and commented upon. In an uncertain situation, the assessment of rating agencies is all the more relevant as they may act as a wake-up call for the government to focus on the underlying weaknesses that have repeatedly been identified as pain points.

Even before the Covid-19 pandemic affected the economy, India’s fiscal position was weak. Almost all rating agencies have pointed out its weak fiscal position and reliance on off-budget borrowings as a drag on India’s sustained economic growth. Similarly, the weaknesses in the financial sector have been pointed out as an area requiring policy attention.

Rating agencies provide an opinion on the strengths and weaknesses of the economy. It is the government’s prerogative to decide its priorities in the short and medium term, to bolster the strengths and address the weaknesses.

Views are personal.

Ignore the ratings for now. Healthier businesses will change them soon

Ashutosh Sinha

Ashutosh Sinha

Business journalist

The frenzy and swings of the markets work as a leading indicator of the health of an economy. Ratings work as a lagging indicator. That is why the two needs to be seen in different contexts. In unprecedented times like now, as everyone looks to navigate through the uncertainty, policymakers will always want to keep an eye on the leading indicator.

Providing credit to businesses and driving demand in the economy are more important steps that the Narendra Modi government need to take now. That will keep the wheels of the economy in motion and the market will react to such measures. Market will react to that, not as much to the rating agencies.

In the manner that rating agencies work, the rating is a result of historical data. For example, if the economy has slipped for two quarters, these companies may talk of a review. However, the economy may have bottomed out during that period and policymakers may have taken steps to address the situation.

Credit rating agencies also tend to have a lot of leverage with policymakers since they speak the same language. Markets speak the language of businesses which are spread far wide. Policymakers, sometimes, pat their own backs when markets go up after an announcement, but dismiss the market when it sells off in reaction.

Ignore the ratings for now. Healthier businesses will change the ratings far sooner.

Also read: Yogi vs Uddhav vs Piyush Goyal: Will politics over migrant workers hurt economic revival?

By Pia Krishnankutty, journalist at ThePrint

Rating are relevant because before coming out with results the data considered is huge and analytical tools used are highly sophisticated.

But the accuracy of the forecast can only be as good as the basic prediction which is neither data based nor analytical. i.e HOW LONG WILL THE COVID-19 CONTINUE TO PUT THE WORLD ECONOMY UNDER PRESSURE.

Left pocket owing to the right pocket is too sanguine a view. Indian companies have borrowed large sums abroad. NRI deposits. For that matter, FII investments in the stock market that can reverse overnight. The government developing a taste for foreigners buying its debt. Public debt will soon touch 90% of GDP. Weak state governments are facing demands to pay a higher rate of interest. So far the answer to all these doubts used to be the claim that we were the fastest growing economy in the world. That was never true, of course, but now lies in shreds. 2. The issue is not just about whether sovereign rating agencies matter. Of course, they do, a great deal. It is more that we have created an overarching bubble that insulates us from all the bad news. All sources of countervailing power or wisdom that in a democracy are meant to puncture these gossamer clouds stand enfeebled or eviscerated. With or without the economic effects of the pandemic and the suboptimal lockdown, don’t flirt with danger. Do nothing that takes us into Junk territory.