Even as small traders in India’s vast unorganized sector express their confusion about the new tax regime, their faith in its long-term benefits has not lessened.

with inputs from AADYA SINHA

It is complicated. It is confusing. But the anxieties arising from the implementation of the new tax regime appears to have made little difference to the political opinion of retailers in the national capital.

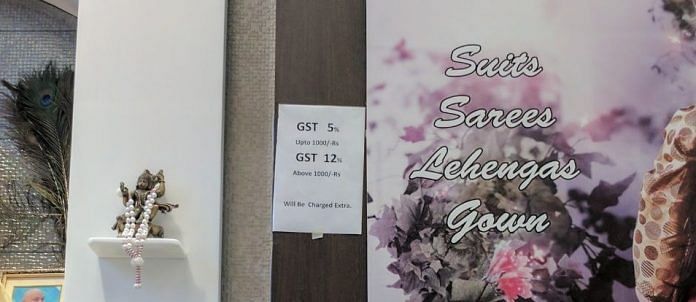

The Goods and Services Tax (GST), which came into effect earlier this month has caused a major disruptive adjustment for India’s vast unorganized sector, which the tax overhaul aims to regularize.

Despite the chaos it has generated in Delhi’s busy markets, the trading community is prepared to wait it out.

Dilip Acharya, 56, who runs a shoe shop in Delhi’s historic Meena Bazaar, admits to problems being caused by the change. “We have no idea about how it’s going to impact business yet, we’re waiting for the information camp planned by the market president at the end of the week to understand the exact details and changes.” He has faith in the central government though, especially the Prime Minister. “If Modiji has planned it, it must be a good decision” said Acharya.

The same confusion prevails among the consumers.

Sangeeta Kumari, 34, a regular customer at Delhi’s Meena Bazaar market said that, “GST has become the ghost that they can’t shake off. Any delay, any price hike is blamed on the GST.” She believes that a severe lack of information has allowed people to take advantage of the new law.

“I worry about the health of businesses. Demonetisation was also chaotic, but it was better planned”, added Kumari, whose husband is a cloth merchant in Chandni Chowk.

Kumari’s concerns mirror those of many clothing retailers who are worried by dwindling stocks in the face of protests and strikes by weavers and suppliers, especially in Gujarat. Protesting the 5 percent GST imposed on cloth, various textile associations have announced an indefinite strike to mount pressure on the government.

Even as many traders are willing to give the government benefit of doubt, others say they are resigned to their fate.

Arvinder Singh, 50, who runs a cloth shop in Krishna Market says: “Now that it has been imposed, we don’t have a choice. Customers still want hand bills, but we’ll have to shift to the computer for billing now.”

Small businessman, Sanawar Khan, 37, was much more vocal in his displeasure. He lamented that business had slowed and he and other businessmen like him did not have enough cash for settling transactions. “I do not have any problem with the government taxing textiles but taxing it in the production phase in the mills is a better option. The present form, in which tax has to be paid at every transaction, is detrimental to small traders” said Khan.

The lack of mechanised billing for hawkers and informal shops seems to be at the heart of the problem for most retailers. Sandeep Kumar Santh (27), who is a vegetable seller in Daryaganj Mandi said that while he faces no issues because vegetables aren’t taxed differently under the new regime, small retailers in the locality are facing major problems.

Many have adapted though, organising camps and discussion sessions around GST. Santh himself plans to buy a book on GST to guide him and his locality through the shift. “My only request would be that, such provisions be made available to everyone,” he said. He credited the government, saying “There is still a long way to go in catching up with the West, but I think this puts us on the right track. There are problems, but I think it will end well”.

Photo: Divya Narayanan