The great rotation in consumer spending continues.

When the world shut down in 2020, we bought what we needed to stay home: Pelotons, pets, sweatpants, and sourdough starter. In 2021, our shopping reflected reopening: We put on lipstick again, whitened our teeth, and swapped loungewear for chinos and dresses. Most consumer, retail, and luxury groups had a pretty good year.

But consumer sectors are now facing another shift in habits, and this one may not be as favorable.

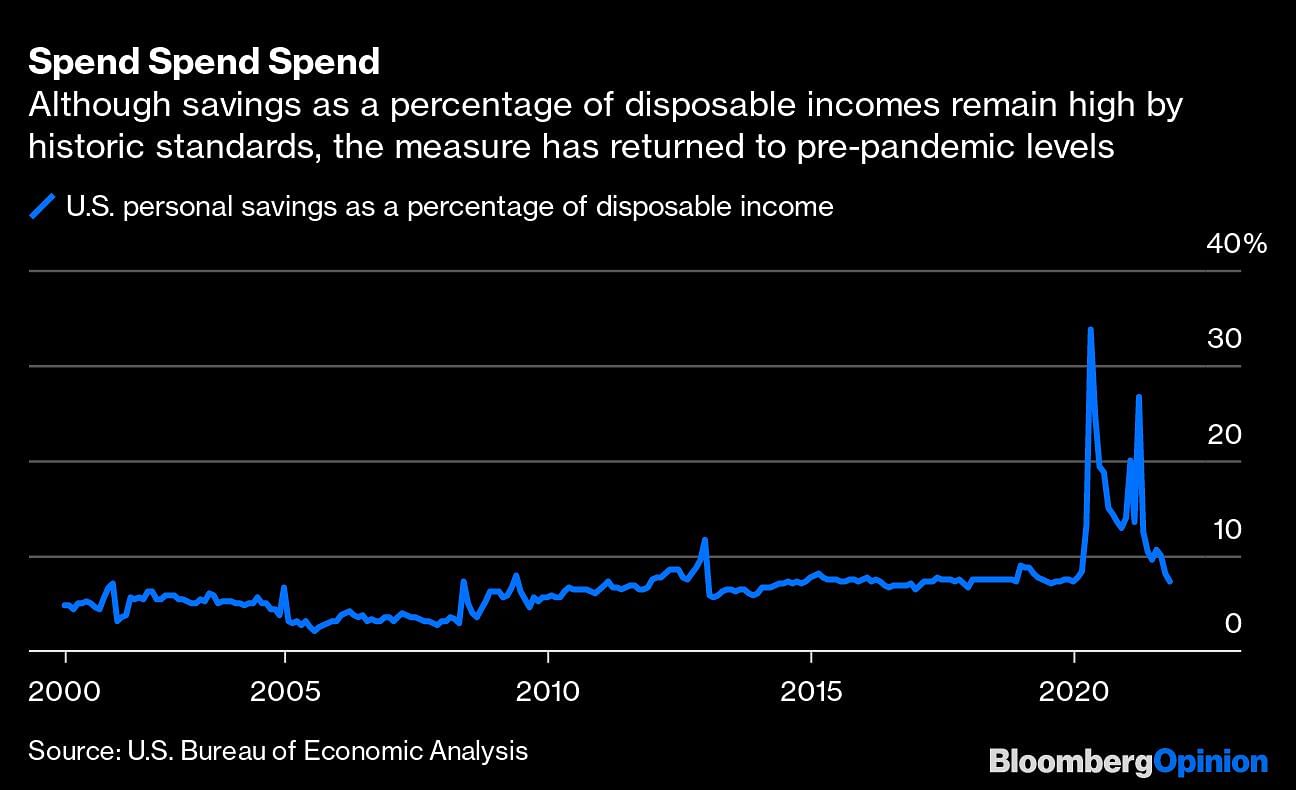

The omicron variant is a headwind for travel, hospitality, and retail. Even if the latest wave of infections peaks relatively soon, there are other perils ahead — from lockdown savings being exhausted just as prices are rising to tighter monetary policy and higher borrowing costs, something consumers haven’t had to endure for several years.

Already, the cracks are beginning to show.

Even before the surge in omicron cases, there were signs of consumers becoming more cautious. British retailer Currys Plc, for example, said demand for its electronics was weaker than expected. And amid fewer people heading into city centers and offices, the famous London department store Harrods brought forward its sales from Dec. 26 (Boxing Day) to Dec. 17. Other metropolitan areas, such as New York City, have also been suffering.

But it’s not just the new variant weighing on shoppers’ minds. U.S. retail sales rose less than forecast back in November. True, some spending may have been pulled forward to October, when many retailers ran special offers and consumers shopped to avoid product shortages. But the real concern is that rising prices have finally begun to take their toll.

Up to now, consumers have been able to withstand accelerating inflation on everything from coffee to coffee tables. Many were flush with savings after being homebound for much of the past two years. But reopening economies drew down that cash.

And now prices are rising at an even faster clip. Most consumer-goods companies are already negotiating price hikes with retailers or will start in January. With inflation coming through in commodities from oil to packaging, that will make for some difficult conversations. It is also likely to lead to further spikes. U.S. food prices rose 6.1% in November, the highest level in 13 years. We could see a similar escalation in Europe.

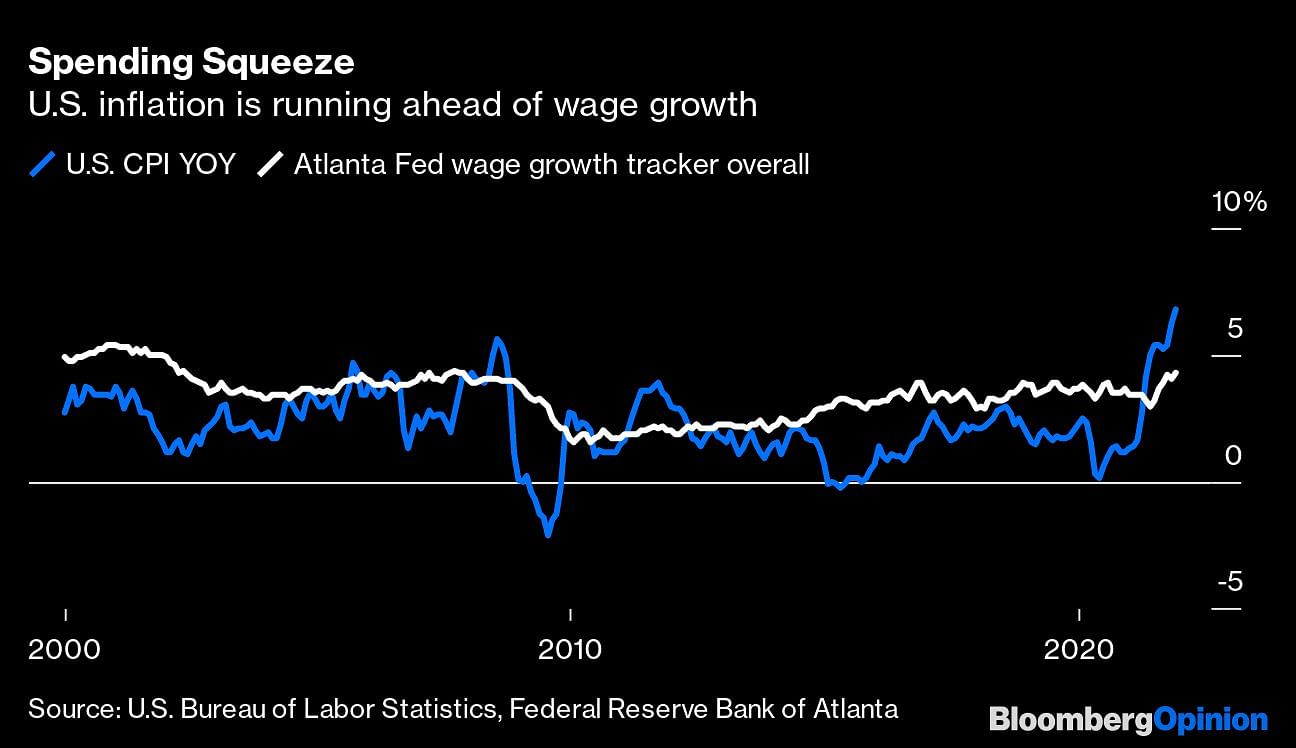

Although wages are increasing too, U.S. inflation is outpacing it by some distance: The gap between the two is the biggest it’s been for more than 20 years.

Some of the caution Currys has seen may reflect a spending squeeze already underway in Britain. After all, a new laptop, iPhone, or oven is a large purchase. In the U.S., Lowe’s Cos. said it expected the pandemic home improvement boom to finally wane.

Many people spent big during the pandemic, especially on new homes. This might be another source of weakness as interest rates rise. Higher borrowing costs are expected in 2022, which could lead Americans and Europeans to pull in the purse strings.

While large, expensive items may be the first to feel the pinch, other areas will eventually suffer too. Consumers have a tendency to trade down from big brands to cheaper private labels, or switch from meat to vegetable-based meals when stressed about their wallets. Cutting back on indulgences that grew during the pandemic, such as ordering takeout, would be another way to save money.

There are some silver linings. Although the arrival of omicron is hurting travel and leisure, it may, in the short term, ease some of the forthcoming consumer pain. Working from home again means saving money on commuting and lunches out. Hopes for a “revenge Christmas” this year — going all out to make up for a bleak 2020 holiday — are already looking fragile, as some people cancel their restaurant reservations and plan to hold large gatherings.

January is always a grim month for retailers, restaurants, and bars. It’s when credit card bills land and trends such as dry January and Veganuary take hold. But this year it could be even more brutal.

It’s a timely reminder that, like stocks, consumer rotations don’t only go one way.—Bloomberg

Also read: 60% Indians ready to spend this festive season, up from 30% at Covid 2nd wave peak: Survey