Last month, the Narendra Modi government opened the insurance intermediary sector to 100 per cent Foreign Direct Investment. The government has also been contemplating opening up the insurance sector to further FDI from 49 per cent to 100 per cent. However, the fundamental problem of mistrust between insurance companies and consumers remains unaddressed.

Even though the insurance sector grew at a compounded annual growth rate (CAGR) of 16.5 per cent from 2001 to 2017, the insurance penetration in India rose by a mere 1 per cent during this period. At the same time, other factors such as sub-par claim ratios among private insurance companies and standalone health insurers as well as a rise in consumer grievances also raise consumer protection concerns. In this situation, the role of India’s insurance regulator — the Insurance Regulatory and Development Authority of India (IRDAI) — is crucial to ensure that the sector’s growth is not at the cost of, but rather to, the benefit of its customers. However, IRDAI’s role in regulating insurance giants and serving customers’ interests has so far not been as desired.

Inefficiency abound

IRDAI has established 17 Insurance Ombudsman’s offices across the country with the objective of providing efficient, cost-effective, and timely consumer dispute resolution. Deriving its powers from the Insurance Ombudsman Rules, 2017, the ombudsman performs both mediatory and adjudicatory functions. The Rules also provide for speedy disposal of cases, within one month for the dispute to be settled through mediation, and within three months where the ombudsman passes an award based on pleadings and evidence on record. It also necessitates that the recommendations and awards be complied within a time period of 15 days and 30 days respectively.

However, factors such as vacant positions and the lack of an efficient enforcement mechanism have disincentivised consumers from approaching the ombudsman office in case of disputes. IRDAI has for long been facing complaints regarding insurance companies not complying with orders and awards passed by judicial and quasi-judicial bodies. The regulator issued a circular on 3 November 2015, advising insurance companies to abide by the order/award within 60 days or file an appeal within 60 days of the order/award. However, this advisory has had little effect on boosting compliance. As non-compliance continues, IRDAI issued another circular on 5 March 2019 to caution insurance companies.

The inefficiency of the regulator raises troubling questions. Reports highlight that the overarching control of India’s insurance companies over ombudsmen structure, administration and management has led to the neglect of consumer interests.

This situation has worsened since 2014, with crippling vacancies in ombudsman offices. All 17 offices of the Insurance Ombudsman remained vacant for the first 4 months of 2018. Even today, 8 out of 17 offices continue to be vacant. The Ahmedabad office has been lying vacant since July 2014 and vacancies in ombudsman offices in Bhopal, Chandigarh, Guwahati, Hyderabad, Ernakulam and Mumbai have persisted for periods ranging from 24 to 46 months.

The situation has deteriorated to such an extent that officials at ombudsman offices in 2017 reportedly advised insurance policyholders to appeal to consumer courts, Motor Accidents Claims Tribunal or high courts instead for dispute redressal.

Also read: 2.77 crore cases pending in India’s lower courts, 25% of them in Uttar Pradesh

Consumer courts clogged with insurance disputes

The inefficient regulation, failure to execute awards and the crippling vacancies not only cast a shadow on the grievance redressal mechanism but also overburden other judicial and quasi-judicial bodies, clogging them with insurance disputes.

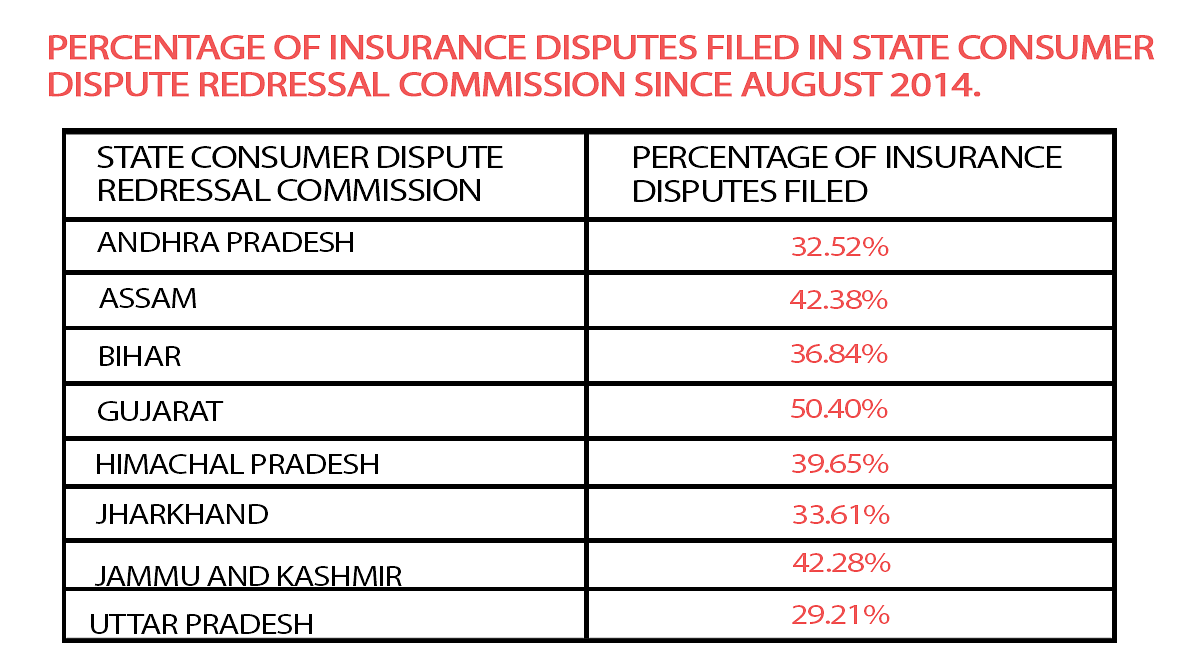

For instance, the Insurance Ombudsman office in Ahmedabad, which has jurisdiction over Gujarat, Daman & Diu, and Dadra & Nagar Haveli, has been lying vacant for the last five years — except 10 months of temporary charge transferred to Insurance Ombudsman, Lucknow. As a direct consequence of this situation, every second complaint filed in Gujarat State Consumer Disputes Redressal Commission and district fora across the state since July 2014 has been regarding insurance.

In Karnataka, out of 10,578 consumer cases pending with the Karnataka State Consumer Disputes Redressal Commission, 5,344 (50.52 per cent) are insurance-based. Such trends can be seen across the country with insurance policyholders queued in front of consumer fora for dispute resolution.

The failure of India’s internal dispute redressal frameworks has led to a delay in resolving cases and an erosion of consumer confidence. Sidelining consumer interest will not help Narendra Modi government’s plan to expand the insurance market and will, in fact, deepen market mistrust.

There needs to be structural changes in the functioning and management of IRDAI in order to prioritise consumer interests. The regulator must provide mechanisms for efficient dispute redressal and hold the insurance giants accountable to the orders of judicial and quasi-judicial bodies, those of including Insurance Ombudsmen.

Also read: Indian society must find ways to hold ‘privileged’ judicial community accountable

As insurance markets penetrate rural India and link basic facilities such as health, livelihood and agriculture, these issues will inevitably snowball, affecting the lives of millions. A flourishing insurance sector might be the crucial link connecting India to the global financial systems. However, consumers must not be neglected in the race to achieve that aim.

The author is a Research Fellow working with the Judicial Reforms and Environmental Law Team at Vidhi Legal Policy, Karnataka. Views are personal.