If oil producers were hoping for a quiet 2022, they may be disappointed. There are two very different schools of thought emerging on what the oil market is going to look like this year. The one thing they agree on: It’s not going to be serene.

The bears see supply running ahead of demand, rising inventories and the OPEC+ producer group perhaps needing to consider another round of output cuts. The bulls focus on low stockpiles, dwindling spare production capacity amid a dearth of investment, and the prospect of triple-digit prices before 2022 is out. Unless demand growth slows dramatically, the latter argument looks more convincing.

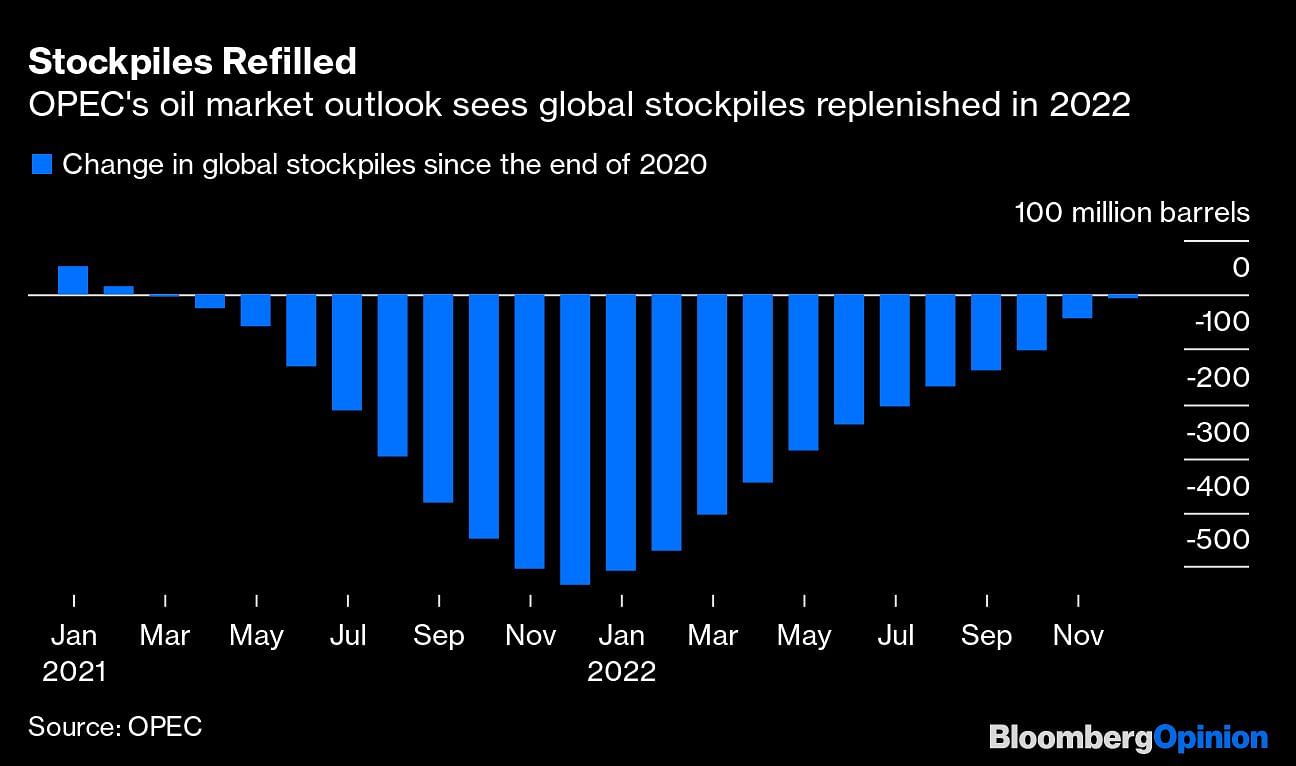

The analysis presented to the producer group ahead of its meeting last week showed global oil stockpiles building throughout the coming year, wiping out virtually all of the draws seen in 2021.

The build isn’t based on a gloomy outlook for oil demand. Far from it. In their base case, they see global oil use surpassing its pre-pandemic high to average almost 101 million barrels a day in 2022, exceeding 103 million barrels a day by December.

There are huge uncertainties around demand in the face of the Covid-19 omicron variant, but evidence from the past month suggests that, while it is more transmissible than previous strains, it is resulting in far fewer hospitalizations — particularly among those who have been vaccinated. In the week to Dec. 29, 74% of people with a confirmed omicron infection admitted to hospital in England from an emergency department had not had the recommended three doses of a vaccine, including 25% who were completely unvaccinated, according to the BMJ.

Some countries are already starting to roll back restrictions that were put in place in December, boosting the potential for more long-haul flights and robust oil demand growth in the coming months.

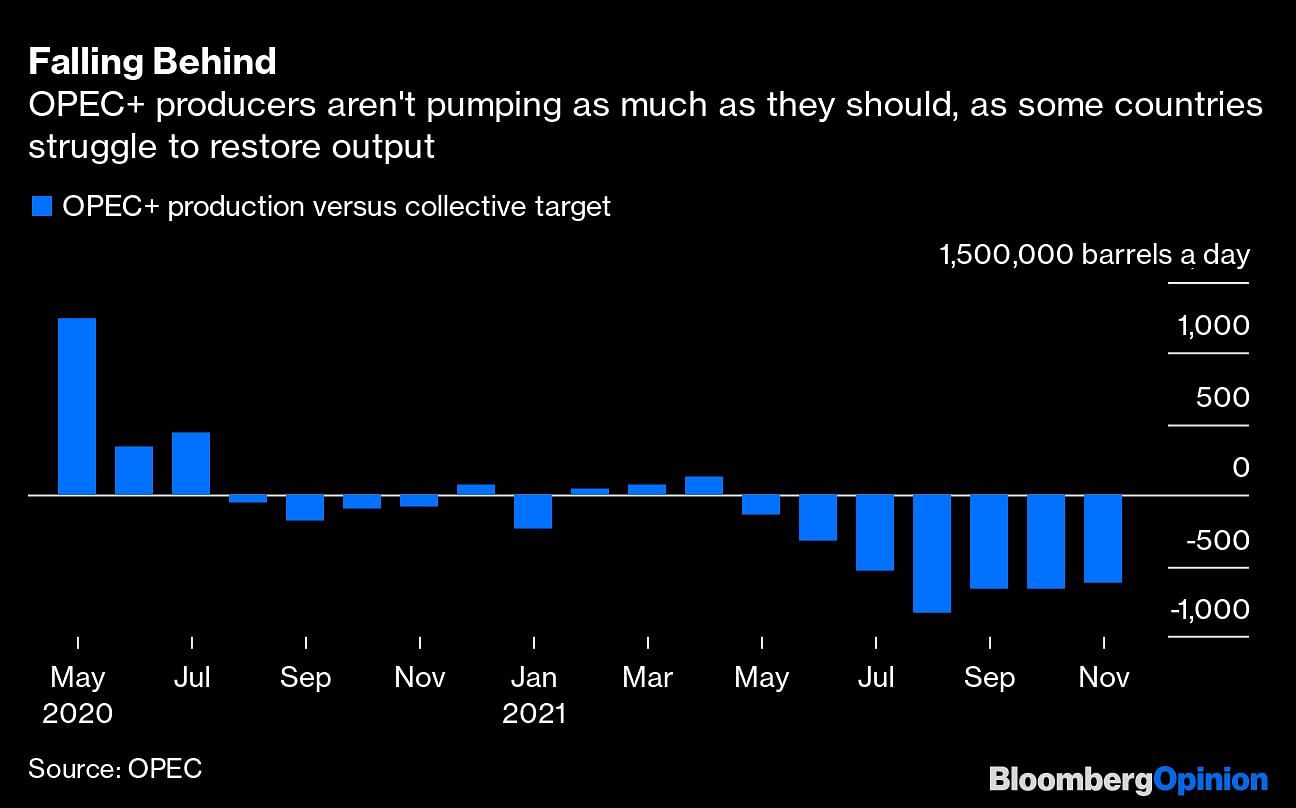

The potential oil market weakness comes from rampant supply, which OPEC sees exceeding 104 million barrels a day before the end of the year. As I have pointed out before, though, there are real problems with this forecast, because it assumes that the 19 members of the OPEC+ group who have output targets will actually pump at those rates. But they aren’t, and many of them can’t.

In December, the group pumped 625,000 barrels a day below its collective target, a slight improvement on the 655,000 barrel-a-day deficit in November, but a seventh straight month in which the group has fallen short of its target.

That gap’s not going to close any time soon. In fact, the deficit won’t ever be recouped unless those in the group with spare capacity are allowed to make up the production shortfalls of those without. This seems unlikely. The deficit is only going to get bigger as the target continues to rise by 400,000 barrels a day each month, which the OPEC forecast assumes it will. That means that the supply won’t be anywhere near as big as feared, or hoped for, depending on your point of view.

And, as the bulls argue, stockpiles are already low. Commercial oil inventories in the economies of the Organisation for Economic Cooperation and Development were 174 million barrels, or 6%, below their corresponding average 2015-2019 level at the end of October, the last month for which figures have been published.

While rising production from OPEC+ is likely to narrow that gap, it will simultaneously erode the world’s spare capacity available to meet unexpected supply disruptions. And those disruptions are already appearing.

Libya, which successfully maintained a production level above 1 million barrels a day throughout 2021, was hit by the closure of the pipeline from its biggest oil field by the people who are supposed to guard it and the need for urgent repairs to one of the lines serving its largest export terminal. The repairs were completed quickly, but the country’s output remains more than 25% below last year’s level.

While the United Arab Emirates, Saudi Arabia and Iraq are all able to pump beyond the baseline levels used to measure their output cuts, they are probably the only members of the OPEC+ group that can do so.

By the time all the output cuts have been restored — due to happen by September — all the world’s spare oil production capacity will be held by those three countries and may not amount to much more than 2.5 million barrels a day, or 2.5% of global demand. That’s a very thin buffer by historical standards and one that’s going to feed the bullish market outlook. –Bloomberg

Also read: Airlines are going to need big data to recover from Covid