The Reserve Bank of India (RBI) Monday released its annual report on states’ fiscal health. The report shows that the fiscal performance of states has seen a visible turnaround since the pandemic-hit year.

The gross fiscal deficit is estimated to decline from 4.1 per cent of GDP in 2020-21 to 3.4 per cent in 2022-23 though there are wide inter-state variations. Gujarat has budgeted a fiscal deficit of 1.7 per cent of GDP, while Himachal Pradesh has budgeted its deficit at 5 per cent for 2022-23.

States’ favourable fiscal outlook is driven by high growth in revenue receipts and higher devolution.

Stable collections from States goods and services tax (SGST) and tax devolution from the central government on account of higher buoyancy in direct taxes have contributed to growth in tax revenues. While allocation to capital spending by some states has seen a big jump, the actual spending on capex is muted in the first eight months of the current year and needs to pick up.

States have exhausted a lower proportion of their budgeted fiscal deficit in the first half of the year. This gives them greater fiscal space to spend in the remaining months of the current year. While overall, states’ fiscal outlook has improved since the pandemic, the RBI report highlights some areas of concern.

Also read: Why India’s critical textile sector, employing 4.5 crore people, is facing challenges

Higher allocation to capex but actual spending needs to pick up

Capital expenditure by states recorded an impressive growth of 31.7 per cent in 2021-22. Strong growth in revenue collections as well as enhanced transfers from the central government gave the states the required space to accelerate capital expenditure.

In the current year (2022-23), states’ capital expenditure is estimated to grow by 38.4 per cent over the provisional accounts of 2021-22. However, the actual capital spending by the states registered a year-on-year growth of 0.9 per cent in April-October 2022.

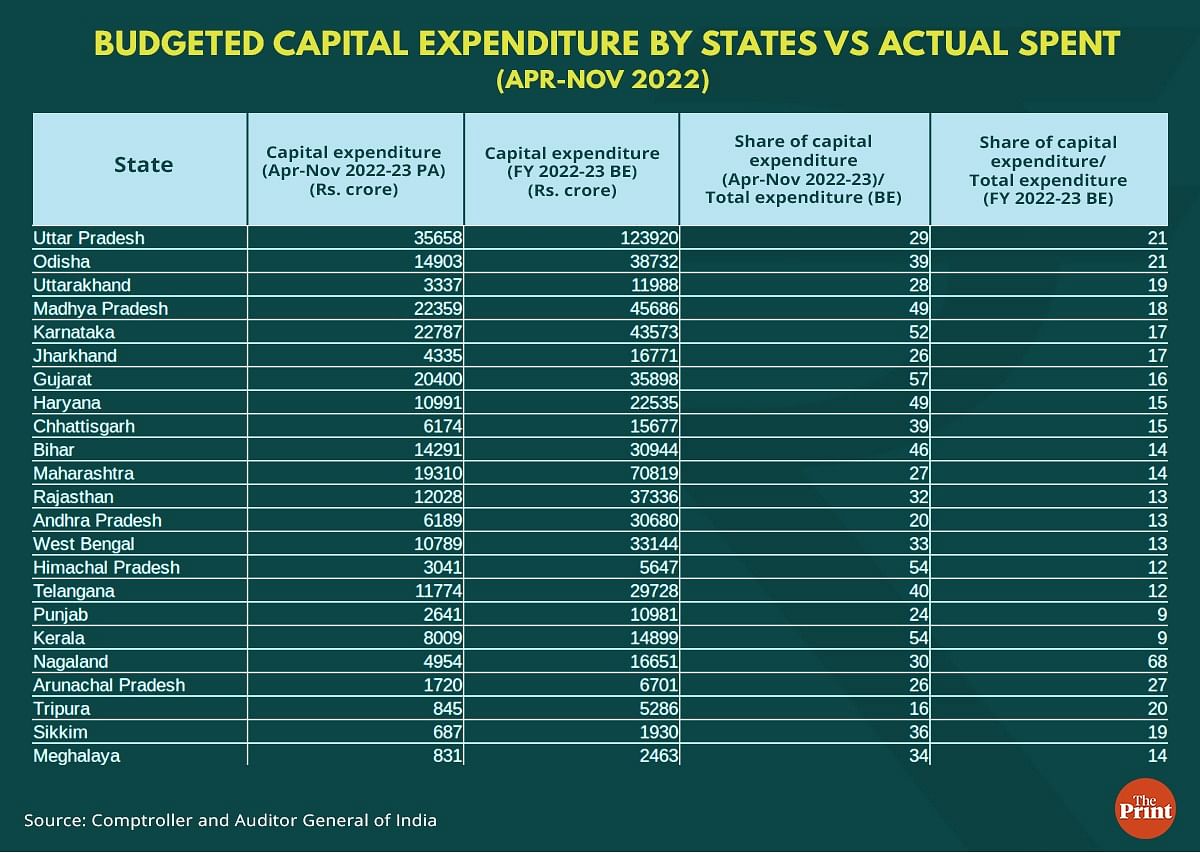

There are inter-state variations in capital spending. For instance, for the current year, Uttar Pradesh had budgeted Rs 1.23 lakh crore on capital spending. This accounts for 21 per cent of the total budgeted expenditure and is one of the highest allocations on capital spending made by states.

However, the actual amount spent till November is less than Rs 36,000 crore. This implies that around 29 per cent of the budgeted capital expenditure has been spent.

In contrast, Maharashtra has allocated only 14 per cent of its total expenditure on capex. In the first eight months (April-November, 2022-23), Maharashtra strikingly has a fiscal surplus, still the spending on capex is just 27 per cent of the budgeted amount in this period. Given that the state has a fiscal surplus, it would have been desirable if it would have front-loaded spending on capex. Punjab and Kerala are the states with the lowest allocation towards capex.

The government launched a scheme for special assistance to states for capital investment. Under this, an amount of Rs 1.07 lakh crore has been allocated and financial assistance is provided to states in the form of 50-year interest-free loan for capital projects. Till December 2022, Rs 77,109 crore has been approved but less than Rs 42,000 crore has been released to the eligible states under the scheme.

While states are expected to step up capital expenditure in the second half, the expenditure pattern of past years shows that they do not spend the full amount of budgeted expenditure, despite having sufficient resources.

States do not have the capacity to ramp up capital spending quickly. Also, to demonstrate fiscal prudence, states tend to scale back capital spending while retaining focus on committed expenditure. The RBI report while emphasising on the need to mainstream capital spending proposes setting up of a capex buffer fund during times when revenue flows are robust to maintain expenditure during economic downturn.

Discrepancies between budget estimates, revised estimates and actuals

Each government puts out three estimates of revenue, expenditure and deficits during a year — the budget estimates (BE), which are the planned estimates for the year at the time of the budget; the revised estimates (RE), which tells how much the budget was revised from the BE; and finally, the actuals.

Some variation between BE, RE and actuals is inevitable given that the revenue and expenditure projections are made at the start of the year. However, if there are vast discrepancies, it reflects errors in assumptions and reduces the credibility of the numbers.

The RBI report shows that for some states, particularly Bihar, Uttar Pradesh and Chhattisgarh, the RE presents an overestimation for spending but the actuals are pulled down due to unutilised spending. The RE, which are released alongside the budget of the next year, should be closer to the actuals.

Wide variations between these estimates indicate errors in forecasting. The variations may also be on account of unexpected events. These variations reduce the reliability of RE (a keenly watched number) in assessing the fiscal health of states.

Borrowings remain elevated

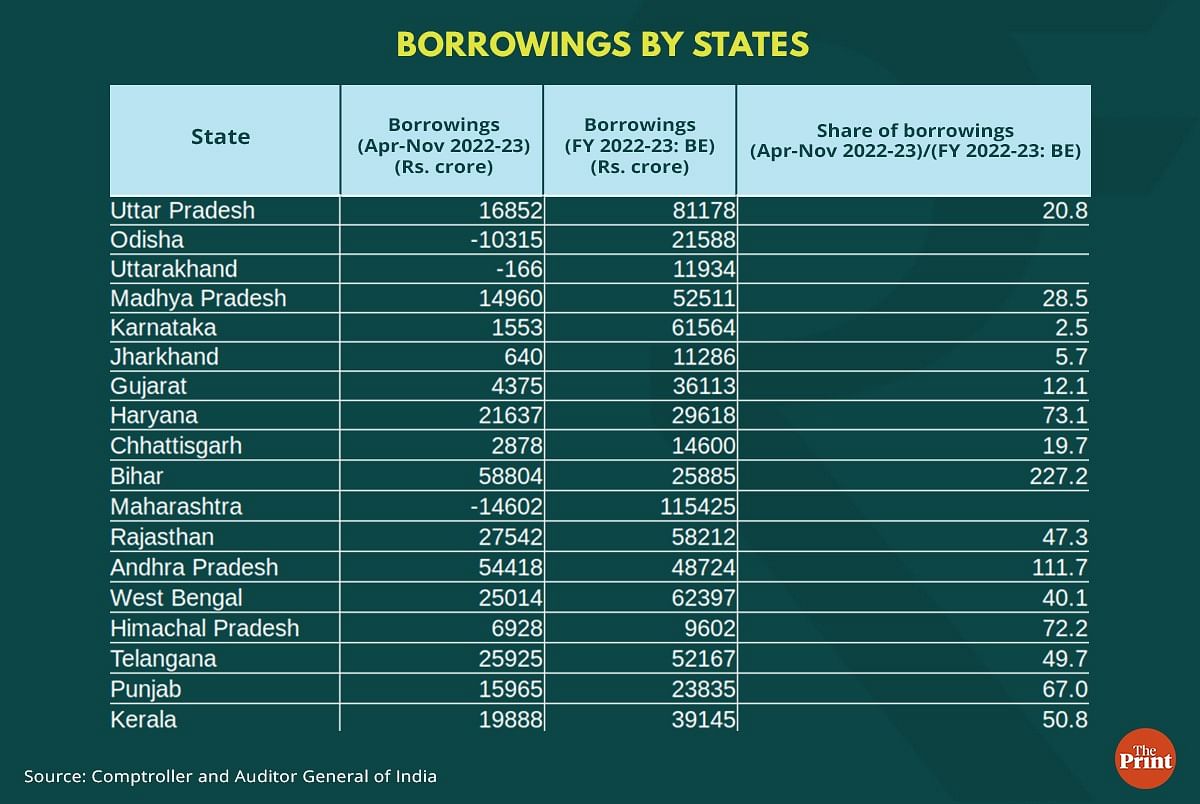

States’ debt-to-GDP ratio ratio surged to 31.1 per cent in the pandemic hit year. It is estimated to decline to 29.5 per cent in the current year. The Fiscal Responsibility and Budget Management review committee, headed by N.K. Singh, had recommended a debt-to-GDP ratio of 20 per cent for states.

The borrowing trends of the current year reflect wide inter-state disparities. For example, Uttar Pradesh has exhausted roughly 21 per cent of its budgeted borrowings in the first eight months of the current year. Given that it has allocated 21 per cent towards capex, the state has headroom for borrowings to finance its capital spending in the remaining months. States like Punjab, Kerala, Himachal Pradesh, Andhra Pradesh have exhausted substantial part of their borrowing targets during April-November.

Reversion to old pension system poses a risk to states’ fiscal performance

Reversion to the old pension system by some states poses a new source of risk to the fiscal health of states. In the early 2000s, there was a growing realisation that the old pension system was unsustainable. The net present value of the pension promises to civil servants (and pensioners) added up to about 60 per cent of India’s GDP. Growing concerns around unsustainable pension liabilities led to the design of the new pension framework.

Some states, such as Rajasthan and Chhattisgarh, have chosen to revert to the old pension system. The report points out that this risks the accumulation of unfunded pension liabilities in the coming years. Instead, focus should be on expanding productive capacities through enhanced capital spending.

Radhika Pandey is Senior Fellow at National Institute of Public Finance and Policy.

Views are personal.

Also read: What do the latest GDP estimates for 2022-23 tell us about the health of the Indian economy?