The Union Budget 2023-24 has tried to strike a balance between the imperatives of fiscal consolidation and boosting growth. The twin boosters of higher capex outlay and moderation in income taxes for the middle class are big positives at a time when global headwinds are expected to slow down growth. This has been done without losing sight of fiscal consolidation.

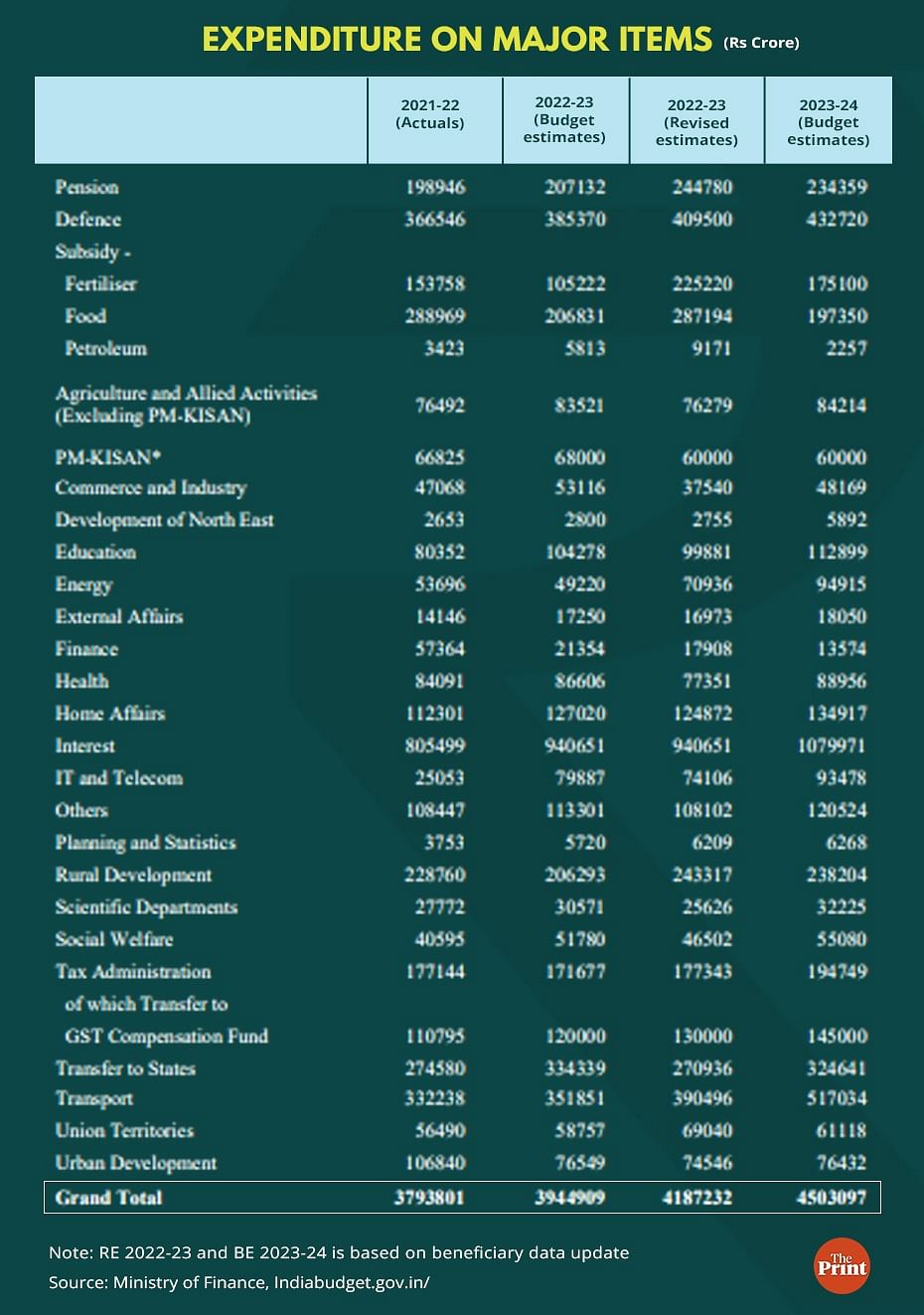

Impetus towards tourism, housing and urban infrastructure in small towns will help in generating employment opportunities. On the expenditure front, while the rationalisation in food and fertiliser subsidy is a welcome development, the cut in the allocation for the rural jobs guarantee programme may require an increase in the coming months.

Boost to capital expenditure

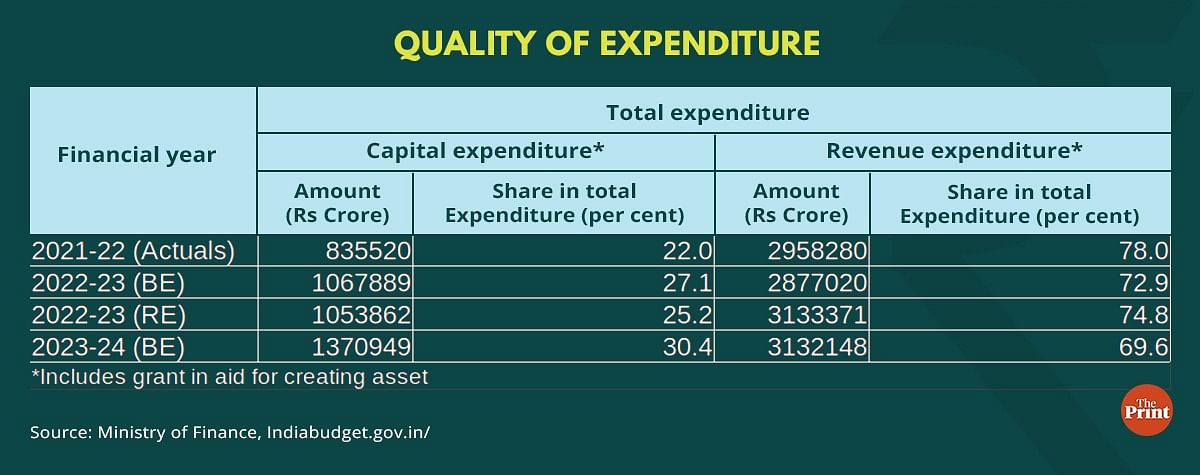

The allocation of Rs 10 lakh crore for capital expenditure is a welcome move at a time when private investment recovery is still uneven. With this enhancement, capex outlay has reached 3.3 per cent of GDP. This is also reflected in the quality of expenditure. The share of capital expenditure (including grants in aid for creating assets) in the total government expenditure is budgeted to increase to 30.4 per cent in 2023-24 from 25.2 per cent in 2022-23.

In another boost to infrastructure, the budget has proposed an urban infrastructure fund of Rs 10,000 crore. The fund will be managed by the National Housing Bank and will be used for the development of urban infrastructure in tier 2 and 3 cities. This will indirectly support employment generation in small cities.

States have also been incentivised to boost capital spending. The 50-year interest free loans to states has been continued for one more year with an enhanced outlay of Rs 1.3 lakh crore. While the central government has been fast-tracking capital expenditure, states are seen to be slow in capital spending. In addition to enhanced allocation, they need to step up their administrative capacity to expedite capital spending.

Steps to spur domestic consumption

The budget aims to spur domestic consumption at a time when external demand is likely to remain muted due to the global headwinds. This has been done through rationalisation and simplification of the personal income tax under the new tax regime.

The new tax regime was introduced in 2020 with six tax slabs. The rebate on personal income tax has been raised to Rs 7 lakh from Rs 5 lakh. Thus, persons in the new tax regime, with income up to Rs 7 lakh will not have to pay any tax. The Finance Minister has now proposed to reduce the number of slabs to five and increase the tax exemption limit to Rs 3 lakh. The maximum tax rate has also been reduced from 42.7 per cent to 39 per cent.

The changes are aimed to make the new tax regime the default one. No changes have been made to the old tax regime. However taxpayers who have parked funds in social security contributions, insurance premiums and are committed to housing loan repayments may continue with the old tax regime.

Fiscal consolidation backed by realistic revenue estimates & expenditure compression

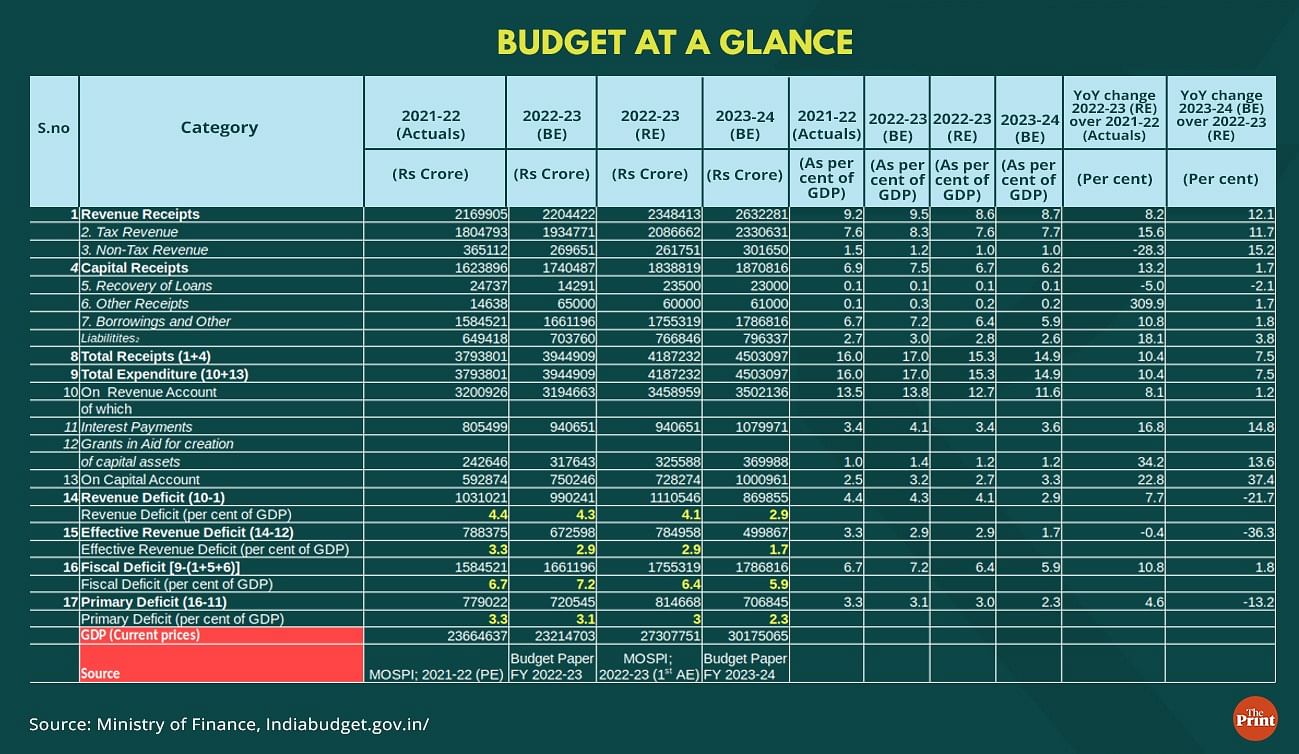

The government has reaffirmed its commitment to adhere to the fiscal consolidation roadmap. The government expects to achieve this year’s target of 6.4 per cent of GDP. For the next year, the fiscal deficit target is fixed at 5.9 per cent of GDP. The deficit on the revenue account is projected to fall from 4.1 per cent of GDP in the current year to 2.9 per cent of GDP in the next year.

The targets for revenue receipts are broadly conservative and reflect the slowdown in nominal GDP growth which is expected at 10.5 per cent next year. Gross tax revenue is expected to grow at 10.4. per cent in 2023-24 as compared to 12.3 per cent in the current year.

The government has projected a lower growth in its expenditure. It projects its expenditure to grow at 7.5 per cent, lower than 10.4 per cent in 2022-23. The bulk of the compression in expenditure is coming from revenue expenditure. Revenue expenditure growth is pegged at a meagre 1.2 per cent for the next financial year, assuming that the unanticipated shocks that rocked the economy in the current year would not re-appear next year.

The allocation on both food and fertiliser subsidy has been slashed sharply in 2023-24. While the reduction in subsidy will provide the necessary fiscal space for capital expenditure, the cut in the allocation on the Mahatma Gandhi National Rural Employment Guarantee Scheme (MNREGS) is puzzling.

This year, the government had to increase the allocation on the scheme. It might have to increase the allocation over the coming months if the demand for work remains elevated.

The net market borrowings are expected to be Rs 11.8 lakh crore for the next financial year. Market borrowing, though elevated is in line with market expectations. As an outcome, the yield on the benchmark ten year bond did not see a jump post the announcement of budget.

Going forward, however borrowings need to see a dip for a material decline in the central government’s debt-GDP ratio. This is important as almost 24 per cent of the expenditure of the central government goes towards interest payments.

Noteworthy initiatives for tourism and green growth

The Budget’s focus on tourism is a positive move and will help in generating employment opportunities. The proposal to set up Unity Malls for promotion and sale of their one district, one product, GI products and other handicraft products will give an impetus to local handicrafts and help in boosting income and employment.

The emphasis on green growth is welcome. The various measures announced in the budget including an allocation of Rs 19,000 crore for the National Hydrogen Mission will help in reducing the carbon footprint of the economy and will help in moving towards the ultimate goal of net zero emissions by 2070.

The scrapping of old vehicles by the Centre and States is not only environment friendly but will also give a boost to the automobile sector.

Radhika Pandey is Senior Fellow at National Institute of Public Finance and Policy.

Views are personal.

Also read: How green bonds can take India closer to meeting its climate goals and deepen investor interest