Bengaluru: Indian pharmaceutical company Mankind Pharma Ltd has set a price band of 1,026 rupees to 1,080 rupees per share for its initial public offering (IPO), valuing the company at 432.64 billion rupees ($5.27 billion) at the upper end of the band.

The IPO for the company, which owns the Manforce condom brand and at-home pregnancy testing kit Prega News, will consist of nearly 40.1 million shares on offer for sale from existing shareholders, according to a prospectus.

The offer size is 43.26 billion rupees, implying the proceeds would go to the selling shareholders alone.

Manforce condom, its best-selling product, has a domestic market share of nearly 30%, while Prega News has an 80% share, the New Delhi-based company said in the prospectus.

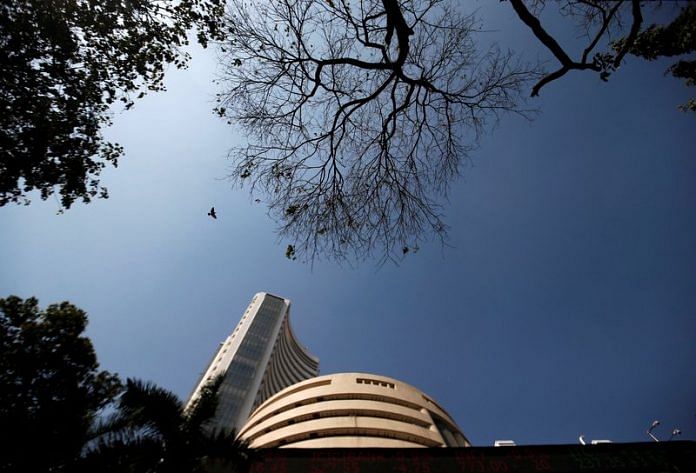

Mankind Pharma’s IPO comes at a time when volatile markets and global macroeconomic challenges have scuppered or delayed various listing plans in India.

Earlier this year, personal care products startup Mamaearth put its IPO on hold while apparel retailer Fabindia and jeweller Joyalukkas withdrew their plans.

Mankind, which also makes acute and chronic therapeutics, posted a profit of 9.96 billion rupees for the nine months ended Dec. 31, down from 12.43 billion rupees a year ago, while its revenue from operations for the same period rose nearly 11%.

The company had filed draft papers for the IPO in September last year, with Kotak Mahindra Capital, Axis Capital and J.P. Morgan India among the book running lead managers.

The bidding date for anchor investors is set for April 24, while retail investors can make an offer from April 25 to April 27.

($1 = 82.1170 Indian rupees)

(Reporting by Rama Venkat in Bengaluru; Editing by Nivedita Bhattacharjee)

Disclaimer: This report is auto generated from the Reuters news service. ThePrint holds no responsibilty for its content.

Also read: India NSE’s IPO plan stumbles at market watchdog’s door – sources