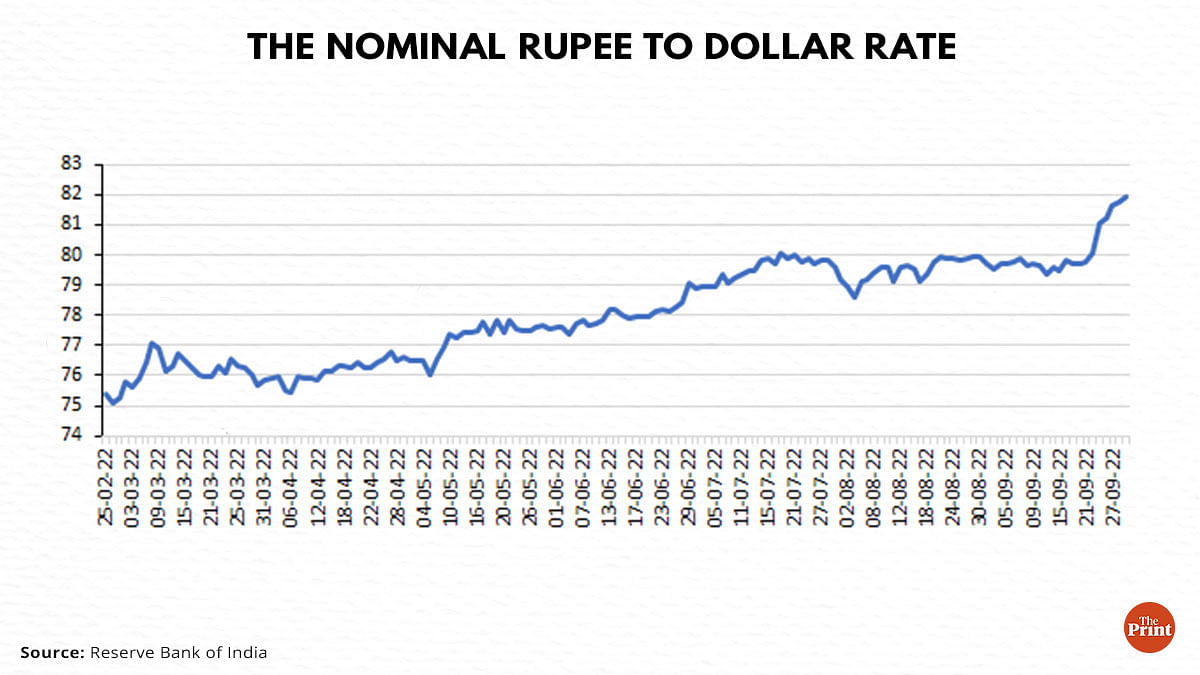

India’s foreign exchange reserves fell for a seventh straight week, dropping to USD 545.6 billion in the week ending 16 September. This is the lowest level of reserves since 2 October 2020. A large part of the fall in reserves has been on account of the RBI’s aggressive intervention in the currency market to prevent the slide of the rupee. The RBI managed to prevent the slide of the rupee beyond the Rs 80 per dollar threshold, till a few days back.

Given the relentless rise in the dollar, the RBI will have to allow the rupee to align to market fundamentals and use other tools to manage the rupee. This is important as reserves have come in not due to current account surplus but due to capital flows which have also turned volatile in recent months.

The rise of the dollar

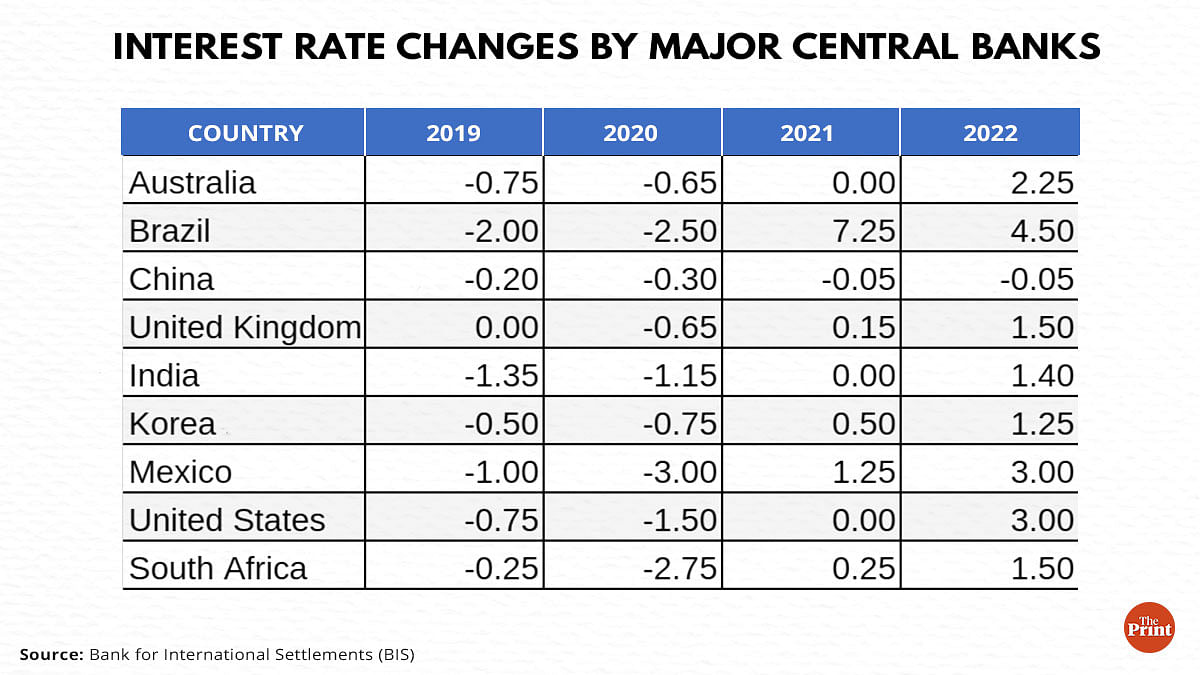

Since the beginning of the calendar year, the US Federal Reserve has been announcing rate hikes. The Federal Funds Rate is now in the range of 3 to 3.25 per cent. The median projections by the Federal Open Market Committee (FOMC) members suggest that the fed funds rate would be 4.4 per cent by end of 2022 and 4.6 per cent in 2023. This implies more rate hikes are in the offing.

Rise in rates makes the dollar more attractive. Other countries’ central banks have also been raising rates but at a slower pace compared to the US Fed.

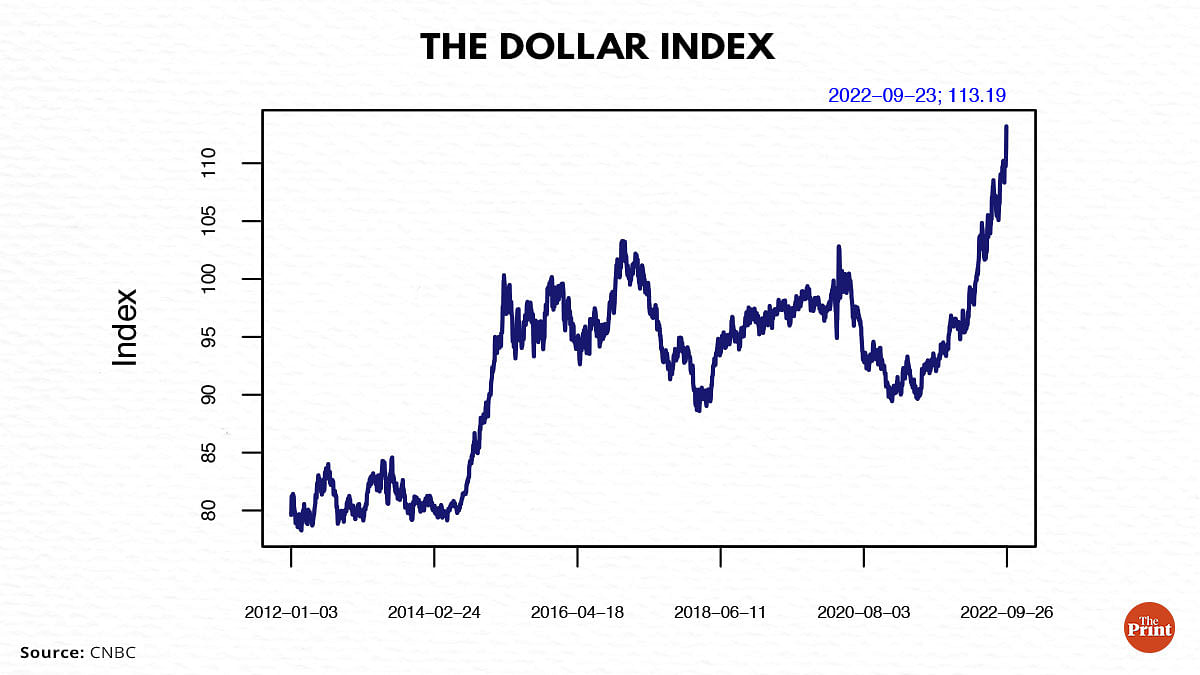

For instance, the Bank of England has raised rates by 1.5 per cent, the Australian Central Bank by 2.25 per cent, and the European Central Bank by 1.25 per cent. As a result, the dollar index, a gauge of the dollar’s strength against a basket of currencies, has seen a significant rise. Post the recent 75 basis points hike in the interest rate by the US Fed, the dollar index rose to a two-decade high at 111.8.

The fall of the rupee

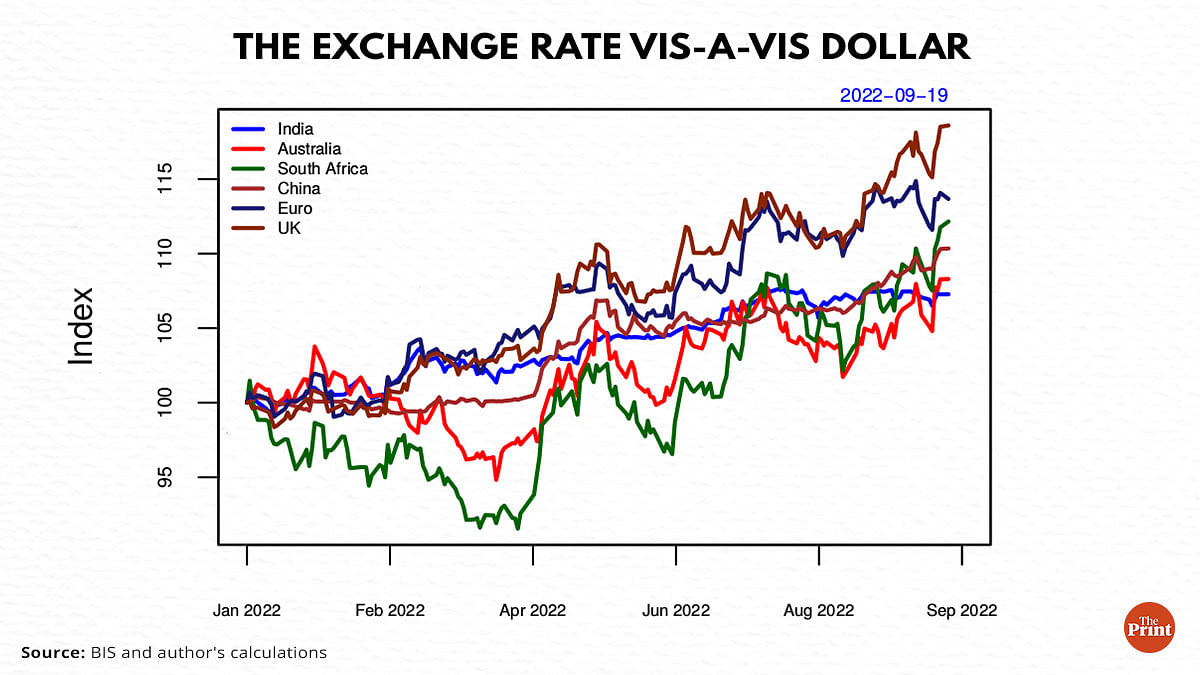

The surge in the dollar index is leading to a downward pressure on the rupee. The rupee has depreciated by 8.9 per cent since the onset of the Russia-Ukraine war. As compared to peer countries’ currencies, the rupee has performed better. But this is an outcome of RBI’s sale of dollars to prevent the fall in the rupee.

The foreign exchange reserves have declined by almost USD 86 billion since the beginning of the war. In July, the RBI sold USD 19 billion dollars to prevent rupee depreciation. Apart from the actual dollar sales, reserves are also affected by a drop in major currencies like the euro and yen against the dollar.

Dollar appreciation lowers the dollar value of non-dollar currencies.

In contrast, during the taper tantrum episode (during late April 2013 to September 2013), the rupee depreciated by almost 16 per cent. The decline in reserves was relatively modest at USD 21.5 billion during this period.

Metrics of reserve adequacy

Foreign exchange reserves are considered an important part of the policy tool-kit of most economies. They are held for many reasons, such as to counter disorderly market conditions, bring confidence in the currency or for influencing the exchange rate.

The International Monetary Fund (IMF), in a series of papers, has developed three traditional metrics to assess adequacy of reserves. For countries with restrictive capital accounts, import cover is seen as a relevant metric. It highlights how long imports can be financed in the event of a shock. Reserves equivalent to cover three months of imports is used as a thumb rule for adequacy of reserves for developing economies. However, with increasing financial integration, the applicability of this measure has become less useful.

Another measure of reserve adequacy which is increasingly used in emerging economies is the 100 per cent coverage of outstanding short-term external debt. This is particularly true for countries with large short-term cross-border financial transactions.

The third measure of reserve adequacy is the ratio of reserves to broad money. This is used to assess the adequacy of reserves towards crises triggered by flight of capital. Recent crises have been accompanied with outflows of resident deposits. To address this risk, reserves should typically be 20 per cent of the broad money (currency with public and deposits).

India’s adequacy of reserves

Traditionally, reserves in India have remained fairly above the 3-months of import coverage. At a peak of USD 642 billion in October 2021, India’s reserves were sufficient to cover 16 months of imports. With the recent decline to USD 545.6 billion, reserves cover of imports has fallen to 9 months. Elevated imports amid a declining forex reserves have led to a decline in import cover. While the present level of reserves are much above the benchmark level of three months of import cover, further intervention by the RBI to arrest volatility will determine the adequacy of reserves.

On the second metric of 100 per cent coverage of outstanding short-term external debt, India’s reserves have been fairly above the short-term external debt. Recent estimates suggest that short-term debt is less than half of the reserves. Reserves are just about the threshold level of 20 per cent of broad money. A study by the RBI shows that there have been times when reserves have fallen below the threshold level of 20 per cent of broad money.

Policy-trade-offs and challenges

The sharp dollar surge has led to weakening of not only the rupee but other currencies like pound, euro and yen. The pile-up of reserves have slowed due to volatile capital flows amid a sustained current account deficit. In July, the RBI had announced measures to boost forex inflows and to stem the slide of the rupee. These included liberalising the norms for foreign investments in government and corporate bonds, easing the limits for foreign currency borrowings and liberalising norms to help banks attract greater deposits from non-residents. These did not have a material impact on foreign flows given the sustained surge in the dollar.

RBI may possibly have to go in for another 50 basis points rate hike to support the rupee. Intervention to support will become challenging as it will tighten liquidity in the banking system at a time when credit demand is picking up. It may be a good time to expedite inclusion of bonds in emerging market bond indices to attract greater inflow of foreign capital.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also Read: Why volatile food prices will keep the heat on India’s consumer inflation level this year