Overall credit to agriculture sector plunges 50%; state sets ambitious targets for 2018-19

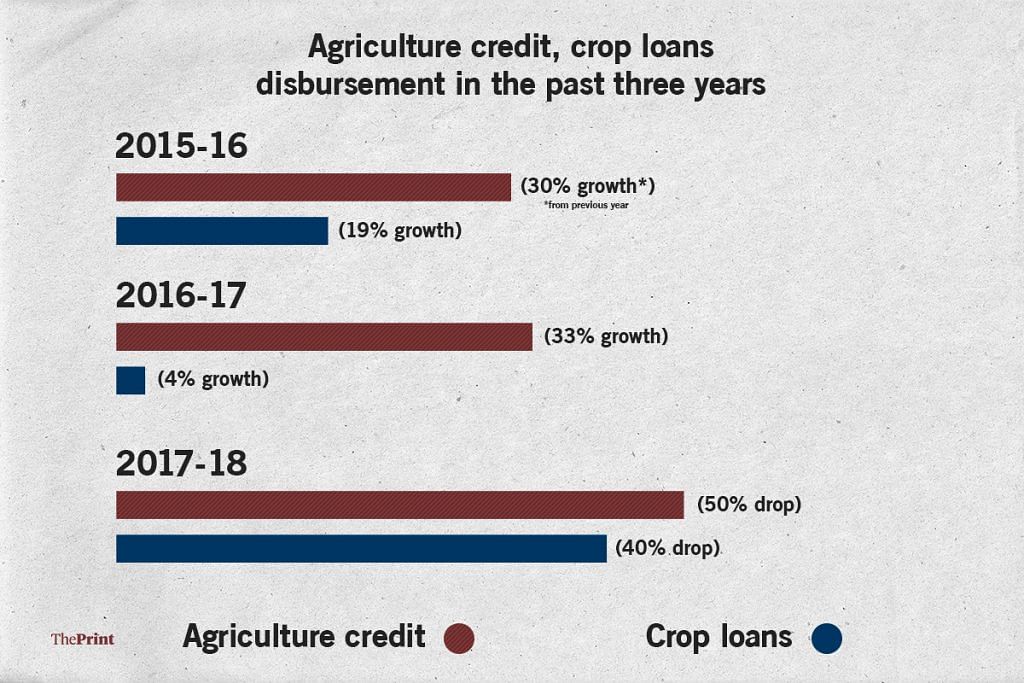

Mumbai: In a year marked by a squeeze in the agriculture sector, farmer protests and a subsequent crop loan waiver in Maharashtra, credit to the agriculture sector, especially fresh crop loans, has plummeted to its worst-ever in three years in the state, with a 50 per cent drop as compared to last year.

As per data with the Maharashtra State Level Bankers Committee (SLBC), the total finance for the agriculture sector in Maharashtra provided by various banks this fiscal is Rs 48,857 crore, only 63 per cent of the targeted Rs 77,207 crore or 2017-18. The figure is also almost half of the credit disbursed to the agriculture in the last fiscal: in 2016-17, the agriculture credit was Rs 96,906 crore, a 33 per cent growth over the previous year.

Similarly, the quantum of crop loans within the agriculture credit fell to Rs 25,322 crore, a 40 per cent drop as compared to the Rs 42,173 crore in 2016-17. While banks had a target of ensuring a 29 per cent increase in crop loans this year, the actual disbursement was just 47 per cent of the target.

In 2015-16 and 2016-17, the disbursement of crop loans had grown by 19 per cent and four per cent, respectively, over the previous year.

The state cooperation minister, the BJP’s Subhash Deshmukh, said a survey would help in ascertaining the reasons behind the drop in credit. “We will have to do a proper survey to understand the reasons, but prime facie, the state government’s announcement of a farm loan waiver could be one reason for the low disbursement of crop loans,” he said.

Bankers too attribute this drop in crop loans to the loan waiver scheme, saying a number of farmers are hoping to be eligible under the scheme and waiting for their loans to be waived off. Banks do not extend fresh loans unless defaults are cleared.

“The reasons for low credit off take this year can be attributed to the announcement/implementation of a farm loan waiver scheme by the government of Maharashtra. However, all this farmers in the state who have received benefit under the Chhatrapati Shivaji Maharaj Shetkari Sanman Yojana, 2017, (the farm loan waiver scheme) are now eligible for fresh finance and disbursements will pick up this year,” an agenda note circulated among members of the SLBC said.

National banks need to buck up, says minister

While he did blame the slump on the loan waiver, Deshmukh did, however, say that nationalised banks had to do better in this sector. “In some places the performance of nationalised banks has also not been as per what is expected. They should take more initiative in reaching out to farmers and meeting targets of crop loan disbursals,” he said.

He added that Chief Minister Devendra Fadnavis too had met the bankers and had appealed to the nationalised banks to make disbursal of crop loans a priority.

As per data, public sector banks had the bulk of the total crop loan targets, but were also one of the most sluggish performers in meeting them. In 2017-18, public sector banks were responsible for 53 per cent of the total crop loan target for the fiscal. However, against the target of Rs 29,005 crore, these banks were able to disburse crop loans of Rs 11,073 crore, about 38 per cent of the target.

The only other category of banks whose performance was worse than the public sector banks was the regional rural banks, which disbursed just 24 per cent of the targeted crop loans of Rs 3,055 crore.

District cooperative banks, accounting for about 32 per cent of the total targeted crop loans for this fiscal, and private sector banks, accounting for eight per cent of the target, were able to disburse 60 per cent and 65 per cent, respectively.

Crop loan disbursement was the slowest in the districts of Vidarbha and Marathwada, which have been known to be water stressed and have suffered an acute agrarian crisis in the past few years.

The disbursement was the worst in Marathwada’s Hingoli district where banks could meet just 17 per cent of their targets as against 74 per cent and 94 per cent in the preceding two years.

Similarly, disbursement was under 30 per cent of targets in other districts such as Vidarbha’s Amravati, Buldhana, Washim and Yavatmal, Marathwada’s Beed, Jalna, Nanded and Parbhani, and Nashik and Dhule in Northern Maharashtra.

A banker who did not wish to be named said, “Every year there are a number of farmers who are unable to repay their crop loans. These accounts are not included in the crop loan disbursements of the current year and go unreported. To get a proper idea of the number of farmers covered, we should ideally also compare the number of crop loan accounts outstanding with the total number of farmers in the state.”

Slump in state’s farm sector

The agriculture sector shrunk by nearly 8 per cent in 2017-18 after posting double-digit growth last year, largely due to insufficient rainfall at 84.3 per cent, as per state government estimates.

According to the 2017-18 Economic Survey Report, it was a nearly 14 per cent decline in the production of crops that pulled the sector down. The production of cotton, oilseeds, pulses and cereals was the worst affected. In comparison, there was a whopping 22.5 per cent growth in the overall sector last year, supported by a 30.7 per cent jump in crop production.

Besides deficient rainfall, crises such as destruction of the cotton crop by a pink bollworm infestation and hailstorms added to the distress.

Ambitious targets for 2018-19

With hopes of a good monsoon boosting crop production, and the implementation of the loan waiver making a lot more farmers eligible for fresh crop loans, the Maharashtra SLBC has proposed ambitious targets for agriculture credit, including crop loans, for the 2018-19 fiscal.

For the current year, the committee proposed a provisional target of Rs 85,464.47 crore as agriculture sector lending, 10.7 per cent more than the target for 2017-18.

Of this, it has proposed the disbursement of crop loans to be targeted at Rs 58,319.47 crore and other investment loans of Rs 27,145 crore, a jump of 7.56 per cent and 18.1 per cent, respectively, over the previous year’s target.

The committee plans to inch towards this target by ensuring that banks offer fresh crop loans to all beneficiaries of the loan waiver scheme, tenant farmers with valid proof of tenancy and even marginal farmers. The loan requirement of marginal farmers is low and with financial institutions reluctant to grant small loans, these farmers are often pushed to private money lenders.

Banks have also been asked to arrange for credit camps in every village during the Kharif season to give them information about their various loan schemes.