There has been a clamour against India’s inflation targeting framework in recent months. Many of the proposals made will take India back many decades, and restore high and volatile inflation.

There are always trade-offs related to any policy. There are always those who gain and those who lose. For example, those with salaries and those who depend on savings such as pensioners will suffer when inflation is high. Personal financial planning would break down with high inflation, and everyone over age 50 would be adversely affected.

However, high inflation is good for those who borrow, as their repayments will be lower in real terms. Inflation is often bad for the poor. For many decades, price rise was an important issue in India’s electoral politics . Many elections were won or lost based on the issue of price rise.

The unhappiness with the inflation targeting regime stems primarily from those who feel that ever since the inflation targeting framework has been put in place, the Reserve Bank of India does not cut rates easily or as much as they would like to see. This is interpreted as the RBI not giving growth as much importance as inflation. It is felt that if we don’t have an inflation target, interest rates would have been lower. It is believed that higher inflation would support or enable higher growth.

Another corner which criticises the inflation targeting regime is industry. Private firms always wants lower interest rates, no matter what. Even if there is high inflation, high credit growth, and the economy is overheating, one never hears private firms or their lobbyists say that interest rates should be raised.

Also read: Interest rate policy makers shouldn’t ignore stubborn food price inflation, RBI study says

Interest rates and inflation rate

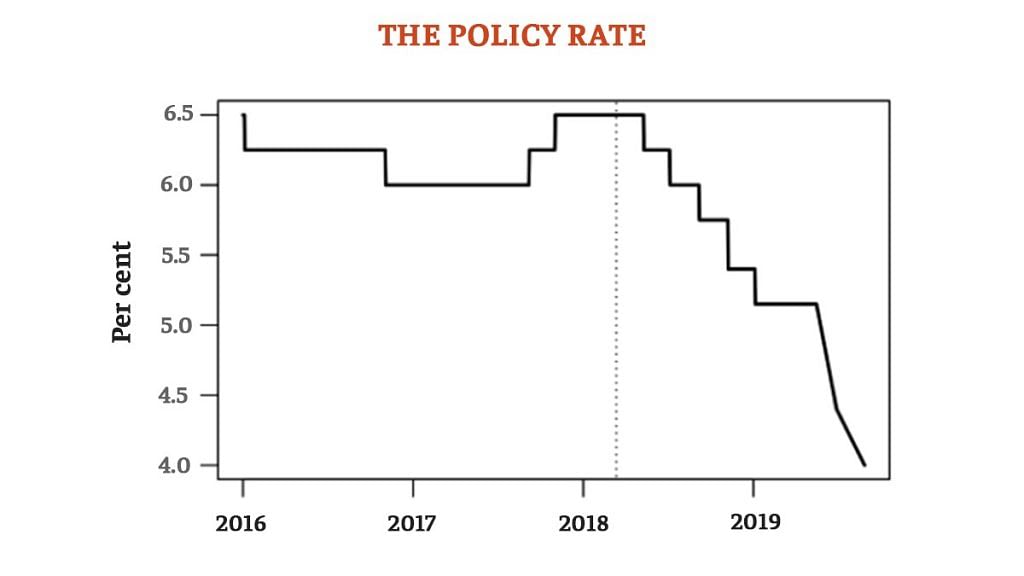

Let us look at the trajectory of interest rates in the period in which India adopted the inflation targeting regime.

Figure 1 shows that the policy interest rate has been cut sharply since India adopted the inflation targeting regime. This does not suggest that under the inflation targeting system, there has been an upsurge of high rates, or an aversion to cutting rates in response to the economic difficulties that have been visible in recent years.

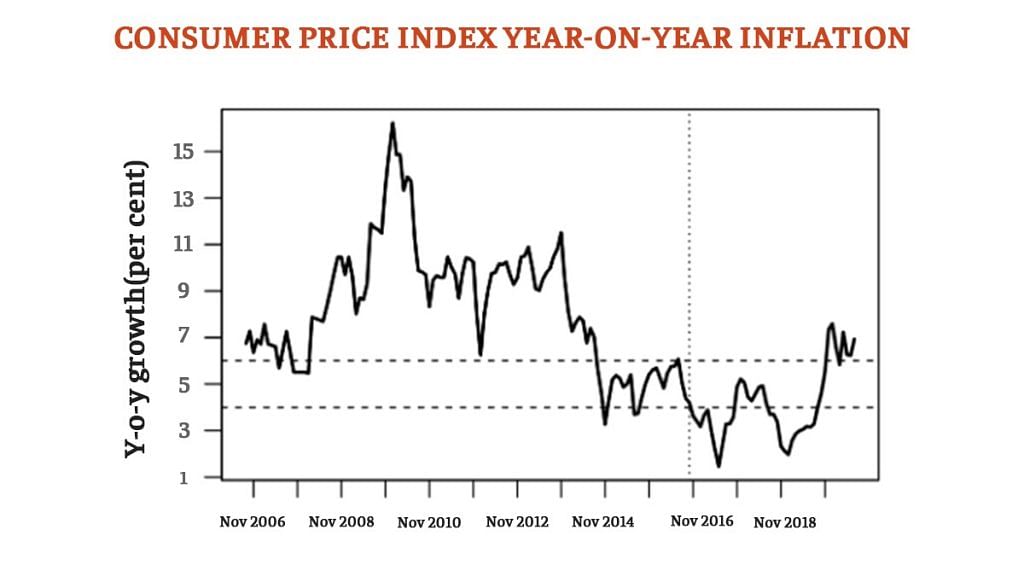

Figure 2 shows the inflation rate based on the Consumer Price Index, which is the target measure of inflation in India. The inflation rate has come down sharply from the high and volatile rate earlier to a far lower and more stable rate after the adoption of the inflation targeting regime.

Also read: RBI won’t allow rupee to rise sharply despite high consumer inflation, ICICI says

Proposals made

We now turn to the proposals that people have made. The first proposal is to abandon inflation targeting altogether. In other words, let the inflation rate be whatever it might be and not be anchored at all. It could be 10 per cent, even 15 per cent, or it could fluctuate between 7-10 per cent, as it was doing in the mid-1990s and early 2000s. There would be no Monetary Policy Committee and the RBI would choose the inflation rate and choose how much money to print. Or maybe it would not have inflation as an objective at all. It is not clear what these commentators have in mind and whether they prefer high inflation, or they think it will happen on its own.

For those who approach this question from the point of view of lower interest rates, there is another issue. What matters for the cost of investment is real interest rates — the nominal rate minus expected inflation. By making real interest rates low through high inflation, they may still not get higher investment and output they are looking for. Uncertainty in costs, in output prices and in profits actually affects investment adversely. Uncertainty may prove to be far worse for investment than relatively higher real interest rates.

A third proposal is to add fiscal priorities for capital spending into the inflation targeting framework. This is problematic in terms of institutional arrangements. The reason why the budget is placed under the control of Parliament is that capital versus current spending choices are made by elected representatives of the people. We economists may disagree, but the meaning of being a democracy is that you have to win elections in order to vote on decisions about taxation or public expenditure.

Another set of economists have proposed targeting the nominal GDP. Let us remember that nominal GDP can be increased by increasing prices. So, it is not surprising that this is not a popular framework anywhere. In addition, GDP measurement in India faces considerable difficulties. It will be many years before sound GDP measurement is in place, and until that is done, nominal GDP is not a credible alternative for the design of monetary policy institutions.

The RBI Act requires that next year, it will be time for the government to review the inflation target. We discussed in a recent study how the government is required to choose the target. Contrary to loose claims that are being made, there is no requirement in the 2016 law that the framework should be reviewed.

One of Modi govt’s defining achievements

In 1934, the RBI was envisaged by our colonial masters as a ‘temporary’ measure. In 2016, for the first time, when inflation targeting was brought in, these words were removed from the preamble of the RBI Act.

Inflation targeting is a historic milestone in India’s institutional maturation, and is one of the defining achievements of the Narendra Modi government. The reform has served India well; for the first time in history, high and volatile inflation is not a significant threat.

We need to deepen our institutional capabilities in making the framework better, not clamour to undermine the reform.

Ila Patnaik is an economist and a professor at National Institute of Public Finance and Policy.

Views are personal.

Also read: Why lockdown can save the RBI from explaining ‘failure’ to fight inflation to govt

Sir,

Everything is strength, prosperity, future direction ; and dealing with adversary in an assertive way. The India’s solution is simple but when it is simple and stupid- difficult to implement with complex minded India. Secret is: 1.Find a way to do more lower half income people. 2. India must become more valuable to the world 3. Do more, give more and Be more by becoming an investor than consumer 4. Be adventurous, risk taker and ready to experiment .

4.Accept the weakness and take the step in right direction on a daily basis- one step at a time. 5. Give confidence to people that higher we want to go — deeper and wider the base is going to be with all the parameters studied and analyssed with a mindset of flexibility tweak as we go 6.Ultimate goal should be to be the leader of fourth industrial revolution and integrating the future technology for prosperity and wellbeing Unfortunately till we address the issue of Pakistan break in to four –India cannot prosper because of religious Islamic radicalization is the biggest danger to India- or convert all muslims of pakistan in to Hindus. .

Inflation targeting is without doubt an accepted way of central bank functioning. However judging its effectiveness in India just based on 3 years data may not be proper. India still has a long way to go before becoming a developed economy with basic needs of overwhelming majority met with. One cannot forget monetary policy tool for directing the economy towards higher growth trajectory and its particular relevance for India considering our growth in last decade prior to 21012-13. Also below normal level international oil prices enabled government manage their finances even in a stagnating economy, which other wise would have put pressure on inflation rates. While we should complement RBI for lower inflation, we should look for more long term data on this policy utility for country with growth aspirations.