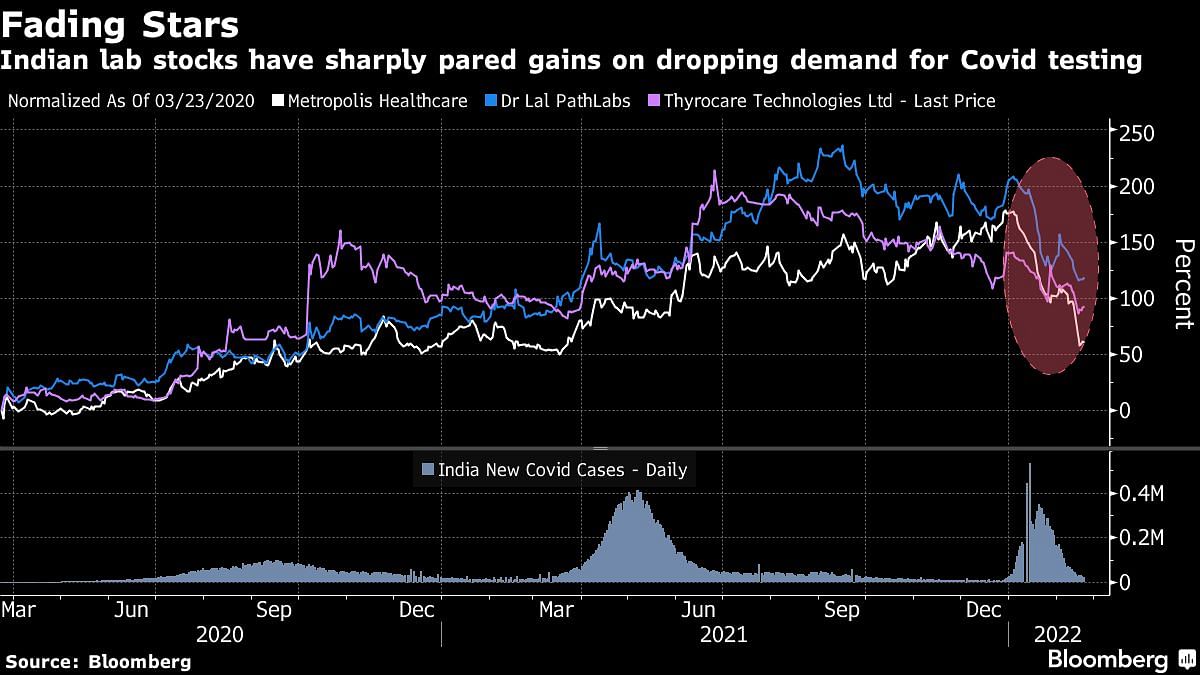

Shares of India’s listed clinical laboratories are fast falling out of favor with investors as an easing Covid-19 outbreak reduces demand for testing.

Top operators Metropolis Healthcare Ltd. and Dr Lal PathLabs Ltd. have each plummeted at least 30% this year in a rout that gathered pace after their December quarter earnings trailed analysts’ expectations. Thyrocare Technologies Ltd., the oldest listed pathology firm, posted sharply lower revenue, hurt by lower churn of Covid-related tests. Its stock has already lost a fifth of its value in 2022.

The selloff is similar to a global trend after surging healthcare spending and demand for Covid tests amid the pandemic led to multifold share-price gains for pathology firms all around the world. The gains have started to fade as countries look to reopen, while concerns over higher interest rates have sparked a flight from risky investments including biotech.

Biotech Investors Unwind Speculative Bets as Pandemic Fears Fade

Shares of all the three Indian companies had at least doubled in the previous two years.

“The outlook for laboratory stocks is muted,” said Kranthi Bathini, a strategist at Mumbai-based WealthMills Securities Pvt. “The companies now need to focus on growth from non-Covid streams.”

India has managed to control the recent outbreak, while testing capacity has been expanded significantly, Bathini noted. He said the companies have looked to expand through mergers and acquisitions, announcing deals when their stocks were at peak valuations.

Metropolis and Dr Lal both announced acquisitions of smaller players last year, looking to move into new fields. API Holdings Ltd., which owns the health-care brand PharmEasy and has announced plans to go public, last year acquired a two-thirds stake in Thyrocare from its founders. –Bloomberg

Also read: Why China’s world-beating sovereign bond rally may have run its course