The I-T Department wanted to probe various financial and accounting irregularities in Patanjali’s books in 2010-11, and the court has agreed.

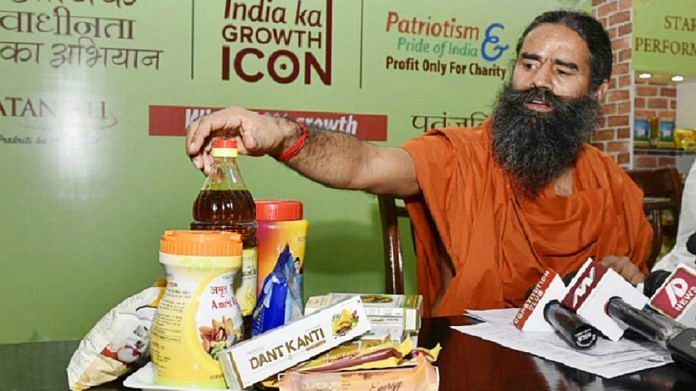

New Delhi: There’s bad news for Baba Ramdev’s FMCG firm Patanjali Ayurveda Ltd — the Delhi High Court has paved the way for a special audit by the Income Tax Department.

The court, in an order dated 6 December, dismissed the writ petition by the company opposing the special audit sought by the I-T Department and directed it to cooperate with the special auditor.

Case history

In 2013, the I-T Department decided to initiate a special audit of Patanjali’s books for the assessment year 2010-11 for various financial and accounting irregularities, which depressed the firm’s profits and consequently the tax outgo.

Patanjali challenged the decision in the Delhi High Court, contending that there were no complexities in its accounts, and it had responded adequately to the points for which the special audit was ordered.

Section 142 (2A) of the Income Tax Act empowers the assessing officer to order a special audit by an accountant on a company in case the books of account are very complex.

The I-T Department questioned the way the inventory was valued — including the raw materials, the work in progress, finished goods (both traded and manufactured).

It also flagged the large number of related-party transactions, and the discrepancies in the many cash books maintained, as well as in the cash flow statement. Upon examination, it also found that the company had claimed exemption under section 80(1C) of the Income Tax Act for operating in a special category state, but the exemption claim differed significantly in the original and revised return. Patanjali operates from Uttarakhand, classified as a special category state for the purposes of the act, making the firm eligible for tax breaks.

The fact that the company was involved in trading activity through trading concerns with voluminous transactions necessitated a special audit, the tax department contended.

The company, on its part, defended its steps and said the assessing officer had not adequately applied himself and was looking at a special audit as an escape route.

Also read: Baba Ramdev’s Diwali gift — jeans that are ripped just enough to be sanskaari

What the court said

The court sided with the assessing officer.

“The AO… ordered special audit, which was quite reasonable, especially in regard to the imprest account for which details of expenses incurred had not been furnished. That amount was sizeable,” the judgment, authored by justices S. Ravindra Bhat and Prateek Jalan, read.

“Also, with respect to the benefit of Section 80 IC and the revision of returns, was an aspect which could not have been given a light treatment, but needed inquiry, if the AO felt it to be so (sic).”

No one quite knew what the true financials of the Sahara group were, where the funds came from, how many of its businesses were profitable. But a larger than life presence. One gets a similar feeling about Baba Ramdev’s enterprises.