New Delhi: Per-capita incomes coming down, budget deficit going up, foreign exchange reserves dwindling, a few weeks of imports left, political turmoil, and a dire need for an International Monetary Fund bailout — these economic challenges are synonymous with India’s two neighbours: Pakistan and Sri Lanka. However, the Islamic nation may just be able to avoid the same fate as that of the island country thanks to its nuclear power.

According to experts like Jawad Nayyar, an economist based in Pakistan, and Richard Gardner, a financial analyst, the nation is an atomic power and the world cannot “afford a bankrupt Pakistan”. Global entities “will take significant efforts” to refinance the debt-ridden country. As often seen, the economy and politics of any nation are intertwined.

Interestingly, there aren’t any takers for this argument in Pakistani publications.

“We still have 30,000-40,000 terrorists who have been trained and fought in parts of Afghanistan and Kashmir,” said former Pakistan Prime Minister Imran Khan in a startling revelation in 2019. In a politically destabilised Pakistan with atomic power at its behest, the IMF and World Bank may not take a chance to leave the country to its own devices.

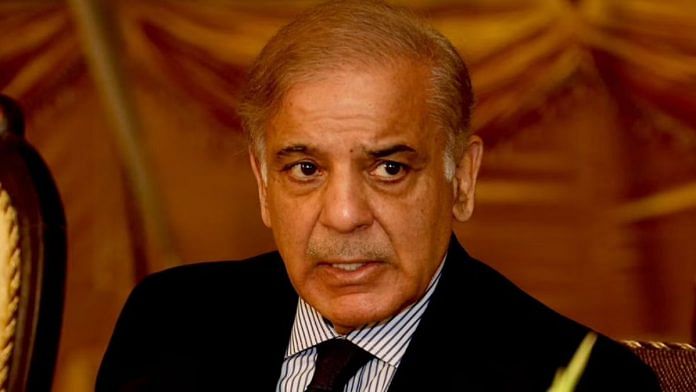

Also read: Shehbaz govt squeezing perks of Pakistani diplomats. ‘Running kitchen abroad becomes tough’

IMF to the rescue

In a recent development, as reported by Dawn, the IMF is expected to begin the process of releasing a tranche worth $1.7 billion to Pakistan later this week. Pakistan had signed a $6 billion bailout accord with the global financial institution in 2019 but the seventh and eighth tranches were put on hold considering the IMF’s rising concerns over Pakistan’s compliance with the agreement.

Army Chief General Qamar Javed Bajwa had even called up the United States Deputy Secretary Wendy Sherman last month, seeking Washington’s support in the matter.

The IMF had reportedly asked Pakistan to get assurances from the two friendly countries — Saudi Arabia and the United Arab Emirates (UAE)— that they would give $4 billion-loan soon after the IMF disburses its tranche. Besides this, Pakistan has reportedly been warned by the monetary institution to monitor their political situation. Whether Pakistan’s status quo as a nuclear power played a role in convincing IMF to facilitate funds is unclear.

This is not the first time that the debt-ridden country has sought financial help. The IMF helped Pakistan earlier in 2013 too, followed by UAE and China in 2016 and 2018 respectively due to their geopolitical equations.

Also read: An ‘out of Pakistan’ solution for population control—produce kids in non-Muslim nations

Is Pakistan the next Sri Lanka?

The burgeoning economic crisis being endured by Sri Lanka seems to have found a company in its distant neighbour in South Asia.

Much like the island nation, Pakistan’s currency has also nosedived. According to Shahram Azhar, assistant professor of economics at Bucknell University, Pakistan’s per capita GDP lost almost one-third of its value under the prime ministerial tenure of Imran Khan—a rare occurrence in the country’s history.

He further adds that the currency dropped 30 per cent of its value and that surging inflation had an especially adverse impact on poorer communities. The Pakistan Bureau of Statistics reported Monday that consumer price rose to nearly 25 per cent in July —the highest spike since October 2008—with transport inflation also surging to a record 65 per cent.

Reza Baqir, former governor of the State Bank of Pakistan, says there are three factors which indicate that Pakistan’s economic crisis “appears” worse—domestic political instability, increased global interest rates, and the distress caused by the spill-over from another high-debt country like Sri Lanka. Of the three, only the first factor can be improved on, and that, in Baqir’s opinion, could be the key factor in resurrecting Pakistan’s economy.

(Edited by Zoya Bhatti)