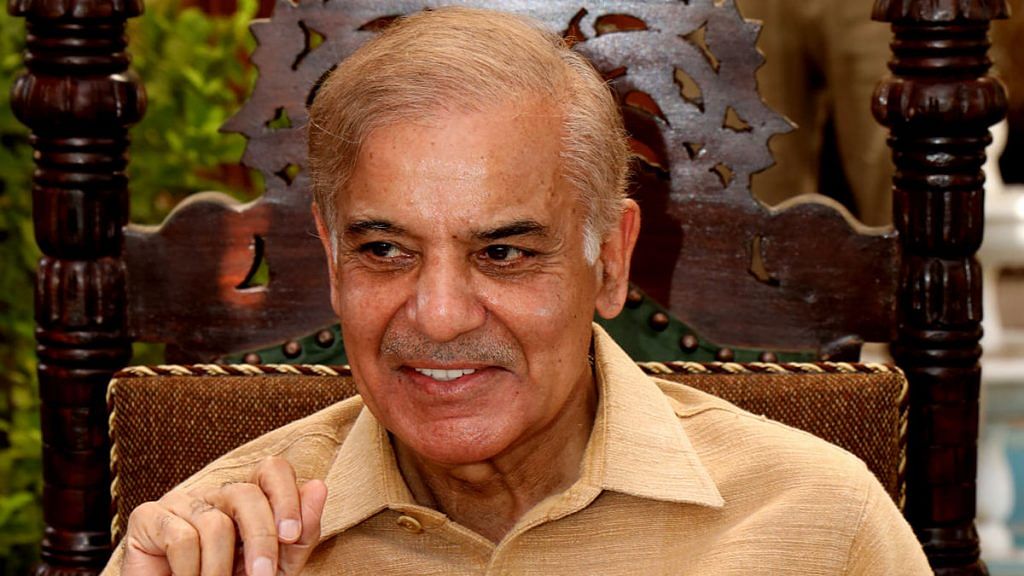

Pakistan might be moving towards a mini socialist revolution to ‘ensure sacrifice is shared’ and reduce its fiscal deficit. And this time, it looks like everyone’s finally on board. Finance Minister Miftah Ismail came out in support of the Shehbaz Sharif government’s decision of raising taxes on the rich during this year’s annual budget.

“In Pakistan, it is the poor who have always suffered the burden of taxes, but the Shehbaz-government has decided to impose it on the incomes of the rich. This time, we will ensure that the sacrifice is shared. You have always seen that previous governments imposed taxes on consumption, which had a disproportionate impact on the poor. But we have not increased any indirect taxes or that on consumption in the budget this time around,” he said in a press conference in Islamabad.

The minister announced that those with an annual income of more than PKR 150 million will pay one per cent, those earning over PKR 200 million will pay two per cent and those earning over PKR 250 million will have to pay three per cent additional taxes.

Along with taxing the rich, the 2022-23 budget also provisioned that it will also ban the import of cars and the buying of new vehicles by government officials.

Also Read: Pakistan wants US to mediate bailout negotiations with IMF. Media says focus on budget

A long-standing demand

Wealth taxation has been a long-standing demand among the economists, intellectuals and common citizens of the country. Pakistan has had a lower tax-to-GDP ratio, even lower than its neighbours India and Bangladesh. According to a decade-old New York Times article, former prime minister Nawaz Sharif was reported to have paid no personal income tax for three years ending in 2007 in the public documents he filed with Pakistan’s election commission.

Abdul Rauf Shakoori, a Pakistani corporate lawyer in the United States and professor Huzaima Bukhari, who teaches at the Lahore University of Management Sciences (LUMS), recently wrote an article stating that Pakistan had been a tax haven for the rich. “In the past, several amnesty schemes have been introduced to facilitate the privileged classes by enabling them to legalise their wealth”.

But the Shehbaz Sharif government is not the first to initiate the discussion around taxing the rich in Pakistan. The Imran Khan government had been an advocate of taxing the rich, but it was never implemented. This year in March, ahead of his exit from the government, Khan had claimed he would tax the rich and give the money to the poor.

Also Read: Pakistan can’t catch a break. IMF won’t give loans to ‘clear debt’. China won’t start CPEC

Imran Khan’s false promises

An editorial in Pakistani newspaper The Express Tribune said, “As opposition leader, (Imran) Khan would hardly miss an opportunity to lash out at the government for sparing the rich when imposing taxes. On occasions difficult to count, the PTI chief had called it his mission to tax those whose luxurious lifestyles do not match the amount of taxes they pay.”

It said: “Khan is starkly the opposite. His government has, while unveiling its first annual budget, burdened every income group—irrespective of its capacity to bear any additional burden—but has favoured the rich with tax break”.

The editorial concluded that the tax exemptions for the rich made up 40 per cent of the amount the government would collect in additional taxes on the salaried persons in the coming fiscal year.

In November 2021, Dawn also published an editorial about how Pakistan’s tax regime unfairly compelled low-middle-income segments to pay a greater ratio of their incomes in (mostly indirect) taxes compared to those with higher incomes and helped the powerful get away without paying their due share.

“A large army of tax collectors also ends up mostly helping truants and delinquents for their personal financial gains. By avoiding tax payments and securing exemptions, the rich have for long forced successive governments to run large deficits, cut expenditure on social and economic infrastructure and increase the tax burden on the rest of the country,” it said.

Also Read: Pakistan plays ping-pong with electoral reforms—Nawaz:1, Imran:1. Now, it’s Shehbaz’s turn

Need for a nuanced approach

On social media, the Shehbaz Sharif government’s initiative has only gathered praises barring some exceptions.

A Twitter handle called ‘Economy of Pakistan’ wrote that the “earlier proposal was taxing rich individuals but again, companies are being taxed which are sometimes owned by common Pakistanis”.

Pakistan’s leading economic commentator Yousof Nazar targeted those who have been criticising wealth taxation. “When it comes to taxing the rich, large properties, big agricultural incomes, they suddenly remember the constitution which is otherwise practically treated as a piece of paper by the powerful elites of Pakistan.”

(Edited by Srinjoy Dey)