Mumbai: The sale of a stake in Zee Entertainment Enterprises Ltd. to a foreign fund failed to cheer investors, who say the transaction leaves founders of India’s largest publicly-traded television network with the need to raise a further Rs 6,800 crore ($983 million) to pare debt.

Zee’s shares tumbled 5.8% to Rs 340.6 in a fourth day of declines, taking the year’s drop to about 30%. Invesco Oppenheimer Developing Markets Fund agreed to buy as much as 11% stake in Zee for about Rs 4,224 crore at Rs 400 each, the company said Wednesday.

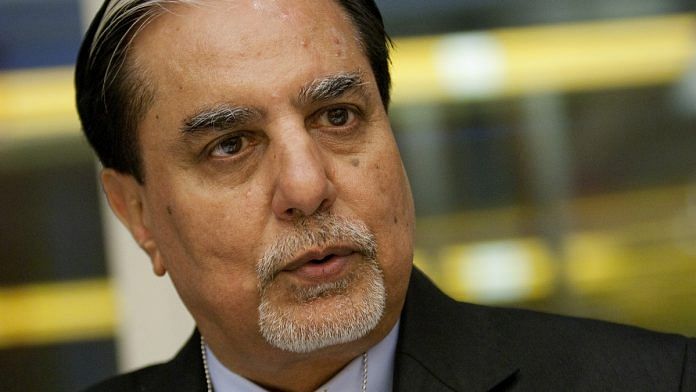

The sale still leaves a large gap for tycoon Subhash Chandra and his Essel Group, which has outstanding debt of about Rs 11,000 crore with shares pledged as collateral. The founders pledged to raise funds by selling assets such as roads and renewable energy plants, with the deadline to pay lenders approaching next month.

“We see this as a first step of many, but it doesn’t remove the overhang on the stock,” Morgan Stanley analysts led by Parag Gupta said in a note. “The risk we see here is that infra asset sales have been pursued for quite some time now, and if that process remains sluggish then monetization may not happen in the next two months.”

Apart from the debt burden, Zee is also facing competition from Netflix Inc., Amazon.com Inc. and hundreds of local TV channels vying to serve India’s booming demand for content. Zee is said to have previously lured investors including Sony Corp. and telecommunications businesses controlled by billionaires Mukesh Ambani and Sunil Bharti Mittal.

“The group will be a purely media company as we are planning to sell all non-media assets,” Punit Goenka, Zee Entertainment’s chief executive officer said in an interview. “My team would be now confident in negotiating with other bidders as Oppenheimer has endorsed the intrinsic value of our company.”

Chandra, a rice trader-turned-media mogul, and his family are selling stake in Zee to help pare debt at Essel Group. Weighed down by borrowings, Essel faces the risk of lenders selling pledged shares of its units. Paying back loans is key to regaining investor confidence eroded by a report in January that the conglomerate had links to a company probed by authorities for alleged fraud.

A consortium put together by James Murdoch’s Lupa Systems that included Comcast Corp. and Blackstone Group Inc. had also made an offer for Zee Entertainment, according to people familiar with the matter. Representatives for Comcast and Blackstone weren’t immediately available for comment.

While strategic investors had shown interest in Zee Entertainment, the parent opted for a financial investor because of timeline constraints, Goenka said.

Invesco Oppenheimer funds have been an investor in Zee Entertainment since 2002, the media company said. Oppenheimer Developing Markets Fund held 7.74% in the company as of June 30, according to exchange data. –Bloomberg

Also read: James Murdoch’s Comcast consortium eyes stake in Zee Entertainment