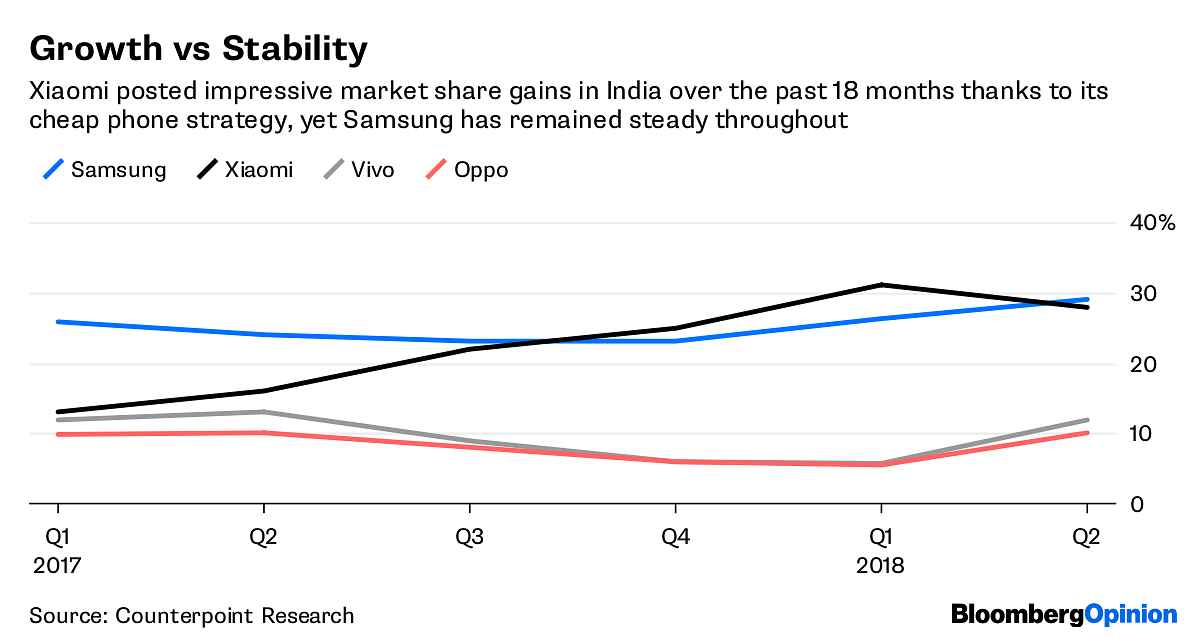

Data released by Counterpoint shows Samsung has dethroned Xiaomi in the June quarter as the leading Indian smartphone choice.

After crowing about how strong it is in India, and how loyal its MiFans are, Xiaomi Corp. can’t hold on to top spot in the smartphone maker’s second-largest market.

Old nemesis Samsung Electronics Co. pipped it in the June quarter after ceding the lead to the Chinese company two quarters prior, according to data released Tuesday night by Counterpoint Research.

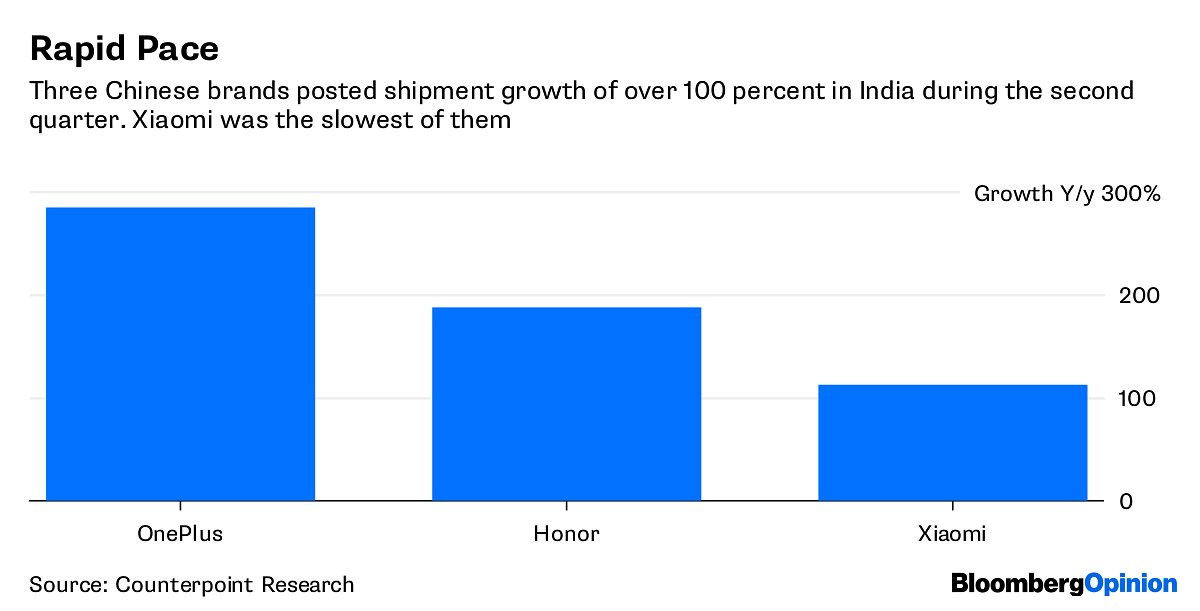

What should worry Xiaomi, and its investors, is that fellow Chinese brands OnePlus and Honor both posted stronger growth during the period.

Now that Xiaomi is a listed company, these numbers are more than just an academic exercise.

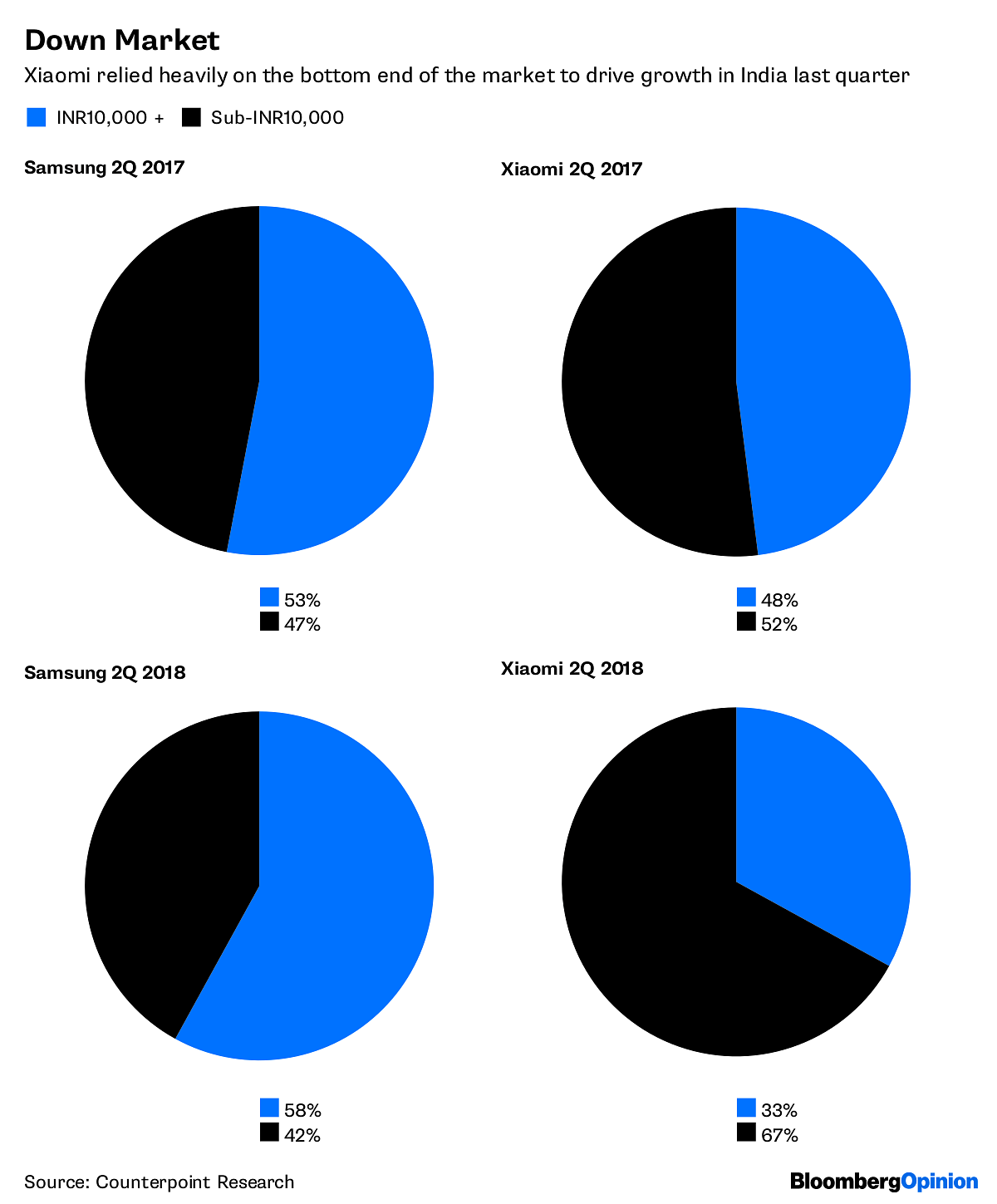

Dig further into the data and you’ll discover something of greater concern. Xiaomi’s growth was even more dependent on cut-price phones than in the past. Over two-thirds of shipments were in the sub-10,000-rupee ($150) category. By comparison, Samsung took first place despite just 42 per cent of the devices it sold being in that price range. In other words, there are plenty of consumers willing to pay for more expensive devices.

Xiaomi likes to pretend that hardware profits don’t matter. And we shouldn’t forget the red herring that founder Lei Jun threw out back in May, when he made a song and dance about limiting net-income margins on devices to 5 per cent.

If we’re to believe that, then we need to buy into the view that Xiaomi’s future is in the platform business, where it can sell ads and other services. Underpinning this strategy is getting Xiaomi devices into as many users’ hands as possible, which is why selling smartphones on the cheap looks like a reasonable trade-off for investors.

Yet cheap doesn’t buy loyalty. Samsung is proof of this. After all, who’s the more loyal customer: Someone who pays $150 for a smartphone, or someone who pays more than $500? Apple Inc. knows the answer.

That OnePlus shipments climbed 284 per cent, according to Counterpoint, and Honor posted a 188 per cent increase, highlights just how little loyalty Xiaomi has bought with its low-price strategy – notwithstanding that its own 112 per cent year-on-year growth is impressive.

If Xiaomi can’t provide investors with reasonable hardware margins, and doesn’t garner much loyalty among MiFans upon which to build its internet business, then investors need to ask what the company really does offer.