New Delhi: The year 2022 saw the demand for houses in India increase by 34 per cent to reach a nine-year-high in a trend driven primarily by a post-pandemic need for security, increased savings, and relatively little income disruption for middle- and higher-income groups, according to a new report.

The report by property consultancy Knight Frank India says 2022 was a watershed year for the residential sector across India’s top eight cities of India following “a significant period of decline”.

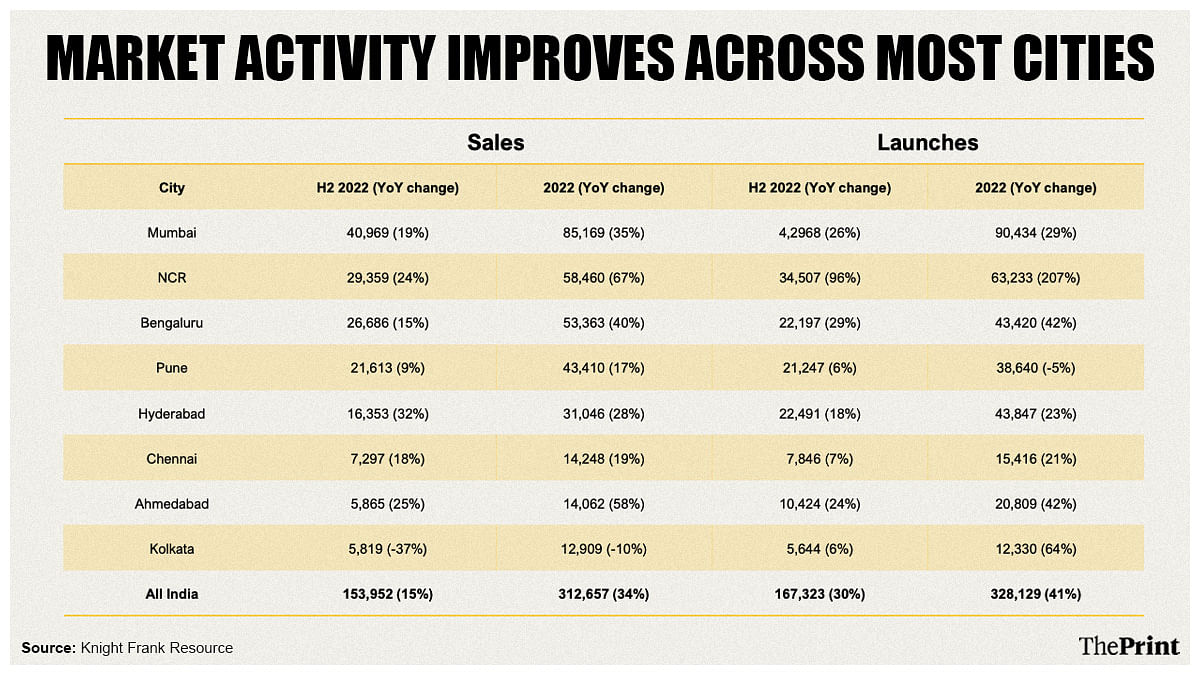

Published Tuesday, the report says house sales stood at 312,666 units in 2022, adding that the growth was particularly noticeable in the higher-income segments. For comparison, the sales in 2021 stood at 2,32,903 units, according to the report.

Additionally, sales levels were not materially dented by concerns over growing inflation, increasing interest costs, or slowing economic growth, the report says.

It also shows a significant uptick in the demand for office properties. India recorded a 36 per cent year-on-year increase in office leasing activities in 2022, with a gross total of 51.6 million sq. ft (516 lakh sq. ft) being leased out in the top office markets.

This was second only to the record levels seen in 2019, the report added.

“Despite global headwinds weighing down on the domestic economy, India has continued to be the fastest-growing large economy globally. This is reflected in the robust office and residential demand, and even complemented by relatively strong price growth seen during 2022,” Shishir Baijal, chairman and managing director of Knight Frank India, said in the report.

Also Read: ‘Hunger games’ in Bengaluru as home rents spike. Spruce up your LinkedIn, brokers are watching

Growth in higher-income residential segments

The report noted that while all real estate asset classes have been on the recovery path over the past few quarters, the resurgence in the residential segment was the swiftest and most substantial.

“While the need for security that was acutely felt during the pandemic triggered the demand for homes, the extremely low-interest rates and comparatively low property prices made the case for homebuying even stronger,” it said. “Despite the Reserve Bank of India raising policy rates by a cumulative 225 bps (basis points) in 2022, residential demand in the country has not only remained resilient but surged to a nine-year high in terms of annual sales in 2022.”

In terms of half-year periods, the first half of 2022 (H1 2022) recorded the highest sales in nine years, followed by H2 2022.

2022 was also the first year since 2014 in which the volume of units launched has exceeded that of units sold, the report said, adding that a comparatively strong economic growth outlook also helped push up sales.

The report shows that sales in the under-Rs 5 million (Rs 50 lakh) ticket size price segment came down to 42 per cent in 2022 from 45 per cent in 2020. In contrast, the share of annual sales in the Rs 5-10 million (Rs 50 lakh to Rs 1 crore) and more than Rs 10 million (over Rs 1 crore) ticket-size categories grew to 37 per cent from 35 per cent and to 21 per cent from 20 per cent over the same period.

“The higher income segments were not as impacted by income disruptions caused by pandemic exigencies as was initially expected. Besides, the high savings rate due to the initial weak sentiments and lockdown periods have played their part in fuelling the current wave of demand,” the report said.

Declining EMI-to-income ratio

Residential sales have been robust in 2022 despite a 4-7 per cent increase in house prices across all markets, the report said.

Cities including Mumbai, the National Capital Region (NCR), Bengaluru, and Pune registered a rise of 7 per cent each, the report showed. Chennai and Hyderabad witnessed a significant increment of 6 per cent, while Kolkata and Ahmedabad saw a 4 per cent increase in prices.

The report also indicated that sales were up despite the fact that the EMI-to-income ratio for households had declined across all cities in 2022. Used to measure a person’s ability to pay their mortgage, this is a ratio of the monthly instalment they pay (called Equated Monthly Instalment or EMI) against income. Here, a “decline” means that EMI now accounts for a higher share of income.

For this, the report used its own index, called the Knight Frank Affordability Index, to measure the income a household would on average require to fund their monthly instalment in a particular city. For instance, a Knight Frank Affordability Index level of 40 per cent for a city implies that on average, households in that city need to spend 40 per cent of their income to fund the EMI of a housing loan for a unit.

The report cited the “225 bps repo rate hike and consequent increase in home loan rates along with higher residential prices” as reasons behind the decline in the EMI-to-income ratio.

“2022 also marks the first year since 2011 for affordability decline in year-on-year terms. However, all markets except Mumbai are recorded to be well below the threshold of comfortable affordability set at 50 per cent ratio, a level exceeding which banks rarely underwrite a mortgage,” it said.

Ahmedabad emerged as the most affordable housing market in the country with an affordability ratio of 22 per cent. It’s followed by Kolkata and Pune at 25 per cent, Chennai and Bengaluru at 27 per cent each, the NCR at 29 per cent, and Hyderabad at 30 per cent.

Mumbai was the only city that recorded a higher-than-threshold affordability ratio of 53 per cent, the report found.

(Edited by Uttara Ramaswamy)

Also Read: A big win for homebuyers in boom town near Mumbai. SC order on sanctuary clears confusion