As the payment for oil increases, India’s current account deficits are prone to widen making the economy more vulnerable to rising US interest rates.

India’s inflation accelerated more than estimated in April, providing ammunition to hawks in the central bank to tighten monetary policy and fueling a selloff in bonds.

Consumer prices rose 4.6 per cent in April from a year earlier, the statistics ministry said in a statement in New Delhi on Monday, higher than the 4.4 per cent median estimate in a Bloomberg survey of economists. It was the first pick-up in inflation in four months.

The data – the final price print before the Reserve Bank of India’s next rate decision on June 6 – highlights the risks from surging oil prices in Asia’s third-largest economy. The central bank expects oil prices averaging around $78 a barrel to stoke inflation by 30 basis points.

The “inflation number is very ugly. It’s way above expectations,” said Rupa Rege Nitsure, chief economist at L&T Finance Holdings Ltd. in Mumbai, adding that fuel prices are a worry. The RBI, which aims to keep inflation around the 4 percent midpoint of its target band, will most likely raise rates, she said.

Brent crude averaged $71.76 a barrel in April, according to data compiled by Bloomberg. It touched a high of $78 this month.

Paying more for oil, the nation’s biggest import, will widen India’s current account deficit, making the economy more vulnerable to rising U.S interest rates. Bonds are poised to decline for the ninth month out of 10 amid concerns this might push the consumer-price inflation targeting central bank to raise interest rates sooner than later.

Read More About India and Rising Oil Prices

Here’s what oil at $70 means for the world Why there’s early India rate hike calls This is what India fears will happen See how Indian fuel prices lag crude’s rise

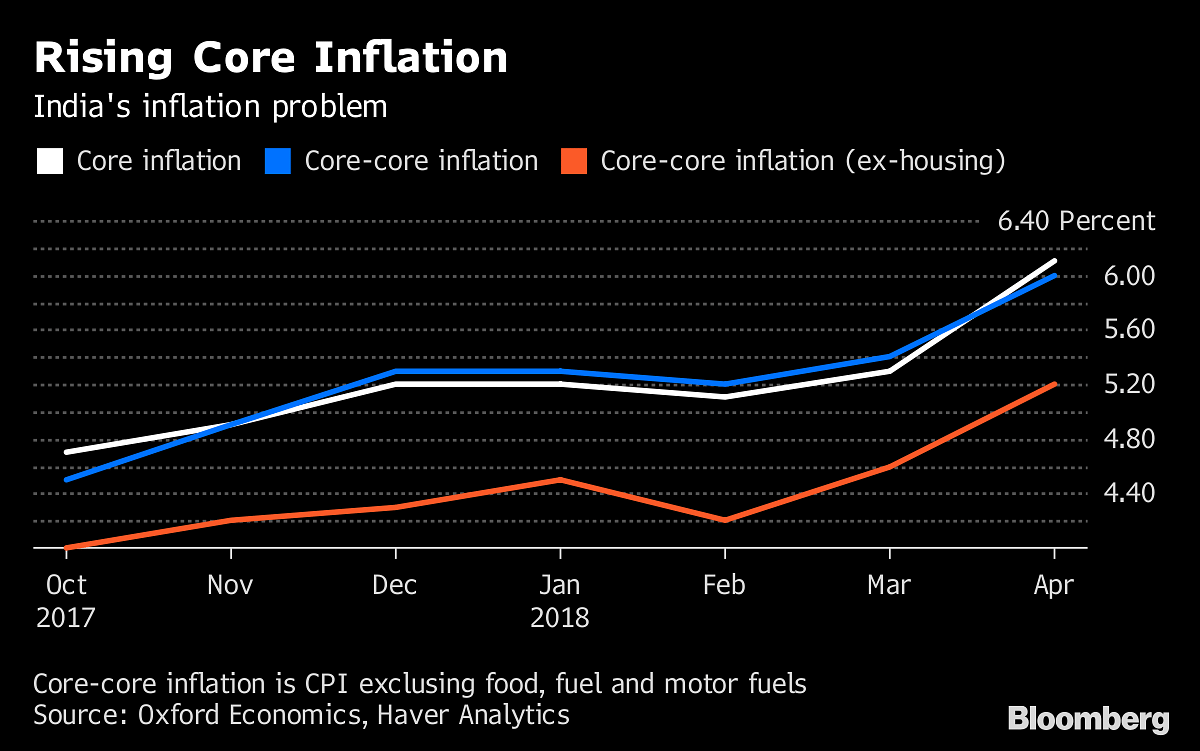

The onshore swap markets are pricing in at least 50 basis points of interest rate hikes over the next year. Those expectations got a boost after central bank deputy governor in charge of monetary policy, Viral Acharya, said he would vote for a withdrawal in monetary accommodation in June, citing sticky core inflation.

According to Shubhada M Rao, chief economist at Yes Bank Ltd. in Mumbai, core inflation was at 5.9 percent — a 44-month high.

That’s made the central bank uneasy about price pressures and the hardening in its stance on inflation led to a selloff in bonds in April. The yield on the 10-year sovereign note rose 2 basis points on Tuesday to 7.85 percent, the highest for benchmark debt since February 2016.

Selloff Deepens

Foreigners have been pulling out of the bond market given a rise in U.S. yields, and along with a slowdown in investments in stocks, they have contributed to weakness in the rupee — Asia’s worst performer this year. That, in turn, is stoking inflationary expectations, especially imported inflation.

In a further sign that pipeline pressures were building, wholesale prices also rose more than expected in April and there’s little respite in store. India’s state-run refiners resumed raising retail gasoline and diesel prices after a three-week break that coincided with the run-up to elections in a southern state.

Key points from CPI and WPI data

Consumer food price index rose 2.8 percent Clothing and footwear rose 5.1 percent Fuel and lighting rose 5.24 percent Housing rose 8.5 percent Wholesale prices rose 3.18 percent in April, faster than the 2.9 percent estimate. – Bloomberg