After a steep fall in shares and a subsequent letter by chairman Subhash Chandra, Essel Group says it reached an understanding with lenders.

New Delhi: Two days after shares of Zee companies fell up to 33 per cent over a news report — the company has, however, posted some recovery since — the Essel Group appears confident that it can convince lenders to not declare it a defaulter.

In its statement Sunday, the group said that during a meeting with the leading entities comprising mutual funds, NBFCs and banks, it was decided there would not be any event of “default declared due to steep fall in price”.

The Essel statement came after group chairman and Rajya Sabha member Subhash Chandra wrote a letter Friday to his creditors apologising for having difficulty in repaying his dues — reportedly up to Rs 12,000 crore — while the shares of his group companies crashed following a report published on news website The Wire.

The 24 January Wire report claimed that the group had links with a company called Nityank Infrapower and Multiventures which is currently under the scrutiny of the Serious Fraud Investigation Office (SFIO) for making deposits of over Rs 3,000 crore just after the 8 November 2016 demonetisation announcement.

On Friday, shares of Zee Entertainment fell over 26 per cent while Dish TV fell by nearly 33 per cent. The Economic Times reported that the crash in the shares of group companies wiped off nearly Rs 13,686 crore of investor wealth.

Chandra claimed in his letter that “negative forces” were trying to sabotage the strategic sale of Zee Entertainment.

What the reports say

The developments were first reported by the Economic Times in an 18 December report which said that Nityank Infrapower and Multiventures had apparent links with Essel Group and was being investigated by the SFIO. The report also said that the March 2018 merger between the DTH arm of Videocon and Essel was now in the middle of a legal dispute. The dispute involved Nityank Infrapower.

On Thursday, the Wire reported, “The Serious Fraud Investigation Office (SFIO) is currently probing a company called Nityank Infrapower (formerly Dreamline Manpower), for deposits of over Rs 3,000 crore made just after demonetisation (November–December 2016).”

According to the Wire’s own investigation, “Nityank and a group of shell firms carried out financial transactions that involved a few firms associated with the Essel Group between 2015 and 2017.”

However, in a stock filing Sunday, Zee Entertainment said the firm has no connection with any alleged transaction contained in an article published last week.

It also said that Nityank Infrapower is an independent company and added that it is going to initiate “legal action as advised”.

Also read: Zee’s Subhash Chandra races to end mess that erased $1.6 billion of his group’s value

Stake sale

Chandra has been trying to sell up to 50 per cent of his stake in Zee Entertainment to a strategic partner since November 2018 to address “capital allocation priorities”.

In his letter Friday, Chandra admitted to having made mistakes, including the acquisition of D2H from Videocon group, which led to ballooning of debt.

He said the acquisition, in which his brother Jawahar Goel was also actively involved, has cost both of them their “fortunes”.

“I have always been the first to accept my faults and we have been consistently accountable for the decisions taken, and I will maintain the same today as well. For the first time in my career of 52 years, I am compelled to apologize to our bankers, NBFCs & Mutual Funds, since I believe that I have not lived up to their expectations, despite the best of my intentions,” he said in his letter.

While Chandra has categorically said that all operating companies, including Zee Entertainment, are performing well and there was no stress, banking sources said that they are a worried lot.

“The non-performing asset level for banks is high and now this comes as another big blow. He (Chandra) can say whatever, that here is no stress, but then the question is why such a letter,” a senior banker of a large public sector bank told ThePrint on condition of anonymity.

Chandra said he is looking to expedite the stake sale of Zee Entertainment and has had a series of positive meetings with potential suitors.

History of Chandra

The success story of Subhash Chandra Goenka is akin to a Bollywood rags to riches hit.

Chandra forayed into business at an early age to help his father after his family suffered business reverses. He ventured into manufacturing early, but the turning point came in 1981 after his Rama Associates got a contract to export rice to the Soviet Union. Chandra hit jackpot.

He expanded his empire and ventured into packaging.

Eventually, Chandra, who had no knowledge of broadcasting, decided to launch his private satellite TV station at a time when there were few private broadcasters.

In 1992, he launched Zee TV, India’s first private TV channel.

Despite initial criticism, Zee rapidly became a household name and its increasing popularity came as a challenge to the monopoly exercised till then by India’s state-run broadcaster Doordarshan.

In a 2010 interview, Chandra said the success of his broadcasting business could be attributed to the fact that he always looked at every programme that was to be commissioned.

As of today, Zee’s bouquet of 75 channels reportedly reaches more than one billion viewers in more than 170 countries.

As business expanded further and the Essel Group established a diversified portfolio of companies, Chandra split up his business empire between his two sons, Punit Goenka and Amit Goenka, and stepped down as chairman of Zee Media in May 2016.

However, there have been increasing complaints from Zee insiders that the security of its jobs, once considered as stable as government employment, had turned increasingly unstable post 2012-2013 with a large number of senior-level sackings from the channels.

“There have been people who have been with Zee for ages, but things definitely changed post 2012-2013. He vested a lot of powers to some people, which got him trapped in his own web,” an insider said on condition of anonymity.

“As a result, people like (senior journalist) Neeraj Thakur, (former Zee News editor) Satish K. Singh left his organisation,” said the person quoted above.

However, over the years, the businessman has maintained good equations with the political party of the day.

At the time of winning the rice export contract, his proximity to the Gandhi family is well known.

In 2016, his independent candidacy for the Rajya Sabha election was supported by the ruling Bharatiya Janata Party.

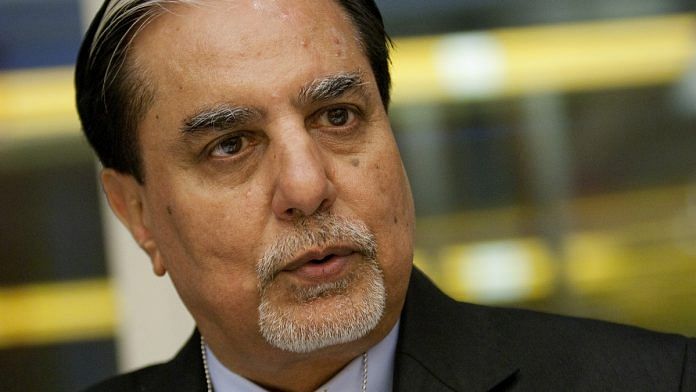

Dr. Subhash Chandra Member of Parliament, Rajya Sabha and Chairman, Essel Group

There is stress throughout the economy. Corporate profits as a share of GDP are at a fifteen year low, one half of the 2008 level. Media seems to be an especially soft spot. Being on the right side of power is a compulsion of doing business in India. The entire political class, in and out of power, as the other side of the equation understands this as well. I have never watched Zee, but it seems to be part of the leading edge of compliant media. They should prepare for a shower of rose petals.