Pakistan’s buffers, steadily dwindling owing to surging imports and debt, is another.

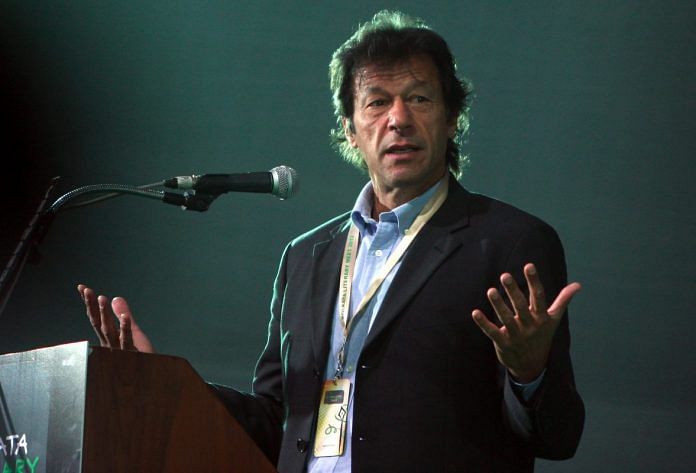

A new government under Pakistan’s incoming leader Imran Khan will need to move quickly to tackle a brewing economic crisis.

The former cricket star’s party claimed victory in Wednesday’s election after preliminary results showed it had the most votes. Khan said in a televised address he’ll focus on improving the lives of the poor and fighting corruption. Stocks rallied on Thursday, with the KSE100 index gaining 1.8 per cent. The rupee was little changed at 129.125 against the dollar.

One of the first challenges he’ll need to tackle is easing a foreign-reserves crunch. The nation’s buffers have been steadily dwindling as a result of surging imports and debt, forcing the central bank to devalue the currency four times since December. All of that comes against a global backdrop of higher oil prices, trade war tensions and an emerging market sell-off.

For many Pakistan watchers, a bailout from the International Monetary Fund may be an inevitable next step.

“Painful, as it may be, an IMF program is unavoidable,” said Ehsan Malik, the chief executive officer at the Pakistan Business Council in Karachi. “The government and the opposition should unite to use it to address the immediate problem and fundamental flaws that have seen manufacturing’s role in the economic decline.”

Here are some of the key economic challenges that await the new leadership:

Reserves Slump

Pakistan’s reserves have dropped at the fastest pace in Asia to $9.1 billion, according to data compiled by Bloomberg. Reserves are now below the level reached when the country approached the IMF the last two times for a bailout, according to Bilal Khan, a senior economist at Standard Chartered Bank Plc.

Low reserves mean the nation has less funds to pay for much-needed imports to keep economic growth going and for the central bank to maintain currency stability.

IMF Bailout

If Pakistan heads to the IMF for aid, it won’t be the first time. The nation has had 12 loan programs with the IMF since the late 1980s and may seek between $10 billion and $15 billion from the Washington-based lender in upcoming months, according to Karachi-based Insight Securities.

The loans typically come with conditions such as reigning in fiscal deficits and tighter monetary policy. Pakistan’s central bank has already increased interest rates three times this year to 7.5 per cent.

The “IMF will not be that easy this time around,” said Mohammed Ali Hussain, head of research at Frontier Investment Management Partners Ltd. in Dubai, which handles $2 billion in assets. “Lots of structural reforms were delayed or not done last time. They will be much tougher in the enforcement process, whether its privatization program, revamping the tax infrastructure, widening the tax net, it’s not going to be easy on the ground level.”

Trade Deficit

The trade gap has widened despite multiple measures to restrict imports and spur exports over the past few months. That’s driven up the current-account deficit by 42 per cent to $18 billion in the year through June.

An economic growth boom and billions of dollars in Chinese-built infrastructure has fueled demand for imports and added to the nation’s debt. Moody’s Investors Service cut the nation’s credit-rating outlook to negative from stable as external balances weakened.

Any IMF loan may come with tough measures to narrow the current-account gap, which may have a knock-on effect on economic growth, said Hamad Aslam, director research at Elixir Securities Pakistan Pvt. in Karachi. The economy is expected to slow for the first time in six years to 5.2 per cent in the year starting July, according to the average of six economists surveyed by Bloomberg.

Over the longer term, authorities will need to find ways to boost exports to improve the current-account balance. Tariffs currently favour commercial imports over manufacturing and “if the country fails to address these fundamental flaws, the imminent IMF program will not be the last,” said Pakistan Business Council’s Malik.

Tax Revenue

One of the structural problems a new government will need to fix is low tax compliance. While Pakistan has increased its tax-to-GDP ratio in recent years to 12.5 per cent in the year through June, that’s still among the lowest in Asia and globally.

Most of the government’s tax revenue comes from indirect levies, and there’s a huge pool of untaxed money in real estate and savings instruments, as well as non-declaration of income that can be tapped, said Shabbar Zaidi, a partner at Karachi-based A.F. Ferguson & Co., an affiliate of PricewaterhouseCoopers LLP. That could help the nation double tax revenue to 8 trillion rupees in two years, he said.

“I vow to protect taxpayers’ money,” Khan said Thursday. “We will convert governors’ houses into hotels instead of splurging people’s tax money on upkeep of politicians.” “- Bloomberg