The central bank has been vocal on the need to curb inflation. It will surely raise interest rates by 50 basis points in next 12 months.

The stage seems set for the Reserve Bank of India to deliver another hike in interest rates. Reason – retail inflation accelerating to a five-month high.

Thursday’s headline inflation number for the month of June will be scrutinized by the six-member monetary policy committee that will meet later this month and announce its decision August 1. The panel, which has been very vocal on the need to curb inflation, is sure to raise interest rates by 50 basis points in the next 12 months, pricing in the swap markets show.

Analysts at HSBC Holdings Plc. and ANZ Banking Group are expecting a quarter percentage point increase in August, though a majority of economists in a Bloomberg Survey forecast the central bank to stand pat.

The latest data, which shows underlying price pressures are surging, could prompt a few more analysts to change their call. Consumer prices climbed 5 percent in June, the highest level since January. That compares with the 5.28 percent median estimate in a Bloomberg survey of 43 economists and May’s 4.87 percent pace.

Here’s what fanned core inflation in June:

Housing inflation quickened 8.45 percent in June from a year ago Transport and communication prices rose 6.2 percent. “The core-CPI inflation hardened to 6.4 percent in June, with a fairly broad-based uptrend in miscellaneous items as well as clothing and footwear,” said Aditi Nayar, principal economist at ICRA Ltd. This rise means there is a “high likelihood of a repo rate hike” in the August policy.

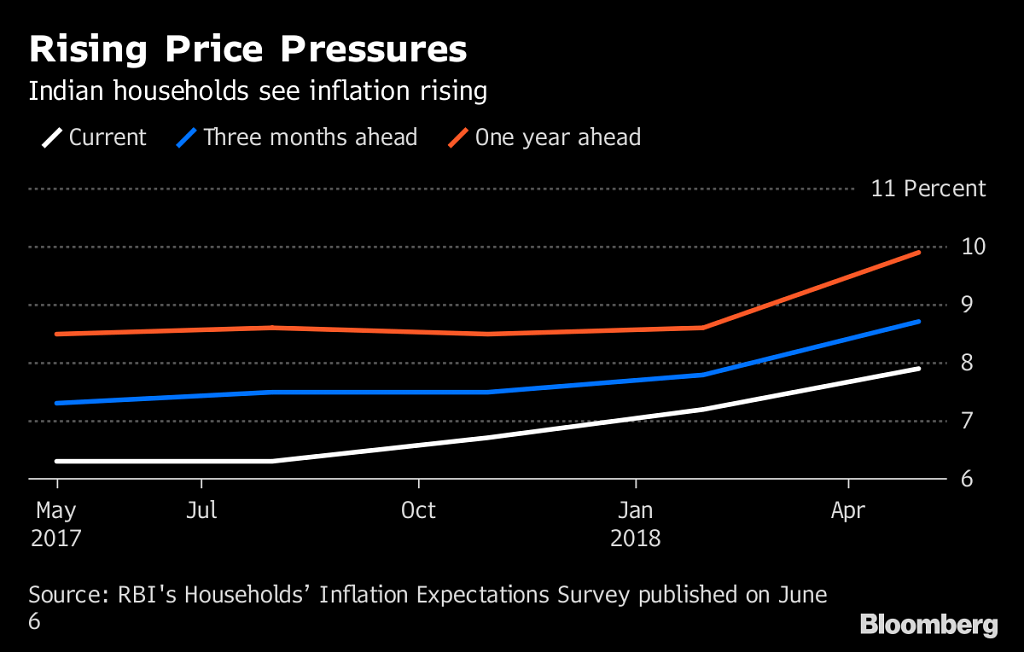

A combination of a weaker rupee, better growth prospects, narrowing output gap and higher assured prices for crops, along with costlier oil, are likely to put pressure on inflation in the coming months and underpin rate hike expectations.

The central bank expects oil averaging around $78 a barrel to stoke inflation by 30 basis points, complicating its job of keeping the gauge at the 4 percent mid-point of its target band over the medium term. Policy makers have been expressing discomfort over rising price pressures and increased input costs, some of which is being passed on to consumers.

In June, the Reserve Bank of India raised rates for the first time since 2014 and revised its inflation forecast for the fiscal year 2019, with the second-half estimate revised to 4.7 percent from 4.4 percent.

Devil in the detail

Core inflation – which strips out volatile food and fuel prices and a risk flagged by some monetary panel members — has moved higher, making the RBI more watchful. Hawks like Viral Acharya, deputy governor responsible for monetary policy, and Michael Patra, head of research at the central bank, are of the view that with growth rebounding from a four-year low any slack in the economy will be reduced.

“It is well known that when a negative output gap begins to close, it starts to push core inflation up,” said Pranjul Bhandari, chief India economist at HSBC Holdings. “We estimate that India’s output gap has been gradually closing, and will turn positive in late fiscal year 2019. This will add to inflation.”

Teresa John, an economist at Nirmal Bang Equities Pvt., said June typically sees a rise in core inflation because of higher education costs and other services. Besides, the second round impact from a rise in gasoline and diesel prices is likely to play a role in adding to inflationary pressures and making bond investors wary.

In other data released on Thursday, industrial production growth for May slowed to 3.2 percent from 4.8 percent in April, and well below consensus of 4.4 percent rise.

What our economists say….

“We argue against rate increases given a continued deceleration in industrial growth in May and evolving risks to the economy. We also expect favorable base effects to lead inflation to turnaround from July.”– Abhishek Gupta, Bloomberg Economics

Foreigners have been dumping Indian bonds with the benchmark 10-year yields climbing 50 basis points in the quarter through June. Increased borrowings from the government and higher oil prices add to fears of an increase in interest rates.

“There’s still pressure on core inflation, which is clearly on the ascent at 6.35 percent,” said Shubhada Rao, chief economist at Yes Bank Ltd. “This could propel the central bank to not sound very dovish. So we continue to expect a rate hike in August or October.” – Bloomberg