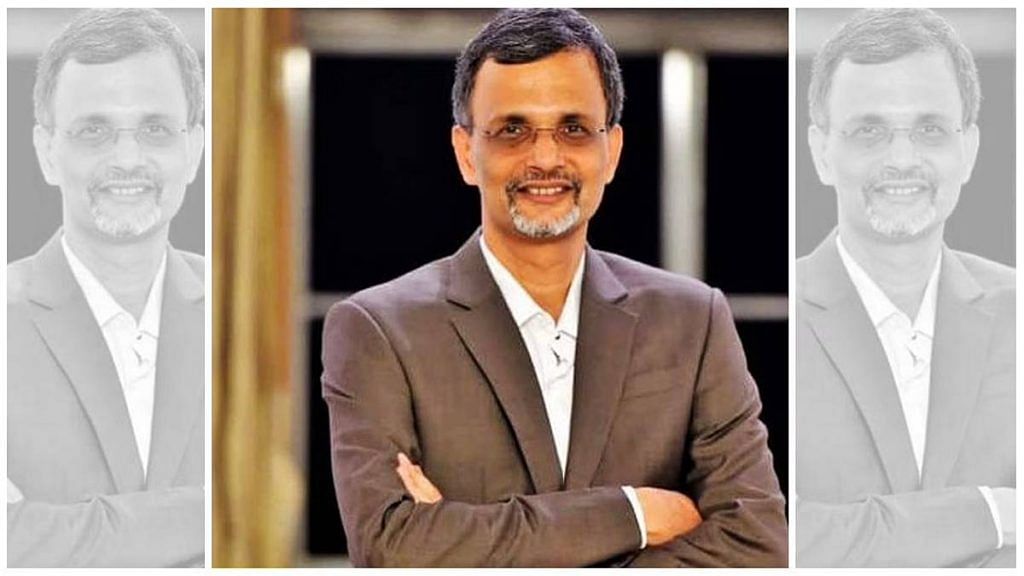

Bengaluru: Referring to stock market volatility and the current ‘craze’ for investing in crypto assets, India’s chief economic advisor (CEA) V. Anantha Nageswaran, said Friday that the ongoing conflict in Ukraine is a reminder of technology bringing partial answer to some challenges, but it also shows us how technology “accentuates” human “fear and greed”, causing a turmoil.

“The conflict that has broken out in Ukraine is a reminder that technology is at best a source of partial answers to the challenges that we face. But, the kind of turmoil and volatility we are witnessing in stock market, or for that matter, the craze with which people are investing in crypto assets, or stable coins backed by crypto assets — both of which have no capital spinoff, is also a reminder that humans are still driven by fear and greed, and sometimes technology accentuates them, rather than eliminating them,” he said.

Commenting on Nageswaran’s comment, a senior economist who didn’t want to be named, said that with the inflation hitting new highs following the conflict, people are seen to be drawn to anything that they can flock to, as a hedge against crisis.

The CEA was speaking at the India Ideas Conclave, organised by the Rashtriya Swayamsevak Sangh (RSS) backed think tank, India Foundation in Bengaluru.

Stressing that technology cannot remove ‘human greed’, Nageswaran said India was now entering the “post pandemic era, with the pandemic expectedly receding”, and was poised for its “4th edition economy”.

He broadly termed the “massive liberalisation of 1991” as the first edition and the then UPA government’s decision to focus on social entitlement schemes and packaging them as empowerment and constitutional rights in 2004 as the second edition. The CEA called the Modi government’s attempt to reform the factor market — land and labour— as the third edition of the economy, and added that the fourth or current edition, will shape country’s economy and future for the next 25 years.

“In 2004, we had a new government that focussed on enacting many social entitlement schemes and packaged them as empowerment, as constitutional rights — the right to food, education and employment guarantee in rural India,” he said, explaining the various stages of transition of the Indian economy.

“In 2014, NDA came to office and this government made an attempt to reform the factor markets — land and labour. And there was also a belief in the formalisation of the economy and we have seen an affirmation of that in 2019. Formalisation opens the doors for finance and small, micro-medium enterprises. Then came, from 2015-16 onwards, the harnessing of public digital goods — aadhaar, jan dhan, GST, unified payment system, pilot launch of open network digital commerce, Cowin app. This is taking tech to a different level,” Nageswaran added.

The CEA also spoke of the ‘privatisation’ of Air India, calling it a “milestone exercise”.

Also read: Who is V Anantha Nageswaran, new chief econoic advisor? IIM-A grad, academic, PM’s ex-advisor

Crisis to opportunity

“To deliver the kind of growth rate that would take us to a state of a middle-income economy in the next 20 years, we have to have a vibrant financial sector that is capable of providing the funds that are required for development,” said Nageswaran.

The CEA added: “Thankfully in that sense, we had gone through a difficult phase in the last decade. Banking system had over-lent, corporate sector had over-borrowed and we spent bulk of the last decade cleaning up balance-sheets everywhere — in the financial system and the corporate system.”

The CEA asserted that is why in this decade as central banks around the world tighten monetary policy, India is better placed than most countries.

“We are paying our share of growth dues of the last decade because the financial sector was rebuilding. We are in a position to deliver domestically-driven growth, that is one important thing,” Nageswaran said.

He added: “On top of that even as the pandemic was unfolding in the last two years, the government is to be expected to use the crisis as an opportunity to deliver many structural reforms, particularly in the industrial policies in terms of production, incentive schemes, in reduction in corporate tax rates. Rules concerning startups and businesses were simplified and retrospective taxation ended.”

Air India disinvestment ‘a milestone’

Calling the privatisation of Air India ‘a milestone exercise’, Nageswaran pointed out that the country has “re-embarked on privatisation after over twenty years” and that it has brought a “paradigm shift” in the country’s economic policies, under the asset monetisation scheme.

The airlines has been acquired by Tata last year.

“It basically improves balance sheet of the government as we retire assets and pass them onto private hands, we will also be extinguishing liabilities and it will bring down debt ratios and cost of capital for private sector under the asset monetisation scheme” he added.

Taking a dig at the private sector, the CEA said that the private sector needs to invest more in innovation, research, analysis and development and above all it has to pay the small and medium enterprises on.

“Responsible economics is also about private sector, which invests little in R&D, which is vital if we have to become a meta economy in next 25 years. Manufacturing complexity has to increase. Private has to do much more.”

(Edited by Poulomi Banerjee)

Also read: The LIC way or the Air India way — that is the multi-crore disinvestment question