Mumbai: Deposits from non-resident Indians (NRI) have surged since the Covid pandemic broke out as workers shifted their funds in their repatriable Indian bank accounts before coming back to India, showed latest Reserve Bank of India (RBI) data.

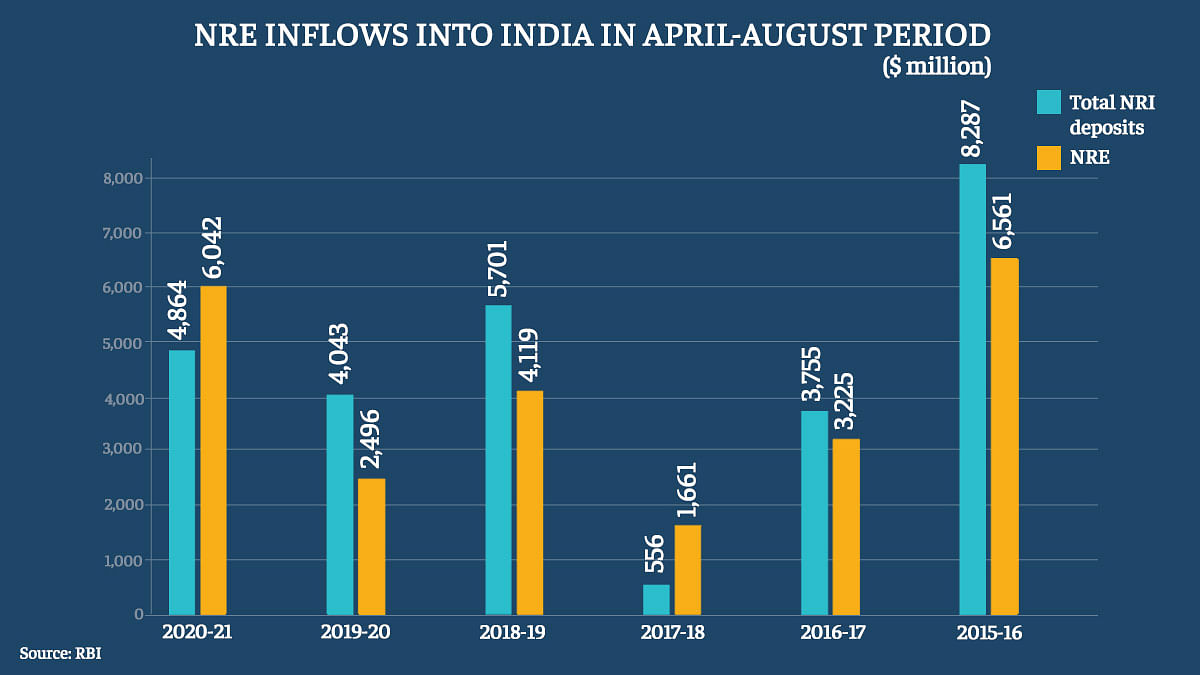

Fresh NRI deposits clocked $4.86 billion, or around Rs 35,000 crore, during the first five months of the current financial year as compared to $4.04 billion during the same period of the previous fiscal.

However, flows into NR(E)RA deposits — the deposits that are repatriable — during the April-August period was $6.04 billion as compared to $2.5 billion during the same period the previous year, showed RBI data.

There are three kinds of deposit accounts of Indian banks where NRIs or PIOs (persons of Indian origin) can park their funds — NRE (non-resident external-rupee account), NRO (non-resident ordinary rupee account) and FCNR(B) (foreign currency non-resident bank account).

Deposits in NRE accounts are freely repatriable unlike NRO accounts. Both NRE and NRO accounts are rupee denominated. FCNR(B) are foreign currency accounts — dollar, euro and pound sterling accounts.

The $6.04 billion inflows to the NRE account in 2020-21 is the highest since 2015-16 when inflows to these accounts were $6.5 billion in the first five months of the financial year.

Also read: India at the doorstep of economic revival, says RBI governor Shaktikanta Das

Inflows due to pandemic

According to bankers, the surge has come as overseas Indians who came back to India after the pandemic broke out deposited their money into NRE accounts since these are repatriable.

“This year has witnessed an entirely different phenomenon because of the Covid-19 pandemic. A good number of NRIs have returned to India in those Vande Bharat Mission flights. They wanted to come back, to closely observe and watch the developments and then take a call whether to continue in the overseas territory or repatriate for good,” said said Ashutosh Khajuria, executive director and chief financial officer, Federal Bank.

“This was true particularly for the Gulf region as those NRIs cannot get citizenship there,” said Khajuria.

“Before they came back, they first remitted the funds. Whatever foreign currency is to be sent to India, normally people keep it in NR(E)RA because it is repatriable. In NR(E)RA, if you want to take it back, you can take it back. As they do not hold citizenship of those countries and stay there only for job/business, it may not make any sense to hold foreign currency funds there particularly when a decision to return for ever has been made,” he said.

Deposits returning to normal levels

But as the pandemic situation is improving, and workers are starting to go back overseas for jobs, the flows are returning to normal levels, the bankers said.

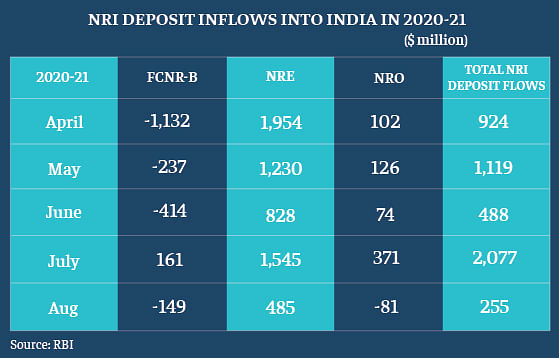

NRE deposits peaked in July, with $1.54 billion inflows, before falling to $485 million in August.

While NRE deposits surged, FCNR-B deposits actually depleted during the April-August period. According to the RBI data, FCNR-B deposits outflows were $1.7 billion as compared to $725 million inflows in the first five months of this fiscal.

“Interest rates for FCNR (B) deposits are aligned with global rates. When one earns interest rate on US dollar deposits at less than 1 per cent, on yen and euro nearly zero, GBP closer to 0.3%, so practically, there is no attraction to place deposits in foreign currency, unless one is scared that rupee will depreciate massively and so dollars may fetch more rupees if deposits are held in foreign currency,” said Khajuria.

“In Federal Bank, FCNR (B) corpus is a small fraction of total NRI deposits. Most of the deposits are kept in NR(E)RA,” he added.

Also read: Bitcoin surges to highest since July 2019 after PayPal allows cryptocurrencies